The last time the Federal Reserve tried to taper its money-printing ways, the S&P 500 dropped 20% in 11 weeks.

I’m not sure if the sequel is going to be any kinder to “America’s ticker,” the SPDR S&P 500 ETF (SPY). It’s time to prepare.

The best time to sell speculative, profitless positions was last week. The second-best time is probably now, with Jay Powell set to stop his bond buying and start raising rates in the next couple of months.

I know many dividend investors are feeling smug, and rightly so. We made a bunch of money from Powell’s printing, and now our dividend darlings appear set to attract “basic” investors from the land of crypto and tech.

But not all dividend payers are safe today. Some are anything but, and will be washed out alongside the speculative junk. (We’ll name two of these dangerous dividends below.) But first, a toast.

Powell Has Been Good to Us

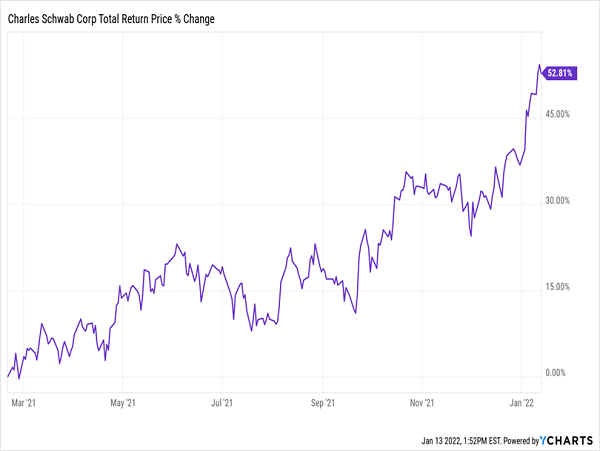

One day we may raise a glass to Powell, whose magic money helped drive plenty of gains (and dividends!) in the portfolio of our Hidden Yields dividend-growth advisory. A prime example: brokerage Charles Schwab (SCHW), which is bringing in more interest income as rates rise. That’s helped us bag a market-crushing 53% total return on Schwab in just over a year, as of this writing!

Thanks, Jay!

But now that the calendar’s flipped, we need to stay on our game, because the 2022 edition of the stock market is likely to be a mess—a classic stock-picker’s setup that’ll be all about picking the right stocks at the right times. Holding stocks with strong growing profits and free cash flow, as well as healthy balance sheets, will be critical.

The good news is that this makes for a great environment for savvy stock pickers like us, while folks who buy index funds or, worse, speculate on profitless tech stocks, NFTs and other gimmicks, will be left very exposed, indeed.

A Teetering Market

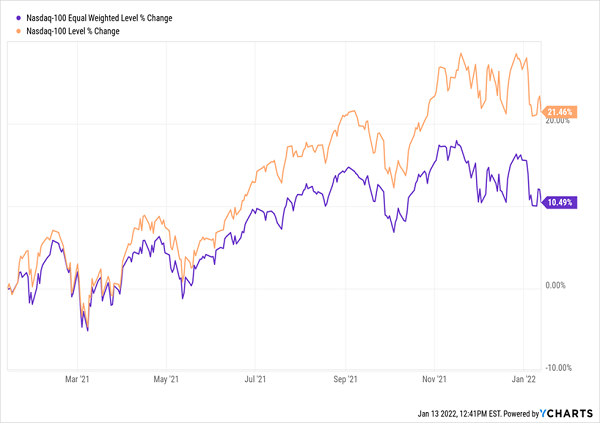

In fact, the most skittish among the “dumb money” have already bolted. According to Sundial Research, about 40% of companies on the NASDAQ—weighted, as the index is, toward go-go tech stocks—have fallen some 50% from their 52-week highs.

Think about that for a second: nearly half of all NASDAQ stocks have been hit for 50% (or more) of their peak value!

It doesn’t seem to square with the 22% gain we’ve seen from the index itself, which, of course, is market-cap weighted, with big names like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN) and Tesla (TSLA) the top-five constituents.

But if you look at the NASDAQ on an equal-weight basis (in purple below), it quickly becomes clear that the index’s performance is wildly unbalanced, and not all it’s hyped up to be.

NASDAQ Gains Are ALL Powered by the Big Names

At just a 10.6% increase in the last year, it’s clear we’ve got several NASDAQ issues—the more speculative small fry—dropping in that time. And the gamblers who are still hanging in are about to get flushed out as Powell slows down his money printer.

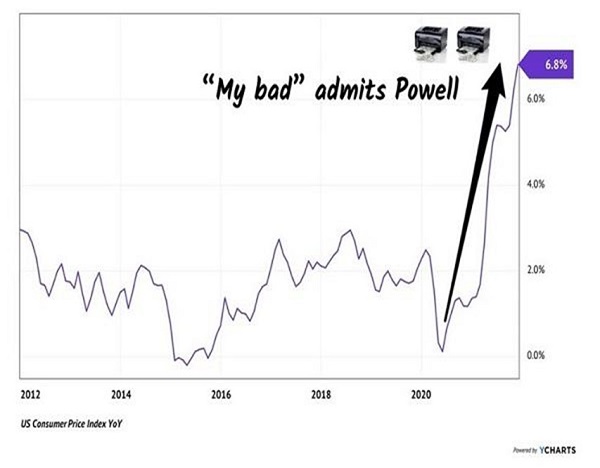

The Fed, of course, turned on the money spigot in March 2020, and greenbacks rained down on us for nearly two years. We are now seeing the implications of this massive money printing: inflation!

Powell has finally acknowledged that the price increases we are seeing every day at restaurants, the gas pump and in the grocery stores are not “transitory” after all.

Problem is, “risk assets,” like tech stocks with low (or no) profits or dividends are addicted to Jay’s stream of money. It’s the reason why, when he began to pump the brakes, 40% of the companies in the NASDAQ rolled over.

“Dividend Magnets” Power Shares Through All Market Weather

We dividend investors tend to be pretty smug in times like this. After all, we’re getting a healthy slice of our return in cash, which buffets us from here-today, gone-tomorrow “paper gains.”

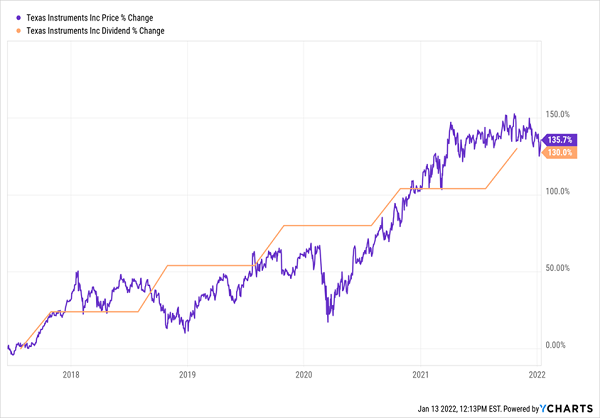

And investors who buy the dividend growers in Hidden Yields get the benefit of the so-called “Dividend Magnet.” This is the propensity for a stock’s price to rise in lockstep with its dividend. It’s been a key driver in many of our picks, including our winning call on Texas Instruments (TXN), which was one of Hidden Yields’ earliest recommendations after its launch, when we bought the stock in June 2017.

TXN’s share price has marched higher with its dividend hikes over our nearly five-year holding period, handing us a 136% price gain (and a tidy 163% total return with dividends factored in!).

TXN Rides Its Dividend Higher

TXN is the kind of dividend grower we love. CEO Rich Templeton has more than doubled the company’s free cash flow since taking the helm in 2008, supporting the company’s 1,000%+ dividend growth since then (a streak it maintained through the financial crisis and COVID-19).

Today, TXN’s dividend accounts for a safe 52% of free cash flow. And the company sports a “fortress” balance sheet, with cash and short-term investments of $9.8 billion, more than its long-term debt of $7.74 billion.

Weak Dividend Payers Give the Illusion of Safety

But not all dividend payers are on such solid footing—and sometimes a high yield is a sign of danger, rather than a solid income stream. For example, as the money printer slows, you do not want to be stuck holding a stock like Pitney Bowes (PBI), which is trying to make the tricky shift from old-school mail services to e-commerce.

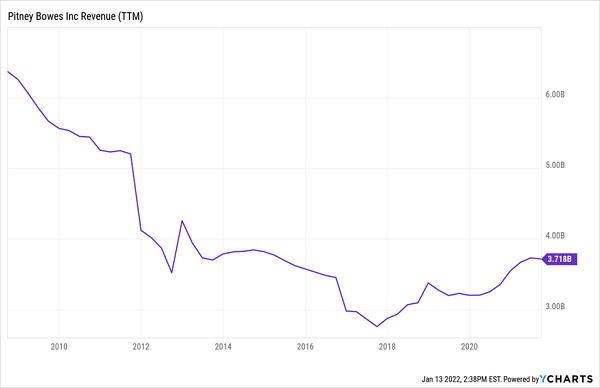

Unfortunately, Pitney has made little headway: its revenue is still trying—and failing—to retake a peak reached 13 years ago!

Pitney’s Sales Flatline

PBI is such a holdover that it got swept up in the meme stock mania of last January, jumping some 93% in a single day as millennial Reddit gamblers tried to catch short-selling hedge funds napping. That puts it in the esteemed company of museum pieces like GameStop (GME), BlackBerry (BB) and even the bankrupt Blockbuster Video.

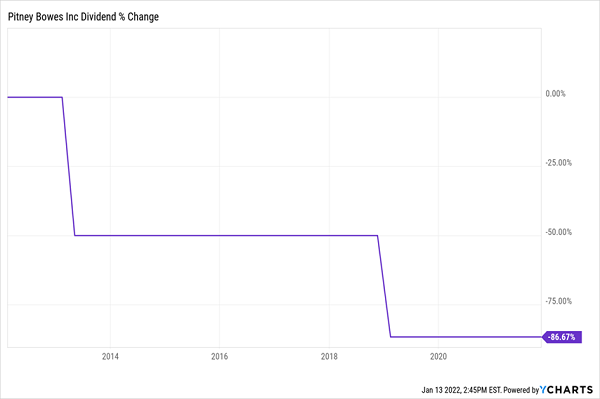

As for dividends, you might be pulled in by Pitney’s 3.1% yield, but that’s entirely because the stock has plunged some 60% in the past year. The payout also accounts for a (seemingly) safe 21% of Pitney’s free cash flow, but don’t let that fool you, either—that “safe” ratio exists because the company has chopped its payout by 87% in the last decade!

Dividend a Shadow of Its Former Self

Another example of a stock held aloft mainly by hope is International Paper (IP), payer of a 3.8% dividend as I write this. The company makes packaging, which should put it in the catbird seat as e-commerce became many people’s go-to during the pandemic.

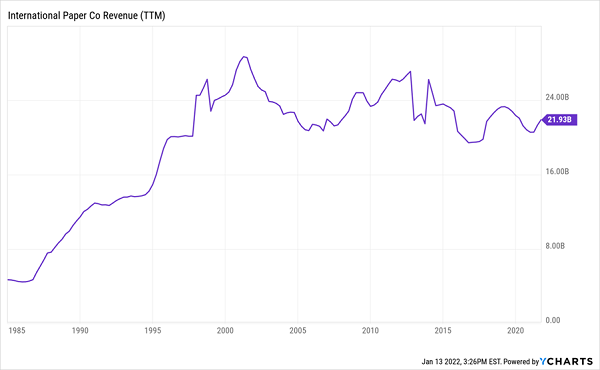

Despite that, revenue has gone nowhere in 20 years!

IP’s Sales: The Very Definition of Flat

The company did cut its dividend by 10% in late 2021 after spinning off its printing papers business, and the stock has been mired in a slump, dropping some 24% from its high in June 2021.

The payout is safe, at 35% of free cash flow, but with revenue basically flat and little dividend growth to power the price higher (the payout had been flat for two years before being cut), this is another stock that could plunge when Powell shuts the stimulus taps.

As Stocks and Bonds Fall, These 7 Dividends Stand Tall

Now that we’ve looked at the kind of stocks to sell as volatility picks up, let’s pivot and dive into 7 stocks that are “must buys” as inflation—and interest rates—tick higher.

These 7 unsung dividend growers flourish in markets like the one we’re facing today, and they’re all ridiculously undervalued now, which means they’ll hold their own when stocks take a header—and soar when markets (inevitably) bounce.

So what kind of return can you expect here? My team and I are calling for a steady 15% in gains and dividends from these 7 picks in 2022 (and for many years afterward).

Don’t miss this opportunity to protect and grow your portfolio (and income stream!) as inflation rises and markets gyrate. Click here for everything I have on these 7 reliable dividend growers, including their names, dividend growth histories, my take on their management teams and a full breakdown of their operations.

Recent Comments