Seriously. Alerian MLP ETF (AMLP) pays a dividend that is now a sizzling 8.2% (read: eight-point-two). Plus, the fund raises its payout regularly. It dishes 12% more today than it did twelve months ago!

As a result, AMLP is so popular that investors keep the price up!

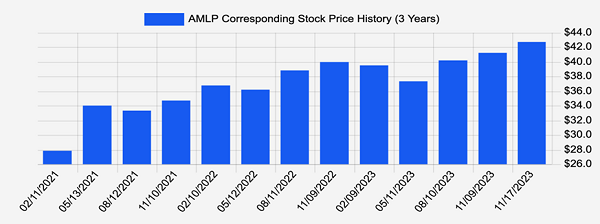

Seriously, check out this quarter-ending stock price chart. AMLP’s quote may drift for a quarter, or two, max. That’s why any meanderings lower are great buying opportunities:

Source: Income Calendar

AMLP is up 19% since we added it to our Contrarian Income Report portfolio just over a year ago. Despite this stellar performance by an income stock, it may indeed be the one missed by most plain-vanilla investors.

These salad days for AMLP feel like they’ve been going on forever. But it wasn’t always this way. The catalyst for the fund’s consistent dividends has been the energy market, which turned around in a big way in 2020.

Previously, this fund was actually a dog. (No offense, Bizzi.) At least for the six-year energy bear market from 2014 to 2020, AMLP ground lower, lower and even lower. Month after month this fund was a big fat loser.

Yet it wasn’t a bad fund. It was simply the wrong time to own AMLP, which holds the stocks of energy infrastructure companies. These are essentially middlepersons that collect tolls on energy transport. Yes, they technically make money during all energy seasons but it’s much better to own them when prices are at least steady or, better yet, heading higher.

(Producers like Exxon Mobil (XOM), on the other hand, are even more sensitive to energy prices. We buy them only when oil itself is cheap and likely to rally.)

AMLP’s 2014-to-2020 trip lower culminated with a complete meltdown in early 2020. In April 2020, crude oil prices crashed, to say the least. They hit negative territory, which means producers were paying people to take the goo off their hands. Crazy!

Ironically, this set the stage for a multi-year rally in crude.

Out in the oil patch, low prices are the best cure for low prices. Producers quickly cut production to save their bottom lines, their dividends, and even their companies. Supply immediately drops off a cliff.

The thing with supply is that it takes years to come back online. Producers can quickly cut shale extractions and bring the offshore rigs back to port, but it takes much longer to ramp back up.

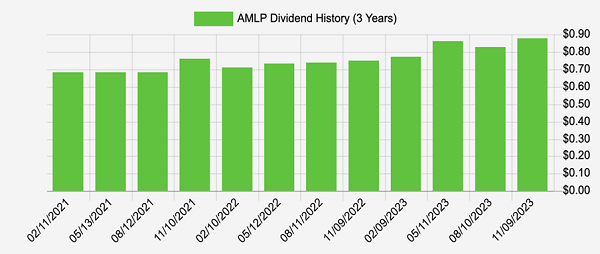

Long-term (over the ensuing years), energy prices stay elevated because of industry underinvestment during fallow times. The result is a sea of rising dividends from the stocks that AMLP owns. Check out this rising quarterly dividend tide. The trend is up and getting better, with a dividend 31% higher over this three-year period:

Source: Income Calendar

As long as energy prices grind sideways or better, AMLP keeps collecting tolls. Which means the dividends continue.

Some of the individual stocks that AMLP owns pay even more. Top holding Energy Transfer LP (ET) yields 9.3%. But be careful! ET will send you a complicated K-1 tax form—unless you own the stock by owning AMLP.

My accountant nearly broke up with me years ago when I handed him two K-1s from these types of toll bridges. I thought I was just buying a couple of stocks. To him, I had joined two partnerships. Messy.

Never again, I promised him. Which is why we like AMLP. No K-1!

Plus, diversification. We’re not looking to walk the Permian basin here looking for deals, inspecting pipelines. Give us a ticker that we can time and we’re good to go.

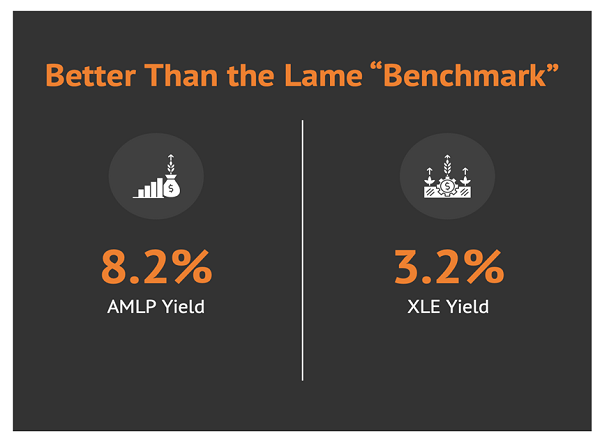

Most mainstream investors (and money managers, for that matter) stop at Energy Select Sector SPDR Fund (XLE). There are a couple of problems with this approach. First, XLE owns the Exxons of the world, which makes it more dependent on rising energy prices.

We dividend investors don’t need the rollercoaster. Pipelines suffice, sans the K-1.

Second, XLE only pays 3.2%. Lame! We’ll never retire on dividends this way.

Before I let you go, let me tell you about something better than an 8.2% yield. That would be a 10.2% dividend.

This final twist is for my closed-end fund (CEF) diehards who worry I’ve gone soft recommending ETF AMLP. Kayne Anderson Energy Infrastructure (KYN) owns many of the same names as AMLP—but mainstream investors don’t know about it. Which means it’s cheaper, and it pays more!

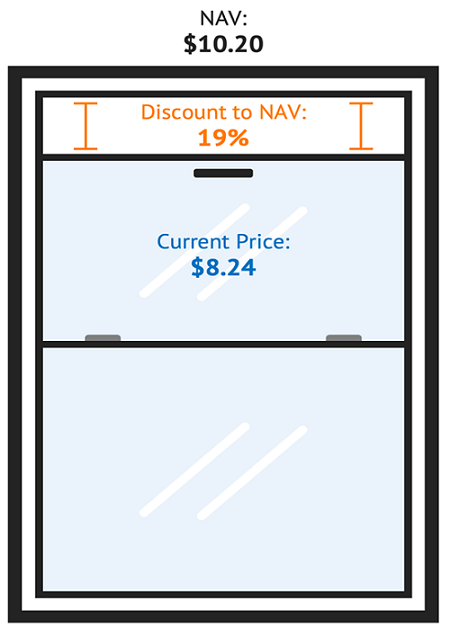

KYN yields 10.2% today and—get this—it trades nearly $2 below its net asset value (NAV):

It’s basically a $10 stock trading for $8—eighty-one cents on the dollar to be precise. On sale!

Now, would I buy AMLP and KYN today? Not quite. I’d wait for a mini dip.

Seriously. We must squint to see tiny drops, but every quarter or two they grant us the opportunity to buy these funds even cheaper. Waiting until these moments reduces our downside risk and secures us more dividend for our dollar.

So, please wait!

You’ll be the first to know when these two names drop into the bargain bin with a risk-free trial to my Contrarian Income Report service. CIR is the newsletter that recommended AMLP 19% ago and features 9% dividend payers that are buyable today. Learn more about CIR and our retiree-acclaimed 9% No Withdrawal Portfolio.

Recent Comments