Investors are sitting on a shot at 100%+ dividend growth and a safe 6.9% yield—and most don’t even know it.

The route to this dividend bonanza runs through real estate investment trusts (REITs) that own apartment buildings. These landlords are raking in cash, with US rents skyrocketing by double digits in the last nine months. (We’ll discuss three specific names shortly.)

Higher cash flows translate straight into surging dividends because REITs are “pass-through” investments: they collect the rent, take out what they need to keep their tenants happy (and renewing their leases!) and send the rest our way.

This pass-through structure is no formality. REITs pay no corporate taxes, and to keep that exemption, they must pay us 90% of their taxable income as dividends.

That 0% corporate-tax rate is a big reason why REITs’ dividends are higher than those of regular stocks—the typical REIT yields about twice as much as the average S&P 500 name. That “dividend gap” is about to get wider for apartment REITs.

2 Soaring Trends That Will Boost Apartment REITs’ Dividends

The fact that landlords can raise rents at all—never mind by double digits—is something no one saw coming when the pandemic hit. A September report from rental site Apartment List showed that the national median rent has spiked 16.4% between January and September. That’s far above the 3.4% average increase seen in the same period from 2017 to 2019.

Why the acceleration? Simple: the Federal Reserve has printed a lot of money since March 2020. Some of this cash has flowed into renters’ pockets via stimmy checks. We can expect further rent increases as eviction moratoriums wind down, letting landlords rent to new tenants at higher rates.

Meantime, real estate prices soared 17.7% in August from a year ago, according to Zillow. Add in the likelihood of higher interest rates (further boosting real-estate costs), and you’ve got a setup for a rush into apartments by priced-out homebuyers.

An Apartment REIT With a “Hidden” 6.9% Payout

When it comes to REITs (or any stock), we income-seekers don’t want to just buy the highest yielders and call it a day. Doing so ignores dividend growers, which let you quickly build up a big (and often safer) yield on your original buy.

Dividend-Growth REITs Let You Build a Safe Payout From the Ground Up

Source: Essex Realty Trust September 2021 investor presentation

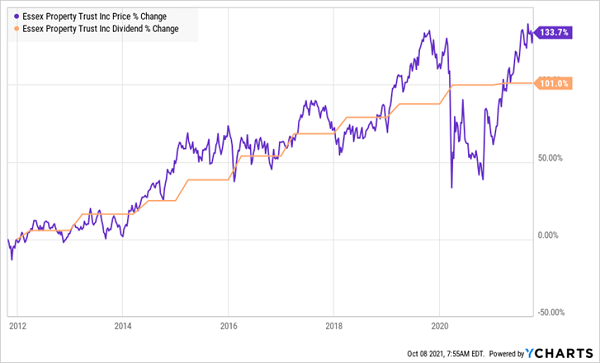

To show you what I mean, consider the first of the three REITs we’ll discuss today: Essex Property Trust (ESS), which yields 2.5% as I write this. That’s okay—again, nearly twice the 1.3% you get from the average S&P 500 stock.

But the real magic happens when you factor in dividend growth: over the past decade, Essex’s payout has jumped 101%. Put another way, anyone who bought in 2011 is now yielding a tidy 6.9% on their original purchase!

Essex’s Hidden Yield Revealed

That’s just the start of what a soaring dividend can do for you. You can see the rest of the story in the orange line above: that’s Essex’s share price, and it clearly marches higher with each payout hike. I call this phenomenon the “Dividend Magnet”—the predictable trend of share prices tracking dividends higher.

This, by the way, is why your favorite dividend payers always have the same current yield—because the company raises the payout, which increases the stock’s yield. That attracts investors, who bid the price up and the current yield down (because you calculate yield by dividing the yearly dividend into today’s share price).

The current yield on Essex, for example, has bounced around 2.5% for most of the last 10 years.

Essex’s “Go-Nowhere” Yield Hides Its True Payout

3 Apartment REITs to Target Now

Now let’s delve into the three dividend-growth REITs we’re putting on our shopping list today.

We’ve already touched on Essex, which focuses on California, specifically the tech workers in Silicon Valley. That’s a good place to be, since job openings in Essex’s markets have jumped 116% since the depths of the COVID crisis and are now 23% above the pre-pandemic peak, according to Essex’s latest research.

Those stats are a strong hint that we want to pick up REITs in America’s biggest cities, which were hit hardest by the pandemic—and are therefore set for the biggest rebounds.

Consider New York, where 28% of employees were back in their office towers as of September 22, according to Kastle Systems, which tracks the number of card swipes used to access buildings. That’s still a low number, granted, but it’s up 5% from late August and will accelerate as the recovery continues. And of course, more people in the office translates into higher demand for nearby apartments.

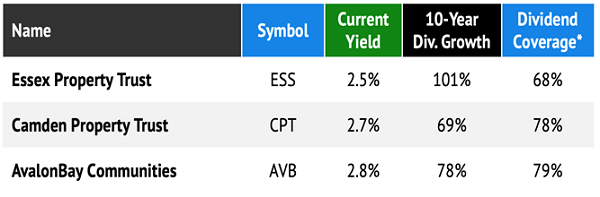

So let’s add two more urban-based apartment REITs to our Essex pick: Camden Property Trust (CPT) and AvalonBay Communities (AVB). Here are the vital dividend stats on our three-REIT “mini-portfolio.”

*Dividend coverage is calculated as the last 12 months of payouts dividend by the last 12 months of core, or adjusted, funds from operations, or FFO, the best metric for REIT profitability.

Camden, for its part, focuses on coastal cities like Washington, DC, Los Angeles and California, while complementing its portfolio with growing midwestern and southern markets, like Denver, Dallas, Atlanta and Tampa.

AvalonBay, much like Essex, focuses on the big coastal cities, with buildings in California, New England and New York and New Jersey.

By the way, the payout ratios you see in the table above are all safe for REITs, whose dividends can be sustainable at 90% of funds from operations or higher (since they’re pass-through investments). Our three REITs’ dividends are also safer (and more likely to grow) than these ratios indicate, as they’re all backward-looking and include the period when pandemic shutdowns were at their worst.

The key takeaway? Now is a great time to pick some well-run apartment REITs and settle in as their rent hikes inflate their cash flows, dividends and share prices.

Alert: These 7 Dividend Growers Double Your Money Every 5 Years

As we just saw, proven dividend growers set you up for big, recurring profits because their “Dividend Magnets” are constantly yanking their share prices higher. That’s why you must hold a selection of these cash machines in your portfolio.

And I’ve gathered my 7 best dividend-growth picks for you, which I’ll share right here.

These 7 stocks boast payouts that are not only rising but accelerating—setting you up for reliable 15%+ yearly returns for years to come. That’s enough to double your investment every 5 years, and it’s nearly twice the S&P 500’s historical return of around 8%!

I’ll share everything I have on these 7 urgent buys with you right now. Click here and I’ll give you my complete research on each one, including names, tickers, current yields, dividend-growth histories (and where I see the payouts on each one heading in the future).

Recent Comments