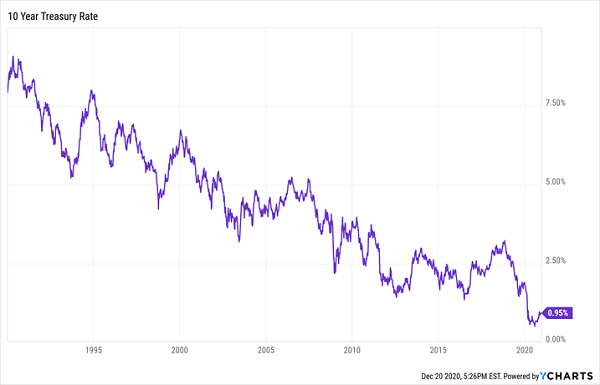

Let’s look at how we closed-end fund (CEF) investors can grab a healthy 6%+ dividend in this zero-rate world and dodge every retiree’s nightmare: that would be having your nest egg run out with years of retirement still to go!

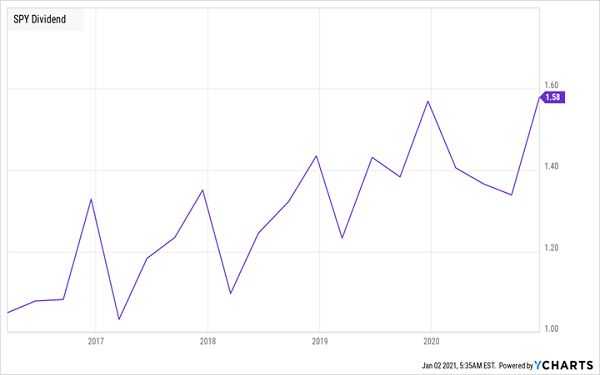

We can pull this off in part because the dividend story is not as grim as most people think. In fact, S&P 500 dividend payments actually hit a new all-time record in 2020!

That’s right: in a year when many long-time dividend payers cut or suspended payouts, the market handed over the highest amount of dividends ever.

Popular Stocks’ Dividends Plunge, Then Rebound …

If you held an ETF that tracks the S&P 500 index, like the SPDR S&P 500 ETF Trust (SPY) or the Vanguard S&P 500 ETF (VOO), you might find this hard to believe, especially when the current yields on the typical S&P 500 stock dropped to its lowest point in a generation.… Read more

Recent Comments