Wondering if it’s too late to cash in on the late-2018 market mayhem?

If so, great news! There are still plenty of bargains to be had. And today I’m going to show you three great funds that are still cheap (though they won’t be for long).

The best part? Each throws off hefty dividends upwards of 7%!

Of course, when discounts like the ones on these three exist, you’re right to ask why. The answer is simple: because these three funds are closed-end funds (CEFs), they’re off most people’s radar. That means they’re slower to snap back from a market decline than, say, a fan favorite like Apple (AAPL). So we still have time to tap them for serious upside.

More on these three buys in a moment.

First, let’s look at why the buying opportunity in stocks (and funds) is far from over—and why the bull still has plenty of room to run.

The One Thing Nobody Tells You About Selloffs

Here’s something you never hear after a market meltdown: these wipeouts reset future expectations for growth—and that makes it easier for companies to surprise investors when they next report earnings.

This is exactly where we are now.

Here’s what I mean: according to FactSet, analysts have lowered their expectations for first-quarter 2019 earnings by 5%, the largest drop since 2015. And it just so happens that 2015 was the worst post-crisis year for stocks, with a late-year crash that looked a lot like what we saw starting in October 2018:

2015 Is Back!

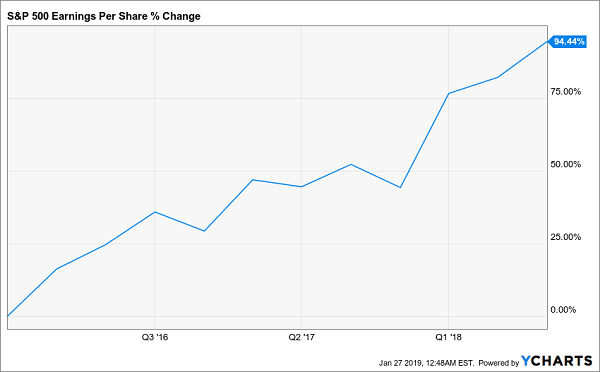

Investors who ignored this noise and doubled down saw a 10% annualized return if they bought after 2015’s earnings forecasts flopped. Why? Because 2015’s lowered estimates led to a big upside surprise when profits skyrocketed over the longer term:

Earnings Soar Despite Pessimism

Anyone who bought in late 2015 or early 2016 caught the market when its P/E ratio was temporarily depressed. We’re in the same situation now.

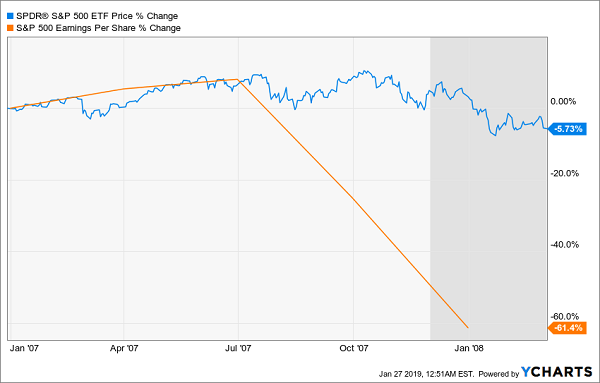

Not all market downturns are buying opportunities, though. For instance, it was a great time to sit things out when stocks dipped in early 2007. That’s because the housing bubble artificially buoyed confidence, so the market took months to price in the massive decline in earnings that was underway:

Crash Warning (in Orange) Is Ignored

Now compare that chart to 2018, keeping in mind that fourth-quarter data isn’t out yet:

No Warning Sign Here!

What these charts tell us is clear: 2018 is more like 2015 than 2007, where there’s a panic and strong growth instead of 2007’s market euphoria and sudden collapse in growth. That’s a buying, not a selling, opportunity, especially as stocks still haven’t gotten back to their pre-October levels.

3 CEFs Poised for Post-Rebound Gains (and Yielding 7%+)

This is where the three funds I have for you today come in. The best thing about them is that each gives you a big part of your rebound profits in cash, thanks to their massive 7%+ dividends.

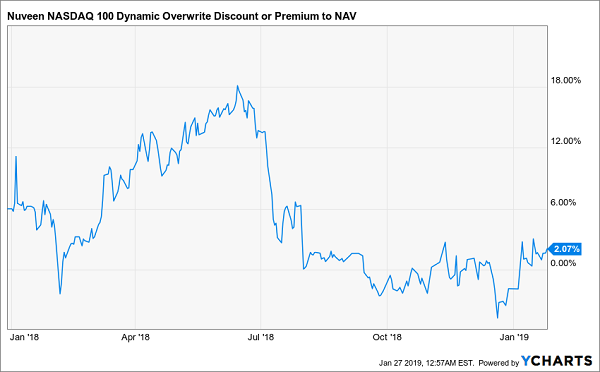

Let’s start with my first pick, the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX), payer of a stable 7.8% dividend. It remains 22.6% off its price high, but more crucially, its massive premium to net asset value (NAV) has evaporated, letting you buy at a fair price for the first time in nearly a year:

QQQX Goes on Sale

Next up, the Liberty All-Star Growth Fund (ASG) pays an 8.2% dividend and holds many small- and mid-cap holdings. It’s also cheap, with a 7.8% discount to NAV that’s near its lowest point in almost two years. That discount and ASG’s focus on smaller firms were the cause of some volatility in late 2018, but a rebounding market makes this fund a huge opportunity now:

ASG’s Ride Up Is Just Getting Started

This fund’s 10.9% price return in 2019 is one of the best of any CEF, and thanks to lowered expectations, there’s still plenty of room for more gains.

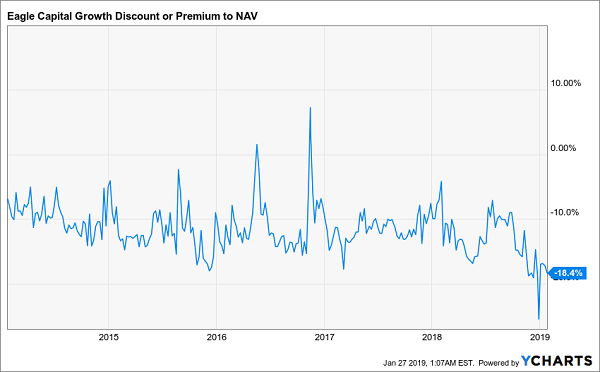

Let’s wrap up with the Eagle Capital Growth Fund (GRF). With large-cap holdings like PepsiCo (PEP) and Berkshire Hathaway (BRK.A), this is a CEF that focuses on steadier stocks while still delivering upside. Its 7.3% dividend yield is nothing to sneeze at, either.

What’s more, the market seems to have forgotten GRF’s 8.1% price decline in 2018, because it’s still down 1.4% so far in 2019. Plus its discount remains near a five-year low:

This Buying Opportunity Isn’t Over

This is a rare gem of a fund with a big dividend and a strong portfolio that hasn’t caught much attention lately. That sets it up for some nice price gains in a continued recovery.

These three CEFs are just the start. Because now I want to show you …

My 18 Very Best CEFs for 8.5% Dividends and BIG Gains in 2019

The 18 funds I want to give you now offer two things the three above can’t: bigger upside (thanks to their unusual discounts) and higher dividends! I’m talking about an incredible cash payout of 8.5%, on average.

So a $500,000 investment in the “average” of these 18 funds would hand you $42,500 in dividend income in the next year alone.

The kicker? Eleven of these income powerhouses pay dividends monthly!

So what are these funds?

They’re the 18 buy recommendations in my CEF Insider service’s portfolio. And as I just said, I’m ready to GIVE you access to all of them right now. All you have to do is “kick the tires” on CEF Insider today with a no-risk, no-commitment 60-day trial.

So with just a couple clicks, the names of all 18 of these cash machines will be instantly revealed to you.

18 Retirement Lifesavers: Yours Now

And remember, that 8.5% dividend is just an average. One of these blockbuster funds yields an amazing 10.5% Another? 11.3%!

That’s not all, either, because you also get …

My 5 “Best Buys” for Your Portfolio Now

You also get a FREE Special Report revealing my top 5 CEF buys for 2019. These CEFs truly are the best of the best: your go-to picks for reliable income and blockbuster upside: I’m forecasting 20%+ price gains in the next 12 months alone, thanks to the ridiculous discounts this 5-pack is trading at right now.

History is also on our side here, because these 5 powerful funds have a long record of market-beating returns, like pick No. 1, which has absolutely dominated since it came on the scene:

This Quadruple-Digit Winner Could Be in Your Portfolio Today

And with just a couple more clicks, the name of this fund, plus the 18 CEFs throwing off an amazing 8.5% dividend and my 5 best CEF buys for 2019 can all be yours.

Don’t miss out. Click here to get your Special Report and full details—names, ticker symbols and my complete research—on this basket of 18 potent 8.5%+ income plays now!

Recent Comments