We’re in one of the trickiest times I’ve seen in my investing career: inflation is receding and we’re well positioned for gains next year. Yet after the year we’ve had, many folks are still hesitant to jump into the market.

Even the 12%+ dividends we’re seeing in our favorite high-yield investments, closed-end funds (CEFs) haven’t been enough to tempt many of them.

I get it.

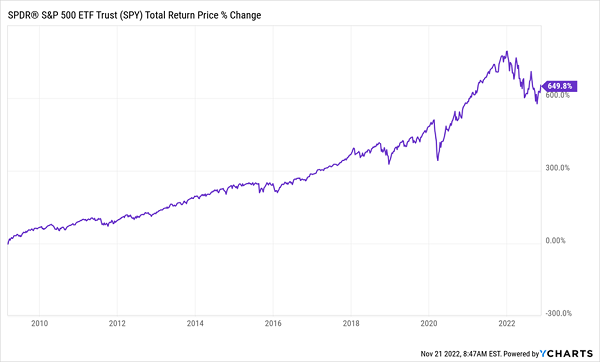

This period reminds me of the early months of 2009, when “green shoots” were appearing in the economy and markets, but investors were still too scarred by the preceding plunge to get in. But those who did buy then—around the bottom in early March 2009—have done very well:

Buying in Times of “Investor Shell Shock” Pays Off

We’ve got a similar opportunity now.… Read more

Recent Comments