Many investors say they buy low and sell high. But how many really do?

Let’s pick on the people buying NVIDIA (NVDA) at atmospheric levels. First, can they even spell NVIDIA? (Hint: Two “I”s).

Second, do they realize it sports a price-to-sales (P/S) ratio of 32? It is usually a really bad idea to pay 10+ times sales for a stock. Let alone thirty-two.

Note that I did not say earnings. I said sales. Revenues. The ol’ top line. Money before everything.

Scott McNealy, the co-founder of Sun Microsystems, famously told investors it was insane to pay 10-times sales for Sun’s stock. Ten!

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends.

That assumes I can get that by my shareholders. That assumes I have zero cost of goods… that assumes I have zero expenses… that assumes I pay no taxes… assumes zero R&D.

An amazing explanation by Scott. Don’t ask me why my stock is down… ask yourselves why it was so high in the first place!

Scott made his now-famous comments two years after Sun’s top. I wonder if we’ll be reading a rhyming phrase from Jensen Huang, CEO of NVIDIA, two years from now.

If Sun’s valuation was on the moon, then NVIDIA’s price is way out there in the Kuiper Belt. NVDA trades for 32-times revenues, which means:

- To give investors a 32-year payback (which is roughly a measly 2.2% per year), Jensen must pay 100% of revenues as dividends for 32 years.

- This assumes he can get it by his shareholders.

- It assumes zero costs, expenses and future R&D. And no taxes. Ha!

Obviously not going to happen.

It’s ironic that the hottest stock in the solar system doesn’t have a plausible path to this 2.2% annual return. Now could someone buy it sky high today and sell it even higher next month? Possibly. But buy and hope isn’t our game.

Most investors are busy bidding NVDA to the moon. They want nothing to do with cheap contrarian plays.

Don’t believe me? Let’s turn back the clock to a simpler time—two weeks ago. The day was Valentine’s Day, and yours truly was begging you to forego the Hallmark holiday and buy natural gas stocks instead:

Natural gas did it again! It fell below $2 per million BTUs. These washout levels typically represent a floor for nat gas prices.

Every time it drops below this $2 linoleum level, the price eventually pops and tests the ceiling. Now that we have this ideal setup again, let’s back up the truck!

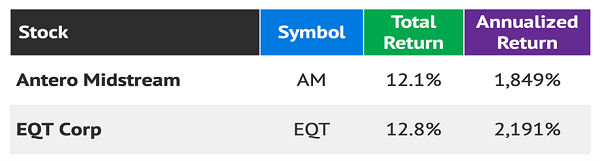

In the piece, we called out two high-payout plays. The first cash cow, Antero Midstream (AM), yielded 7.6%. The second “dividend dumpster dive,” EQT Corp (EQT), featured 425% payout growth in just five years.

Our contrarian reasoning was that natural gas always bounces back. The cure for low prices is low prices. The reason for this is simply supply and demand. When natural gas prices are low, producers stop producing. Which means less supply.

Natural gas companies can cut (“shut in”) production quickly. They do it out of self-preservation—to save money so that they can live to see another “up cycle” in prices.

Just one week after we went to “print,” producer Chesapeake Energy Corp (CHK) announced it was… wait for it… cutting production. This was immediately reflected in higher stock prices:

What a Couple of Weeks!

If you bought these two stocks when we highlighted them, congratulations! Most of your fellow investors did not, I can assure you, because contrarian investing is, by definition, uncomfortable.

It’s comfortable to run with the herd and chase NVIDIA to the moon because other investors are doing it too. But that typically is not a good way to make money. Buying high and selling higher can work but, eventually, stock flippers run out of willing partners—and no one knows when they will be Wile E. Coyote in the air discovering gravity!

I’d rather dumpster dive for cheap dividends which, oh, do we ever have in the bond market today!

The bond markets freaked out recently when inflation data came in hotter than expected. Vanilla headlines proclaimed that the Federal Reserve’s inflation fight is not over. Bloomberg cleverly stated the “last mile” for inflation looks elusive.

Good one, guys. The real story here is long-dated interest rates, which rose during Tuesday’s mini-hysteria. The 10-year Treasury yield bumped back above 4.3% for the first time since November.

Here we go again, Chicken Little investors fretted. The inflation boogeyman is back.

I don’t think so. And even if I’m wrong, it’s only a matter of time before I’m right. Here’s why.

The Fed decides the Fed funds rate. The two-year Treasury yield often follows. (True, sometimes, the two-year leads, but not often. As always in economics and relationships, it’s complicated.)

We can debate who leads who, but the key is that the Fed controls short-term rates, while the bond market determines long-term rates.

The Fed may hold short-term rates “higher for longer” now. So what? The more resolute the Fed is, the faster the economy will cool, the sooner short rates will drop.

Why? A slowdown will cool wage hikes and all the things that boost inflation. Long rates will slump. Big picture, this is already happening. The 10-year rate peaked last October when Mr. and Ms. Market achieved peak insanity. The benchmark topped 5% and, on its journey to the stars, clipped equities. A high long rate upsets every apple cart in finance.

As contrarian investors we want to fade the “high long rate” hysteria.

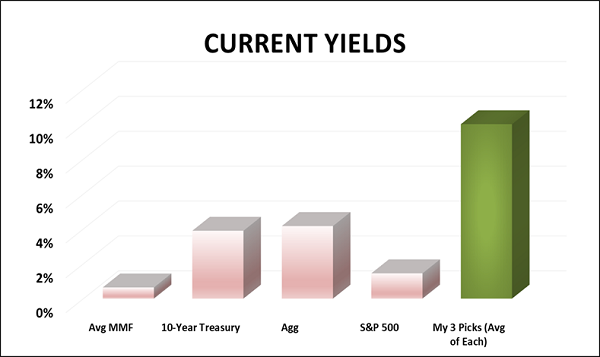

The most straightforward way for us to do this is to buy long-duration bonds. iShares 20+ Year Treasury Bond ETF (TLT) is the popular play. But we can do even better by considering my three favorite bond funds today. These funds average a terrific 10% yield:

Sources: FDIC, US Department of the Treasury, iShares/BlackRock, Contrarian Income Report Portfolio

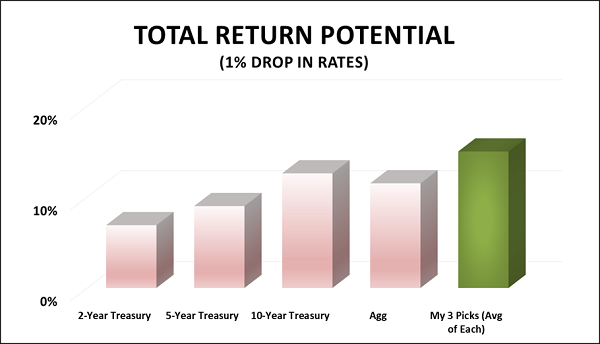

We also have the potential for 15% annualized upside from each one with a mere 1% reduction in rates:

Sources: JPMorgan Asset Management, Contrarian Income Report Portfolio

While I wouldn’t chase NVIDIA or even natural gas here, I am actively combing through big payers in the bond market. Some of the best dividend deals on the board can be found in Bondland.

I’d love to share the details of my three favorite picks here—including names, tickers and buy prices. They’re available in my new special report entitled Ride the Bond Bull: 3 Funds with Yields Up to 12% and Massive Upside Potential. Please access my new report on a risk-free basis here.

Recent Comments