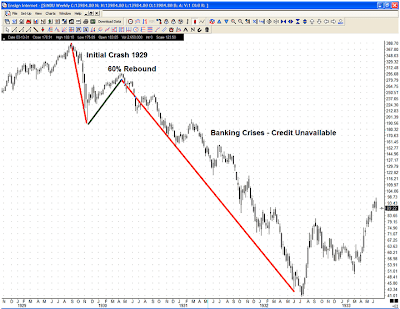

As financial pundits and common investors breath collective sighs of relief that “the worst is over” and “the bull is back”, let’s explore the possibility that 2009 may be following a script that was originally penned in 1930.

- “The worst is over without a doubt.” – James Davis, Secretary of Labor

- “The Depression is over.” – Herbert Hoover

- “We have avoided the worst.” – Ben Bernanke

- “I can tell you, without question, the Recovery Act is working.” – Joe Biden

If the Federal Reserve had an inflationist attitude during the boom, it was just as ready to try to cure the depression by inflating further. It stepped in immediately to expand credit and bolster shaky financial positions. In an act unprecedented in its history, the Federal Reserve moved in during the week of the crash—the final week of October—and in that brief period added almost $300 million to the reserves of the nation’s banks. During that week, the Federal Reserve doubled its holdings of government securities, adding over $150 million to reserves, and it discounted about $200 million more for member banks. Instead of going through a healthy and rapid liquidation of unsound positions, the economy was fated to be continually bolstered by governmental measures that could only prolong its diseased state.

President Hoover was proud of his experiment in cheap money, and in his speech to the business conference on December 5, he hailed the nation’s good fortune in possessing the splendid Federal Reserve System, which had succeeded in saving shaky banks, had restored confidence, and had made capital more abundant by reducing interest rates.

- Natural Gas fell below $3! Here’s why oil may be next to slide.

- Private sector valuations and VC/angel funding are still in the tank – despite the run-up in the public equity markets.

Recent Comments