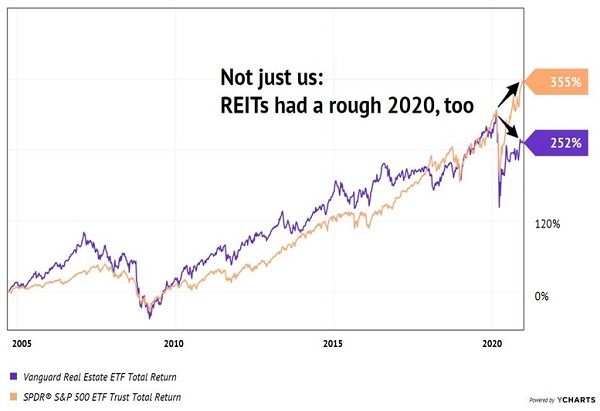

The Vanguard Dividend Appreciation ETF (VIG) is the largest and most popular dividend ETF on Wall Street. It boasts an amazing $60 billion in assets under management, and holds about 300 of the largest dividend stocks.

And it yields a miserable 2.1%.

That’s because, like many index funds, VIG weights stocks by size. That means companies like $450 billion drugmaker Johnson & Johnson (JNJ) and $1.8 trillion Big Tech icon Microsoft Corporation (MSFT) alone represent about 7% of the portfolio – even though they pay relatively light yields of 2.5% and 1.1%, respectively.

The false promise of index funds like the Vanguard Dividend Appreciation ETF is that you can “set it and forget it.”… Read more

Recent Comments