A dividend hike is the ultimate sign of dividend safety. It’s also the surest, safest way to “get rich soon-ish” in stocks.

Find me stocks that are raising their dividends quickly and regularly, and I’ll show you some stocks that are doubling every few years.

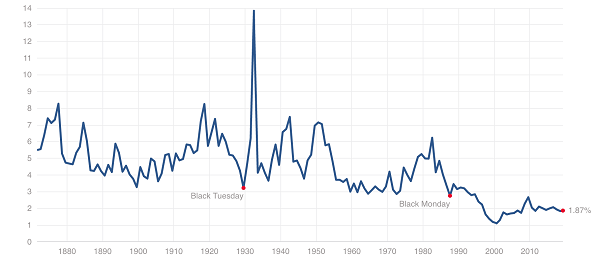

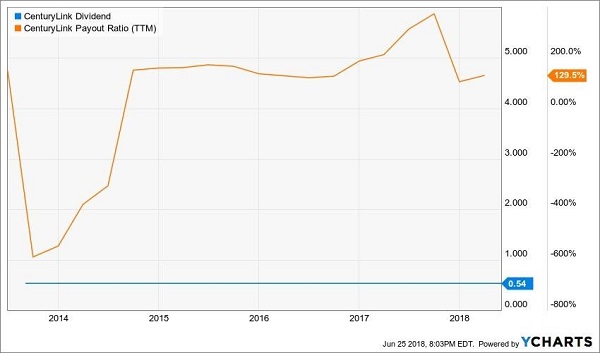

What drives the dividend? Well, the likelihood that a company is going to raise its dividend (or cut it) is directly related to its payout ratio, or the percentage of its profits that it is dishing out to shareholders as dividends.

As a rule of thumb, a payout ratio below 50% is a sign of dividend safety.… Read more

Recent Comments