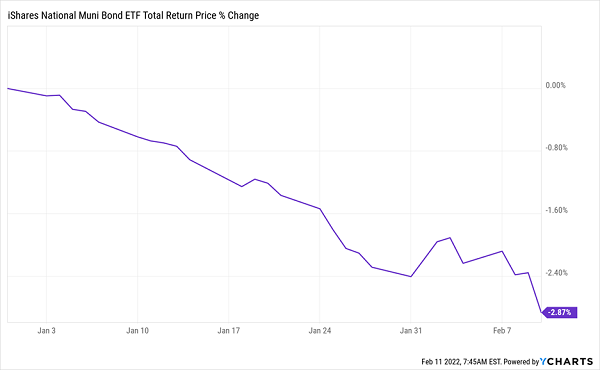

If you own a bond fund, it’s probably down in recent months. Let’s talk about why and walk through three popular fixed-income ideas from worst to first.

We’ll start with the iShares 20+ Year Treasury Bond ETF (TLT). TLT is the knee-jerk investment that many “first-level” investors buy when they are looking for bond exposure. Unfortunately, there are two big problems with TLT:

- It only yields 2.1%.

- Worse yet, its 19-year duration is drubbing its total returns.

Any kid knows that 19 years is “way too long” to hold a bond when inflation is running a hot 7.5%. (Please, somebody get these TLT investors a Contrarian Income Report subscription!)… Read more

Recent Comments