Savvy contrarians know that when markets crash, the most beaten-up sectors are often the ones that lead the (inevitable) surge higher.

It’s one of the most reliable trends in investing. With their valuations (and dividend yields) crushed, these stocks are tempting bait for bargain hunters who like to run against the herd.

The 2008 financial crisis is a great example. Financial stocks, which were pummeled as millions of mortgages went bust, went on to soar after the market bottomed in ’09. So did real estate investment trusts (REITs).

Which is why I’m looking to roughed-up tech stocks, and tech-focused closed-end funds (CEFs), to lead the way in 2023. Below we’ll discuss one pick from my CEF Insider service that yields an outsized 13.4% today, so we’re getting most of our return in dividend cash. This leading-edge income play pays dividends monthly, too.

I’ll say right up front that these contrarian moves are never easy. It took guts to wade into real estate and finance in ’09. And tech still looks fragile, with Meta Platforms (META) announcing major layoffs last week and Amazon (AMZN) reportedly about to do so.

However, the broader economy is holding up, pointing to long-term profits for tech firms, especially those in high-demand niches like IT security. That makes the period we’re in now—which NYU marketing professor Scott Galloway has cleverly dubbed the “Patagonia vest recession” (after the trendy clothing garment favored by tech workers)—a smart time to buy.

Falling Inflation = Rising Tech Stocks

As the past year has shown, tech stocks move in opposition to interest rates, as many of these companies must borrow heavily to launch new products.

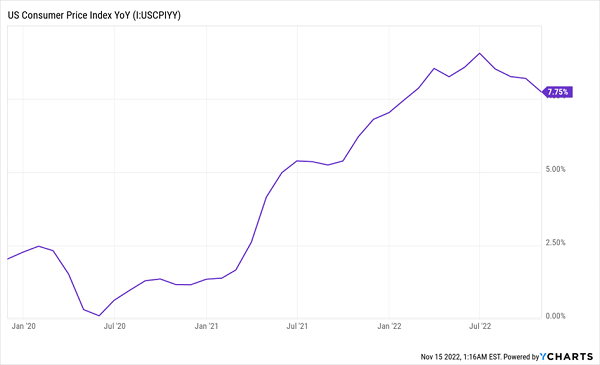

But inflation is finally starting to turn in their favor, rising 7.7% in October, below expectations and far below the 8.6% peak in May. The decline since then is obvious and consistent. And it lends weight to the idea that the Fed will soon pause its rapid rate hikes.

Inflation Relief Is Bullish for Tech Stocks (and CEFs)

It is true that tech stocks have bounced: they’re up 8% since Fed Chair Jay Powell’s press conference a couple weeks back, in which he contradicted the Fed’s own statement on future rate hikes with an overly hawkish tone. (We’ve never been fans of Powell’s messaging, which is often contradictory. But the market was sucked in: it quickly tanked, which we saw as a buying opportunity.)

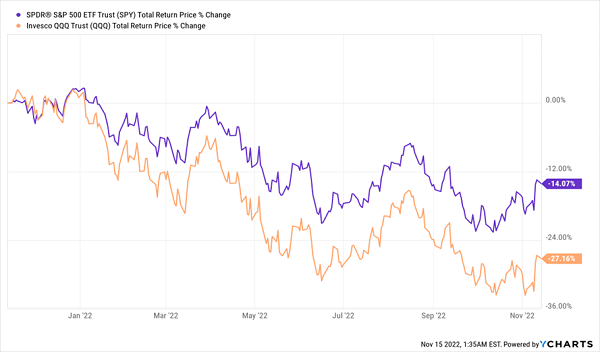

That opportunity is not yet over. Consider the chart below, which shows how far tech (shown by its benchmark ETF, in orange) trails the S&P 500 (in purple). That’s our upside potential.

Tech Still Has Room to Rise

Which brings us to the CEF I mentioned earlier, the BlackRock Science and Technology Trust II (BSTZ). It’s a recommendation of my CEF Insider service that trades at a 16.5% discount to net asset value (NAV, or the value of its portfolio).

That discount exists because BSTZ is the youngest tech CEF out there, having been launched in late 2019. With little history behind it, paranoid investors have been quick to oversell it this year. It also amounts to a pretty sweet “double deal” for us, as we get the fund’s discount in addition to the deal we’re getting on its overly washed-out portfolio.

Thing is, BSTZ’s doesn’t square with its holdings of strong companies like semiconductor maker Marvell Technology (MRVL) and security-software provider Synopsys (SNPS). BSTZ also holds a number of private-equity firms that are providing value that will be realized when they go through their IPOs.

All of this is on sale, and investors who add BSTZ now, and who can handle some short-term volatility, will likely see strong gains beyond the CEF’s 13.4% dividend, which is paid monthly.

4 More “Double Discounted” CEFs to Buy Now (for 9.5% Yields)

BSTZ is far from the only high-yield deal waiting for us in the CEF space. I’ve uncovered 4 more “double discounted” funds yielding a gaudy 9.5%, on average, today. They also come from across the economy, with holdings that include corporate bonds, blue chip stocks and REITs.

Put them together and you’ve got a diversified “mini-portfolio” with a high—and monthly paying—income stream you can count on. With the discounts each of these funds sport, I’m calling for 20%+ price upside from each of them in the next 12 months.

Now is the perfect time to buy them. Click here and I’ll give you my research on all four of these high-yielding funds, including their names, tickers, current yields, a full breakdown of their portfolio holdings and more.

Recent Comments