I’m just going to come out and say it: If you want to be financially independent (and who doesn’t?), you must own closed-end funds (CEFs).

For those “in the know” about CEFs, the reason is simple: massive yields. As I write, closed-end funds yield 9.1% on average. And game-changing dividends like that are only one way CEFs reward us—and I’d argue they’re not even the best one!

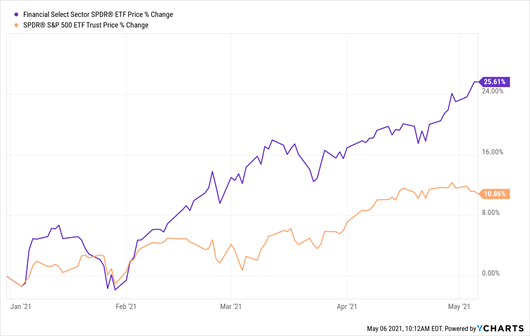

The best-in-class CEFs out there—and here I’d definitely include the three we’re going to get into below—also offer strong total returns, with price gains and dividends combining to hand us overall returns of 10%+ yearly.… Read more

Recent Comments