Worried about a market pullback?

Let’s discuss seven sturdy dividends with yields up to 8%. These are “low beta” stocks which means they stand tall when the market sinks. Low beta stocks may still go down, but they tend to regress less than average.

And generally speaking, the lower the beta, the more cushion to the downside. The lower a stock’s beta, the less volatile (the less it moves) compared to a benchmark (like the S&P 500). It’s really easy:

Beta more than 1 = more volatile than the market.

Beta less than 1 = less volatile than the market.

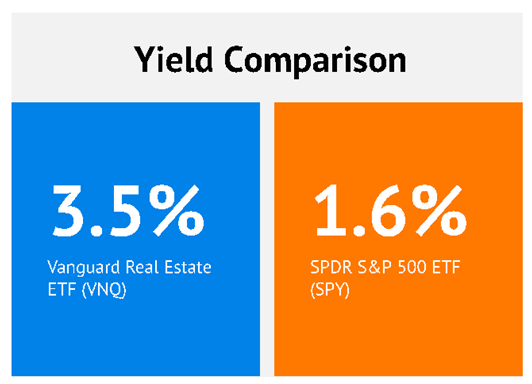

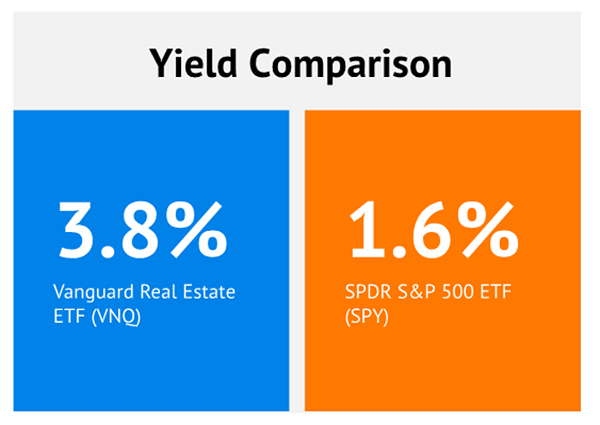

Then we want to pair low beta with high dividend yields.… Read more

Recent Comments