Let’s look at how we closed-end fund (CEF) investors can grab a healthy 6%+ dividend in this zero-rate world and dodge every retiree’s nightmare: that would be having your nest egg run out with years of retirement still to go!

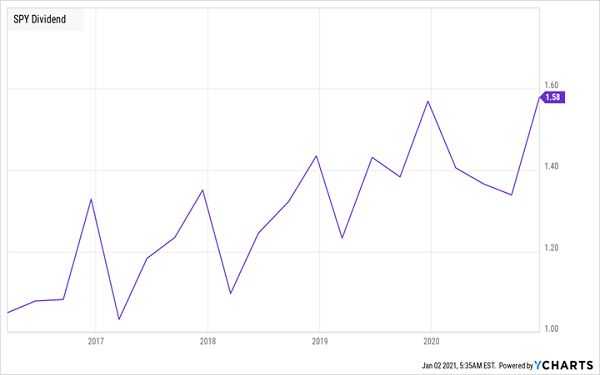

We can pull this off in part because the dividend story is not as grim as most people think. In fact, S&P 500 dividend payments actually hit a new all-time record in 2020!

That’s right: in a year when many long-time dividend payers cut or suspended payouts, the market handed over the highest amount of dividends ever.

Popular Stocks’ Dividends Plunge, Then Rebound …

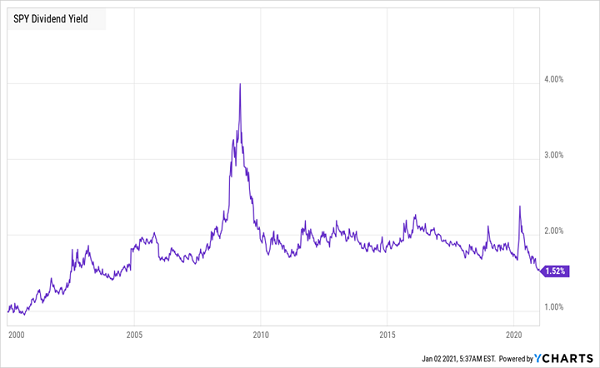

If you held an ETF that tracks the S&P 500 index, like the SPDR S&P 500 ETF Trust (SPY) or the Vanguard S&P 500 ETF (VOO), you might find this hard to believe, especially when the current yields on the typical S&P 500 stock dropped to its lowest point in a generation.

… But Yields Are Skimpier Than Ever

The S&P 500’s average yield collapsed because its price soared in 2020 (as you calculate yield by dividing the annual payout into a company’s current share price). While big price gains are always good, they still present a problem if you need cash—or if you’re close to retirement.

A “Dividend Triple Threat” That Can Hurt Your Retirement

Let’s imagine you held an index fund at the start of 2020 and you’re now getting just $1,700 in dividends a year (or $142 divided out on a monthly basis) for every $100,000 you have invested (based on SPY’s yield a year ago). But at the same time, the value of your portfolio is worth a lot more than it was when you bought in. Should you augment your dividends by selling some of your SPY holding and generating additional cash that way?

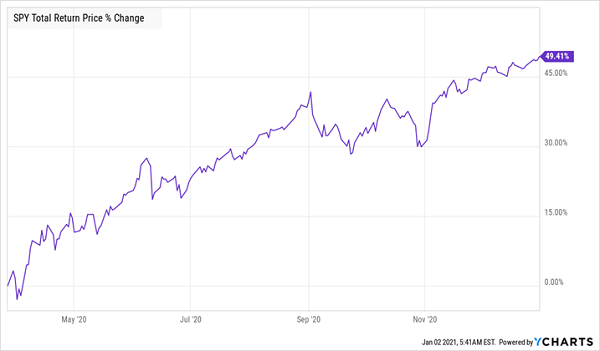

While you could, doing so on a regular basis means you’ll inevitably have to sell into a downturn. And as anyone who sold in March 2020 will tell you, selling into a storm can magnify your losses because you’ll have to sell more shares at depressed prices to generate the cash you need. That, in turn, will shrivel your income and cause you to miss out on a rebound like the one we’ve seen since last spring.

S&P 500 Investors Leave a 49% Gain on the Table

If you sold during the market crash at the start of the pandemic, for every $100,000 you sold, you lost out on $49,410 in missed profits. This is where index investors get tripped up: by not thinking about cash flow, they can end up losing a lot of money by being forced to sell when they need cash.

A 1-Click “Option” for 6.4% Dividends and Upside in 2021

This is why investing through a closed-end fund (CEF) is a much better way to go than buying stocks through an ETF.

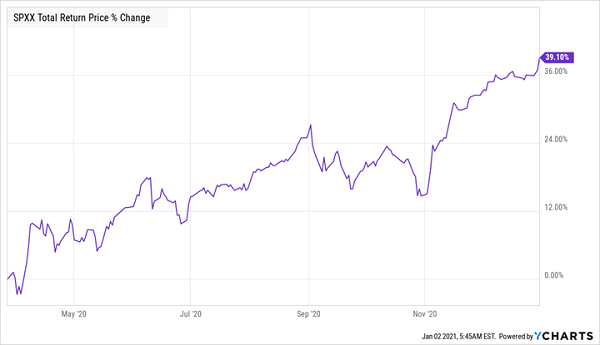

To demonstrate, let’s look at the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), which invests in top S&P 500 stocks like Apple (AAPL), Amazon.com (AMZN), Microsoft (MSFT) and Visa (V) and so remains close to the index. That makes it an appealing option for ETF investors, especially as its 6.4% yield is much more generous than the payouts of SPY or VOO.

SPXX pays its outsized dividend in two ways: one is by having a four-person management team that balances sales of shares and payouts to investors, limiting the risk of selling at a market bottom. The other is by using covered-call options, a kind of contract SPXX sells to give speculators the option to buy the CEF’s shares in the future. It then hands the cash it gets for selling these options to shareholders.

SPXX’s higher payout means plenty of investors who bought it and held throughout the March lows would have avoided keeping their money out of the market and missing out on this return:

SPXX Lets You Collect Your Cash and Stay Invested

True, SPXX’s 39.1% return from March to the end of 2020 isn’t as good as the index’s return, But even so, an investor who needed cash flow and used SPXX to secure a higher dividend payout ended up with much more money than the investor who sold in March because they needed money immediately.

This is the power of CEFs’ higher dividend yields—and there are many CEFs yielding as much or more than SPXX that outperformed both this fund and the index in the last nine months.

These Ignored Funds Make Money 99% of the Time, Pay You 7%+ in CASH

I’ve got 5 CEFs to share with you that I see as your very best plays for the year ahead. My indicators have all 5 pegged for 20%+ price upside in the coming 12 months AND they pay even higher dividends than the CEF average: I’m talking a 7.5% average yield between them!

And there’s something else you should know about CEFs: they boast a safety record that few other investments can match.

Here’s what my latest research says: of the 330 CEFs out there that are a decade old or older, only 14 have lost money in the last 10 years.

That’s a 96% win rate!

That’s amazing enough on its own, but there’s more: of the 14 CEFs that did lose money, 11 were in the energy sector. Dump those 11 laggards and CEFs’ win rate jumps to an amazing 99%!

And I’m making my 5 very best CEF picks available to you now. It’s a rare opportunity to position yourself for potential price upside of 20%+ this year while you collect a 7.5% CASH dividend you can count on.

Recent Comments