Where are we to turn for high, safe dividends these days? Certainly not 10-Year Treasuries, unless you think you can scrape by on their 1.7% yields.

I’ll save you the calculation: you can’t, because that yield matches the inflation rate to the decimal point.

Your “true” income? $0.

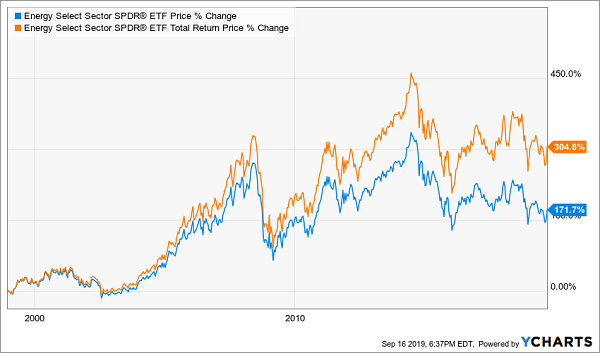

The S&P 500 isn’t much better: for a pittance more (a 1.84% average yield), you’re exposing your nest egg to this:

When a 1.8% Dividend Costs You 20%

But don’t, because I’ve got a better way—a low-key alternative I call a “layup dividend.” If you’re a basketball fan, you know what I’m talking about: the layup is the simplest shot in the game, where you simply “lay” the ball over the rim into the net.… Read more

Recent Comments