We’ve been extolling cash in these pages since the start of this year. As the Federal Reserve prepared to pause its money printer, we contrarians booked profits and stacked dollar bills.

Long before the media began saying “bear market,” we recognized that a volatile 2022 was highly likely. We were ready for a decline.

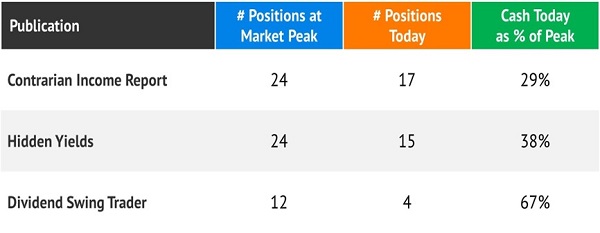

As I write, our premium portfolios are all sitting on sizeable cash positions:

Yup. Plenty of capital ready to be deployed after the final “wash out” in the markets.

These comfortable cash seats have served us well. Bonds kicked off their worst start to a year since 1788 (per Nasdaq).… Read more

Recent Comments