People often don’t believe me when I tell them there are great funds out there paying sustainable 8%+ dividends—it just sounds too good to be true.

But there are literally hundreds out there that pay that much and way more, including the 9.6%-yielding Liberty All-Star Equity Fund (USA). Beyond having the best ticker out there, this one just hiked its payout even higher (by 6.7%, to be precise). The move came as no surprise to anyone already in the know about this smartly run closed-end fund (CEF).

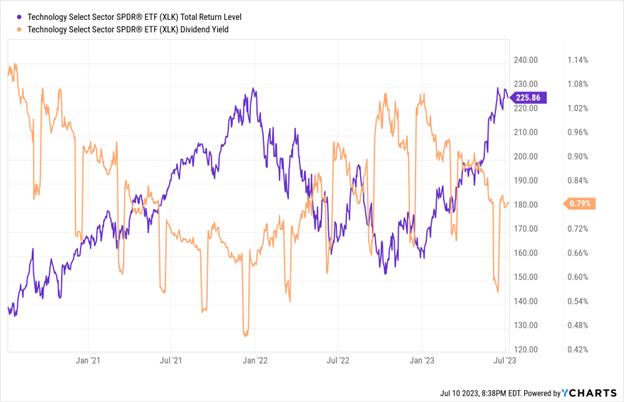

USA (in purple below) has a terrific track record, too, soundly beating the S&P 500, shown below by the performance of the benchmark Vanguard S&P 500 ETF (VOO), in orange, over the last decade.… Read more

Recent Comments