Top posts from the past week:

- Inflation or Deflation – Which Will Prevail?

- Fed Out of Ammo; Dollar is Toast

- Stratfor: Oil Prices Likely to Remain Low

Our coverage of Marc Faber’s recent interview on CNBC from December 1st continues to see a lot of traffic.

A review of our trades from the previous week:

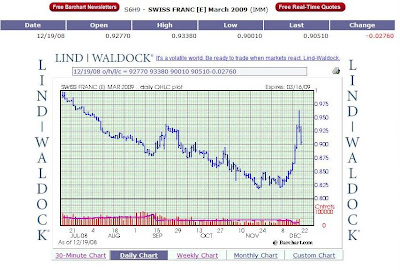

- Bought a Swiss Franc position on Tuesday. Tried to pyramid with another position Wednesday night. Sold both on Friday – about even after it was all said and done. Check out this volatility:

- Bought an Australian Dollar position on Tuesday – sold it on Friday at a loss. Again, we unsuccessfully timed the breakout here.

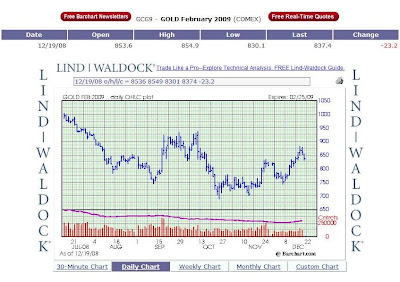

- Bought a Mini-Gold position. Again, tried to buy the breakout.

- Bought a Cocoa position. Ditto.

Our wish list…everything here looks beaten down…silve

- Sugar

- Coffee

- Cotton

- Natural Gas

- Silver

- Crude Oil

- Wheat

- Corn

Open positions

| Date | Position | Qty | Month/Yr | Contract | Entry Price | Last Price | Profit/Loss |

|---|---|---|---|---|---|---|---|

| 12/15/08 | Long | 1 | MAR 09 | Cocoa | 2586 | 2587 | $10.00 |

| 12/15/08 | Long | 1 | FEB 09 | Mini Gold | 836.6 | 837.5 | $29.88 |

| Net Profit/Loss On Open Positions | $39.88 | ||||||

Account Balances

| Current Cash Balance | $47,927.72 |

| Open Trade Equity | $39.88 |

| Total Equity | $47,967.60 |

| Long Option Value | $0.00 |

| Short Option Value | $0.00 |

| Net Liquidating Value | $47,967.60 |

Cashed out: $20,000.00

Total value: $67,967.60

Weekly return: -3.6% –> Mostly due to the bad Aussie dollar trade

YTD return: -11.9%

***”Cash out” mostly means taxes, but lately we’ve also been using it for living expenses, and also to finance a cool new time management software startup that is starting to lift off – and was recently covered by the Sacramento Business Journal.

Recent Comments