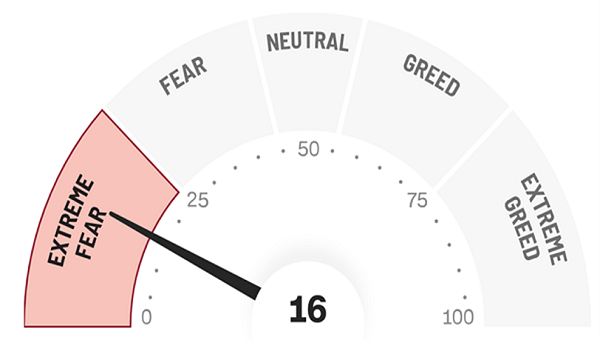

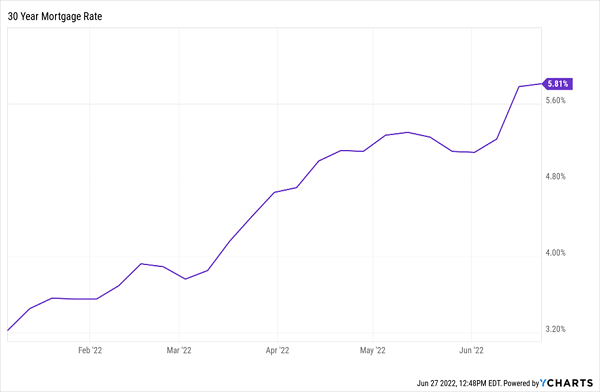

Since last week, markets have been hamstrung by the fear that inflation is going to hang around. So we (naturally!) are going to make a contrarian play on this overdone worry.

How? By picking up high-yielding closed-end funds (CEFs) focusing on real estate—particularly real estate investment trusts (REITs). Many of these are discounted now.

I’ll show you why this timely move is our route to locking in a steady (and monthly paid) 8.3% dividend in just a moment

First, let’s break down the so-called “bad” inflation number that came out last week, because there are some quirks about it that are easy to overlook.… Read more

Recent Comments