People often don’t believe me when I tell them there are great funds out there paying sustainable 8%+ dividends—it just sounds too good to be true.

But there are literally hundreds out there that pay that much and way more, including the 9.6%-yielding Liberty All-Star Equity Fund (USA). Beyond having the best ticker out there, this one just hiked its payout even higher (by 6.7%, to be precise). The move came as no surprise to anyone already in the know about this smartly run closed-end fund (CEF).

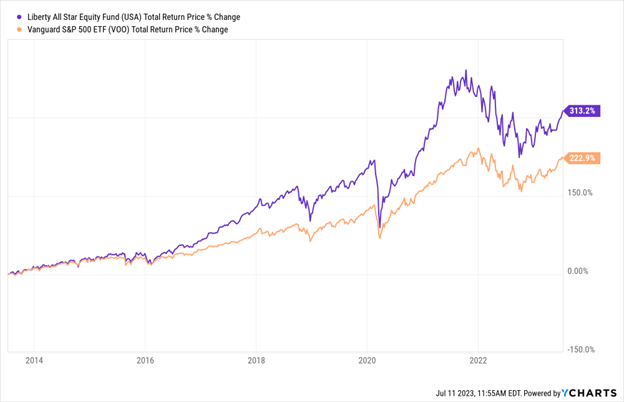

USA (in purple below) has a terrific track record, too, soundly beating the S&P 500, shown below by the performance of the benchmark Vanguard S&P 500 ETF (VOO), in orange, over the last decade.

313% Gains in a Decade—That’s USA

If you bought just $100,000 worth of USA shares a decade ago, you’d have over $400,000 now, and your dividend would have not only held fast—it would have grown.

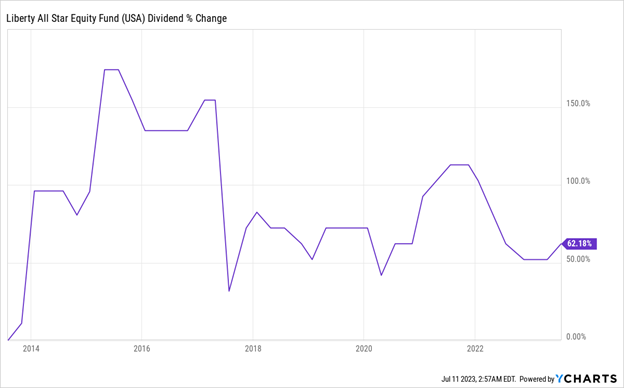

Big Pay Raises for a Big Yielder

Just to be clear, this means investors in USA today would get around $800 per month in dividend payouts on every $100,000 invested, while an index-fund investor would get maybe $150 if they’re lucky.

One thing to note is that USA has a unique dividend policy under which it will pay 10% of its net asset value (NAV, or the value of its underlying portfolio) per year as dividends, in four installments of 2.5% each. That does make the payout less predictable, as you can see in the chart above. But that variability also comes with a thick silver lining: it gives management flexibility to buy bargains when it spots them, fueling the fund’s total return.

And best of all, the overall trajectory of USA’s dividend is up, and by no small amount, either—more than 62% in the last decade. How does USA pay out so much cash?

Source: Liberty All-Star Funds

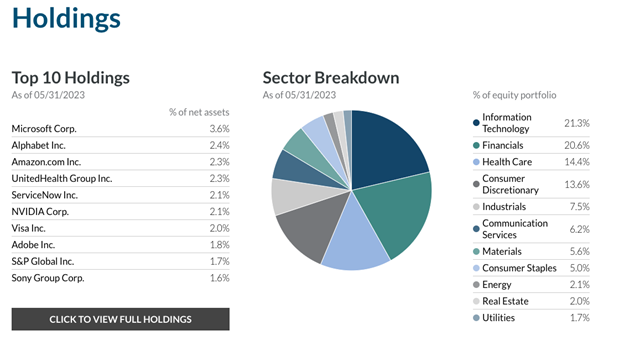

The fund is managed by a team of pros who buy larger firms with strong cash flows, like Microsoft (MSFT), Google (GOOGL) and Amazon.com (AMZN). But don’t let those three names lead you to believe the portfolio hinges entirely on tech. While that sector accounts for a large slice of the US economy—and USA reflects that by holding nearly a quarter of its portfolio in tech—the fund holds numerous stocks from other sectors, too, including top-10 holdings UnitedHealth Group (UNH) and Visa (V).

Moreover, a big advantage of going with a CEF like USA over an index fund is that the USA holder gets most of their profits as dividends they can use as they choose. Folks holding an index fund like 1.5%-yielding VOO, meanwhile, are more likely to be forced to sell units, inevitably into a crash at one point or another, to generate cash.

Now let’s take a look at how a big—and growing—payout like that of USA can really add up over time.

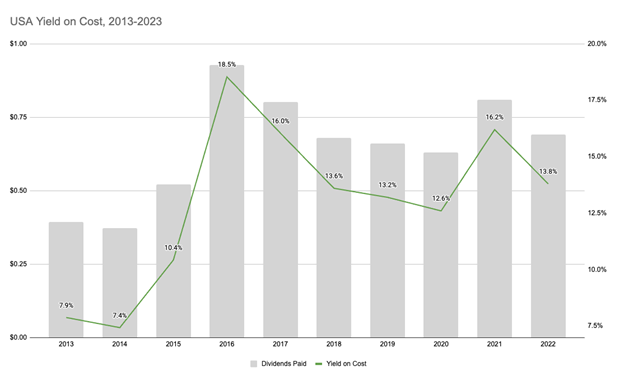

Source: CEF Insider

This chart might be a little hard to follow, but it’s important because it’s a snapshot of how you build lifelong wealth in CEFs. Yes, USA is a great buy today because you’ll get a 9.6% dividend, but the real power of holding this fund kicks in over the long term.

A high yield and dividend hikes mean the already-impressive 7.9% that USA yielded in 2013 is now a 13.8% yield for investors who bought then and held for a decade. If they held for another decade, at this rate of growth, they’d have a 24% yielder on their hands.

We got a taste of that potential growth last week, when USA announced that its next quarterly distribution, payable September 5 to shareholders of record on July 21, will be 6.7% higher than its previous distribution.

With its solid value-investing approach to growth stocks, it is not surprising to financial professionals that USA is doing so well and making a small pool of investors a large amount of money. What is surprising is that the fund is so small: with just $1.8 billion in assets under management, it has attracted a small group of investors because Liberty’s team is more interested in making this fund outperform than adding new funds.

A quick glance at Liberty All-Star Funds’ website tells the tale here: the company has just USA and its sister fund, the Liberty All-Star Growth Fund (ASG), in its stable. And both funds have had long careers, having been launched within months of each other back in 1986.

CEFs aren’t just the place to shop for stock funds like these, by the way. The asset class contains funds holding a range of other investments, such as municipal bonds, corporate bonds, real estate and even more exotic plays, like Treasury derivatives.

In short, there’s a CEF for just about every approach to the market in a $400-billion industry that has been tightly regulated by the SEC (tighter, in my opinion, than mutual funds or ETFs). That gives us a pool of highly diversified funds that can translate “paper gains” on pretty well any investment into an 8% income stream—or more.

Alert: Our Chance to Buy 4 Life-Changing 9% Dividends Is Fading Fast

My top CEFs to buy now trade at such ridiculous discounts they’re “spring-loaded” for fast 20%+ upside. And that’s before you factor in their huge 9% dividends!

The gains and income on offer here are simply too good to pass up. Which is why I urge you to act now—before these obscene discounts close and this opportunity races away from us.

Recent Comments