Milton Friedman said that inflation is “always and everywhere a monetary phenomenon.” Judging by the recent price action in many of the soft and agricultural commodities, they appear to agree.

Ben Bernanke, a student of the Great Depression, is making a bet the Friedman was wrong. Bernanke believes that because Friedman did much of his work during a period of time when the velocity of money was relatively constant, he did not properly account for this factor in determining inflation.

Helicopter Ben is conducting this “Great Experiment” of money printing to stave off a Depression based on the monetary theory developed by economist Irving Fisher, who believed the Depression occurred because money velocity dropped off a cliff, and there was no increase in money supply to counter this. Thus the US slipped into a deflationary spiral.

This is the big question – when the velocity of money drops, as it is today, should the money supply be increased? Who’s right – Fisher or Friedman?

We don’t yet know – though, as always, the market will decide the winners and losers. And lately it’s hard not to notice what the commodity markets have been telling us, especially agriculture.

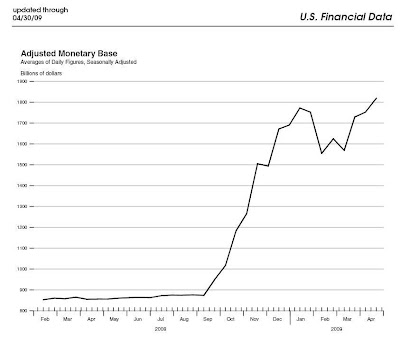

First, let’s see Exhibit A – the adjusted monetary base of the US, which still appears to be in a “bull market”:

Many of us saw the initial spike and immediately yelled “Inflation!” We loaded up and gold and ran for the hills. And what happened? The spike in monetary growth continued to grow to the sky, and gold got slammed – along with almost every other asset class. (Save the US Dollar and US Treasuries – hats off if you had that trade, as you are a true “contrarian’s contrarian”!)

Fast forward to a few weeks ago, and we noticed that not only had commodities appeared to have formed a bottom, but they were starting to climb.

This week, we saw a full fledged break out in the softs and the grains – let’s quickly have a look at three of our current favorites.

Sugar futures – our old favorite – rallied over 5% this week, to close a shade under 15-cents. Sugar’s been on a steady climb – fundamentals look quite appealing, as we discussed last week, and there’s no arguing with this chart:

- Why gold is going much higher than $2,000

- Jim Rogers interviewed by GoldSeek Radio

- The US is now “swimming” in Natural Gas

- Atlas Shrugged sales are soaring!

04/20/09 Long 1 JUL 09 Sugar #11 13.79 14.91$1,713.60

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now

Recent Comments