If you’re like most folks, you likely at least take a second look when you run into a big dividend yield, like, say, 14%.

Think about that for a second: drop, say, $100K into a fund like that and just seven years later, you’d have collected enough in dividends to recoup your entire initial stake.

Everything else is gravy!

But when we come across a dividend that big, we need to do a second-level analysis to make sure it’s sustainable. And that brings me to the closed-end fund (CEF) I want to tell you about today—it gives us that 14% yield but misses the mark on just about every factor you could imagine, giving us:

- Impossibly high management fees

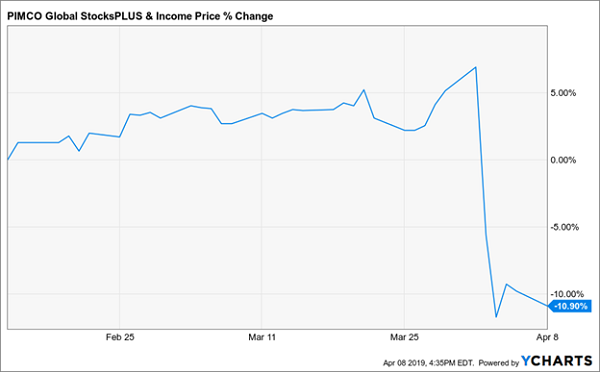

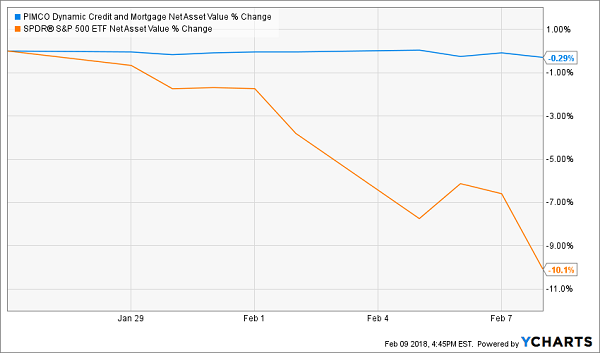

- A portfolio that underperforms the market

- An overpriced valuation, and …

- Its profits are falling short of payouts.

Recent Comments