No matter what Jay Powell says, interest rates are topping out here—and that’s put three “stealth” stocks (growing payouts double digits!) in perfect position to gap higher.

This trio are midcap stocks—which we love now because of, well, history: at times like this, midcaps, particularly midcap dividend growers, soar. This chart paints the picture:

Midcaps Counter Rate Moves

Here you can see that the Vanguard Mid-Cap ETF (VO), in purple, rose when the yield on the 10-year Treasury fell at the start of the pandemic. But look at the right side of the chart: as rates soared, midcaps slipped. That opens a buy window as Powell steps to the side and (eventually) cuts, flipping rates lower—and midcaps back up.

There’s more to like about midcaps now, too, such as their mainly domestic focus, which makes them winners from the building boom here in the US as companies move home from basket cases like Xi’s China and Putin’s Russia.

But we’re not simply going to buy VO and call it a day. Fact is, midcap ETFs hold too many stocks that pay low (or no) dividends.

This doesn’t mean VO is useless to us, though! We’re simply going to “cherry-pick” its portfolio for holdings with spiking dividends and cash flows. Here are three that make the grade, ranked from third to first:

ETF Cherry-Pick #3: A 385% Dividend Grower With Curb Appeal

Lawn-equipment maker The Toro Co. (TTC) is a smart sleeper pick as rates roll over. Over the past decade, it’s delivered near-400% dividend growth, with recent payout hikes accelerating. On cue, its stock has followed along:

Toro’s “Dividend Magnet” Is Running Full Throttle

That makes Toro’s 1.4% yield easier to bear, and the payout is set to keep growing as Toro puts supply-chain problems behind it and more people swap their gas mowers for battery-electric models. According to Fortune Business Insights, the cordless-mower market will nearly double between 2022 and 2029, from $2.61 billion to $4.6 billion.

So why is Toro in third? Two words: interest rates. In its last earnings report, the firm reported strong results from its professional division (serving clients like golf courses) but softer sales to homeowners. The residential market could remain a bit soft until rates do definitively turn downward.

Moreover, Toro is paying 96% of its last 12 months of free cash flow as dividends—too tight for our liking. Management is still calling for solid 7% to 9% sales growth this year, but we’d like to see rates definitively turn down, and Toro’s payout ratio swing back the other way, before buying.

ETF Cherry-Pick #2: An Industrial Play With a “Refreshed” Payout

Cintas (CTAS) is another stock whose products are decidedly unsexy: it sells work uniforms, mats, cleaning supplies and first aid and safety products to a wide range of businesses. Its 0.94% current yield doesn’t exactly get our hearts racing, either.

Even so, Cintas should be on any serious dividend investor’s radar because, even though it did cut payouts during the pandemic (understandable, with workplaces shuttered), it’s gotten right back on track, raising its payout 53% in just the last two years.

That’s because Cintas’ results have come roaring back with the economy: in its latest quarter, revenue jumped 11.7% and adjusted earnings per share soared 16.7%. That means we’ve got more payout growth to come, especially with dividends accounting for just 33% of its last 12 months of free cash flow, far below my 50% “safety line.”

That snags second spot for Cintas, but it falls short of the crown because it trades at 39-times its last 12 months of earnings—high for a stock posting strong numbers against early last year, when we were still emerging from lockdowns. That performance will be tough to match next year.

The bottom line? Put this one on your watch list—if (when!) we get a recession, it could be worth picking up on the dip.

ETF Cherry-Pick #1: A Savvy Builder Laying the Foundation for a Big Yield

AECOM (ACM) is a construction-and-design firm that’s profiting from soaring government infrastructure spending. And there’s no end in sight to that particular outlay: most of the $1.25 trillion earmarked for roads, bridges and the like in the Infrastructure, Investment and Jobs Act and the Inflation Reduction Act is still waiting to head out the door.

But it is heading out the door—and showing up in AECOM’s backlog, which hit a record high in the latest quarter.

Meantime, AECOM continues to execute and tap into wider trends. Earlier this month, for example, the Chemours Company (CC) hired AECOM to oversee construction of its green-hydrogen facility in France.

The government of Ukraine has also brought in AECOM to help with the country’s rebuild from Putin’s despicable war. Under the deal, AECOM will share its engineering expertise on specific projects and help manage Ukraine’s overall reconstruction plan.

It’s a clear case of doing well by doing good. Good for them. Go AECOM.

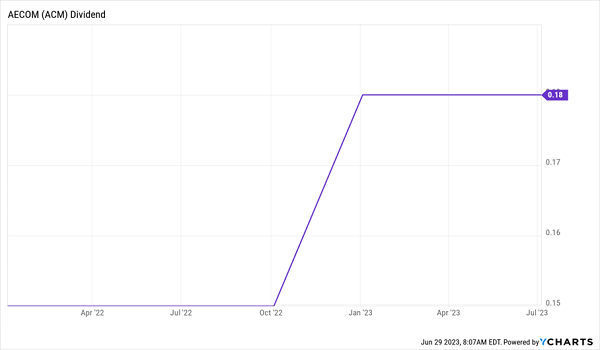

Meantime, we get to grab a dividend in its youth. AECOM only started payouts in early 2022, but it already delivered a 20% hike earlier this year. And with its backlog, revenue and earnings all trending higher, I expect another strong payout hike next year.

AECOM’s Dividend Gets Off to a Hot Start

Moreover, AECOM’s payout accounts for just 18% of its last 12 months of free cash flow, and it’s a big buyer of its own shares, taking 13% off the market in just the last three years. That creates a sweet “feedback loop” for us, as buybacks pump up earnings per share, influencing future share prices. They also leave AECOM with fewer shares on which to pay dividends, driving bigger payout hikes down the road.

Urgent: My Top 5 “Rate Rollover” Buys Are Growing Payouts Up to 600%

As we just discussed, NOW, just before rates top out, is the time to buy dividend growers for HUGE gains—and payout hikes—for decades to come!

The chart we looked at earlier is crystal clear: every time rates pull back, stocks soar. And by grabbing “megatrend” midcaps with fast-growing payouts (and buybacks!), you’ll turn the tables even more in your favor.

Sometimes investing really is this simple!

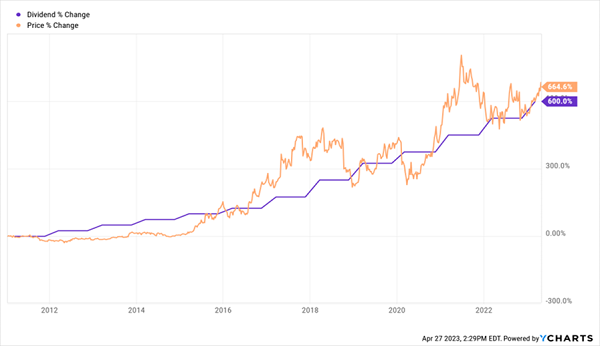

Which is why I’m urging all investors to grab the 5 stocks my proven “Dividend Magnet” system (which I’m eager to share with you today) recently turned up. One of these winners booked 600% dividend growth—driving 665% price growth!—in just the past decade (including the 2022 dumpster fire).

600% Dividend Growth Ignites Share Price

This is, quite frankly, one of the most reliable dividend plays I’ve ever seen.

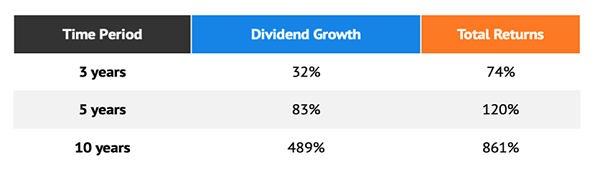

And there’s more. Another of this “fabulous 5” delivers double-digit dividend hikes every year. It’s a perennial grower we really want to own forever. Check out how the dividend has driven massive total returns over the last three, five and 10 years:

Now is the time to grab these two swift dividend growers and the three others I want to share with you today. Click here and I’ll show you how to use my powerful Dividend Magnet strategy and give you the opportunity to download a free Special Report naming all 5 of these “must-own” dividend-growth plays.

Recent Comments