Buying a business development company (BDCs) is kinda, sorta like investing like a venture capitalist (VC).

Minus the arrogance. And the lack of yields!

I was 26 when I realized that VCs were just regular guys and gals. Well, let’s be honest—mostly guys. They didn’t necessarily know anything special. But VCs play the part, sitting in their Steelcase chairs and short sleeved polo shirts while it’s 60 degrees out here in Northern California.

BDCs, on the other hand, are investments for the people. Plus, they pay—up to 15% in dividends!

Here’s a quick primer. BDCs lend to small and midsized businesses that the big banks either won’t touch. Or will, but only with loan-shark-type arrangements. (Or VC-type deals—ha!)

Congress wrote BDCs into existence back in 1980 to encourage greater investment in the small-business community. Congress also took a few pages out of their playbook from 1960, when it brought real estate investment trusts (REITs) to life. Specifically, BDCs and REITs share a crucial requirement: They’re generally not taxed at the corporate level, so long as they distribute at least 90% of taxable income back to shareholders as dividends.

And almost all of the time, these dividends are huge.

A 13.5% average yield put to work in a million-dollar nest egg would come to $135,000 in annual retirement income. Heck, even if you just have $500,000 to invest, that’s still nearly $68,000. Not too shabby!

But we need to be able to actually rely on these dividends in retirement, so let’s examine some of the largest yields in the BDC world and see how their underlying companies hold up under the microscope.

I’m interested in business development companies that are at least one of two things right now:

- Best-in-class operators

- Positioned for lower interest rates and/or slower economic growth

Runway Growth Finance (RWAY, 14.3%) is a relatively newer BDC—it was founded in 2015 and went public in 2021—so it’s hard to tell if it’s the former. But it’s very much the latter.

Runway Growth focuses on late- and growth-stage companies, taking advantage of an environment where both VC funding and IPO opportunities are dwindling—and thus the need for private capital is growing. The entire portfolio of 50 portfolio companies is floating-rate senior secured loans (99% first lien, 1% second lien).

Short-term interest rates have almost certainly peaked, and margins likely with them. Thus, fundamentals and valuation, and RWAY has both in spades. Net balance sheet leverage of 76% is well below the industry average of 113%. Dividend coverage is 123% of net investment income (NII). And it trades at a nice 9% discount to NAV right now.

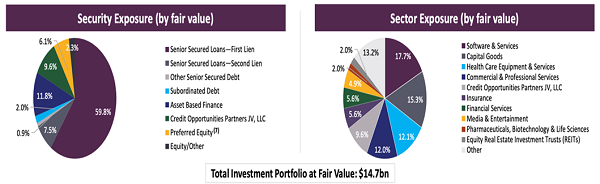

FS KKR Capital Corp. (FSK, 15.2% yield) could provide similar ballast. FSK provides financing to private middle-market companies, primarily by investing in senior secured debt (68%), though it also deals in subordinated debt, preferred equity, equity and other means of financing. Its 200 portfolio companies are spread across a fair number of industries, though again, there are several heavy chunks—software and services, capital goods, healthcare equipment and services, and commercial and professional services are all double-digit weightings. It also has high-single-digit exposure to Credit Opportunities Partners JV, a joint venture with South Carolina Retirement Systems Group Trust that invests capital across a range of investments.

FSK: A Well-Diversified BDC

Source: FS KKR Capital Corporation first-quarter investor presentation

FSK hasn’t historically given investors much to cheer about, but there are several things to like. A double-digit yield, sure, but also a healthy, well-covered payout, a growing streak of bottom-line beats, and a comically deep 21% discount to NAV.

If you’re not familiar with Barings BDC (BBDC, 11.8% yield), you might be familiar with Triangle Capital—a BDC with a checkered past that it put in the rear-view with a brand change, yes, but also a change in operations. Barings also brought on a new external adviser and the firm overhauled its portfolio. It now provides capital to well-established middle-market companies, as opposed to previously, when it lent to any borrower that moved.

BBDC’s credit situation is plenty healthy, as is its dividend, which has been steadily growing for years. But the biggest draw is an unthinkable price, with shares currently trading at a 22% discount to NAV—or 78 cents on the dollar!

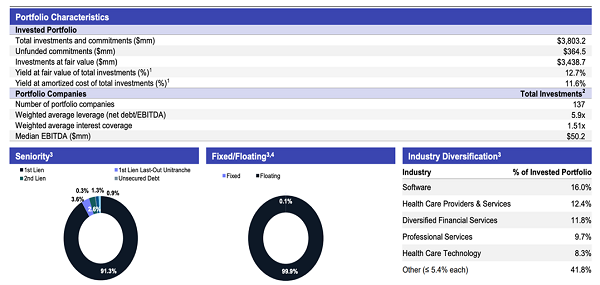

Goldman Sachs BDC (GSBD, 12.1% yield) has more pedigree than virtually any other BDC, with management allowed to “draw upon the vast resources of Goldman Sachs to assist in the evaluation of potential investment opportunities.” GSBD’s 137 portfolio companies typically sit between $5 million and $75 million in EBITDA annually, with investments—almost exclusively debt—ranging from $25 million and $75 million.

Goldman Sachs BDC: A Debt Specialist in Small Business Financing

Source: Goldman Sachs third-quarter investor presentation

One bugaboo I’ve mentioned previously, debt-to-equity, improved in the most recent quarter. Net asset value grew, and NII came in ahead of expectations, too. The dividend remains stagnant, though. Shares are actually a touch overvalued at a 2% premium to NAV. And honestly, despite the Goldman Sachs credentials, it has been a woeful underperformer over the past few years.

I’ve spent years knocking around Prospect Capital Corp. (PSEC, 12.5% yield), but at a whopping 38% discount to NAV, is this monthly dividend payer finally worth a look?

Prospect has some $7.9 billion invested in 128 portfolio companies across 36 different industries. The lion’s share (81%) of investment assets are in senior secured debt. Non-accruals are virtually nonexistent, and the company boasts a thin 0.5 net debt-to-equity. But as strong as those basic fundamentals are, PSEC’s management has largely not walked the walk, producing several dividend cuts and long-term underperformance—not exactly the team you want to roll with if the industry faces turbulence.

BlackRock TCP Capital Corp. (TCPC, 13.9% yield), which is externally managed by Tennenbaum Capital Partners (TCP, an indirect BlackRock subsidiary), invests in the debt of middle-market companies with enterprise values of between $100 million and $1.5 billion.

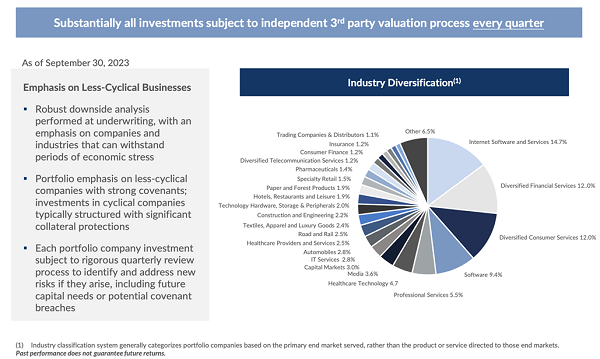

TCPC has a healthy 143 portfolio companies spread across a wide range of industries. That said, TCPC does have several pockets of double-digit exposure—internet software and services, diversified financial services, and diversified consumer services—while many of its other industrial weightings are relative sprinkles.

TCPC: Diversification & Preference for Stable Industries

Source: BlackRock TCP Capital Corp. third-quarter presentation

TCPC bears watching for several reasons, not the least of which is an increase in nonaccruals. Also, in the third quarter, TCPC announced it would be merging with another BlackRock (BLK) BDC, BlackRock Capital Investment Corp. (BKCC). The move should give TCPC significantly more scale, but I want to see what happens to my favorite aspect of TCPC: Its special dividends.

BlackRock TCP has been raising its quarterly dividend over time, but it’s also starting to rely on special dividends to share the wealth without overcommitting. In 2023, TCPC has distributed or announced 35 cents’ worth of specials—given that its regular is 34 cents, it’s like investors are getting a fifth quarterly payout!

Fidus Investment Corp. (FDUS, 14.5% yield) invests in a wide range of lower-middle-market companies across the U.S. It leans hard into technology companies, which make up more than a quarter of the 80-firm portfolio, and business services are the only other double-digit component, at 14%. It also has a more diversified asset mix than many of these other BDCs, with 58% in first-lien debt, 20% in second-lien debt, 14% in subordinated debt, and a decent single-digit chunk in equity.

Fidus makes a good case to be considered among the best-in-class BDCs, with a solid track record of NAV/share growth. It also has scant net balance sheet leverage of 65%, and a well-covered, growing regular dividend.

FDUS keeps from going out over its payout skis by leaning heavily on special dividends. Last year, it paid $2.00 per share in dividends, 56 cents (28%) of which were specials. This year, it will pay $2.88, $1.22 (42%) of which were/will be specials.

Give Me 4 Minutes, I’ll 4X Your Retirement Income

We should keep our eyes on FDUS—but given that it actually trades above its NAV, us contrarians should probably keep our hands to ourselves for right now.

Yes, it sounds greedy, but we need to “have it all” when picking our holdings.

Big yields? Yes.

Growth potential? Absolutely.

A bargain price? A must.

And while we’re at it, we need investments that can survive a few gut punches—whatever Jerome Powell, the economy, and presidential elections can throw their way.

If it sounds like too much to ask, believe me, it’s not. Because those are exactly the kind of investments you can find right now in my “Perfect Income” portfolio.

My “Perfect Income” portfolio attacks income investing from a different angle.

Rather than trying to time the market and chase trends, we target high-yield holdings (roughly 5x the S&P!) that walk their own path, no matter what the Fed, Congress or the rest of the world throws their way.

So, what makes these dividends “perfect”? Well, they have to have a few things in common:

- They DO pay consistently, predictably and reliably.

- They DO survive—and even thrive—in market crashes.

- They DO deliver double-digit returns, with safe, secure investments.

- They DO require minimal management time—just a few minutes every month!

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

Recent Comments