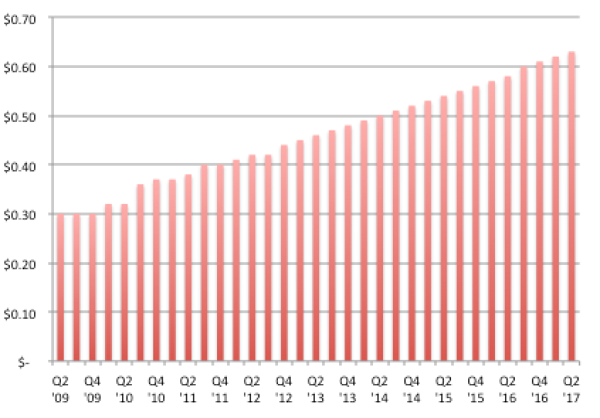

Dividend growth is one of the keys to a strong retirement portfolio (and 12% annual gains forever). While any stock boasting a big stated yield is sure to grab your attention, if that dividend isn’t growing, it’s actually shrinking (as inflation eats up more and more of that income every year.)

That’s why I regularly keep my eye on dividend increases … and why I’m looking at a bundle of stocks that are very likely to up the ante on their regular payouts over the next few months.

If you’re an income investor, it’s increasingly important to focus on dividend growth because – guess what? – it’s slowing. Check out the chart below, which shows the S&P 500’s rate of dividend growth has pulled back to its lowest point since 2011. …

Read more

Recent Comments