Investors did not like what Chairman Powell and the Fed had to say this week, resulting in a 1,300-point decline in the Dow Jones Industrial Average in less than 24 hours.

When Doves Cry

As expected, the FOMC raised its short-term interest rate target on Wednesday, to a range of 2.25%-2.50%. The composite expectation of the committee for 2019 also turned more dovish, now calling for two more rate increases next year, down from three.

It’s not in the Fed’s mandate to make equity investors happy and traders quickly voiced their disapproval of the policy changes.

Prior to the announcement at 2 p.m. ET on Wednesday, the Dow was up 300 points on the session. By the time the market digested the FOMC statement however, a similar 1.5% gain on the S&P 500 turned into a 1.5% daily loss in less than two hours.

Worst Decline in 9 Years Could Create Opportunities

This is first such intraday reversal the index has experienced since February 2009 and the selling continued through Thursday’s session.

Anyone that was actively trading nine years ago is probably experiencing flashbacks this week, as the Dow and S&P 500 are also on track for the worst monthly performance since the Great Recession.

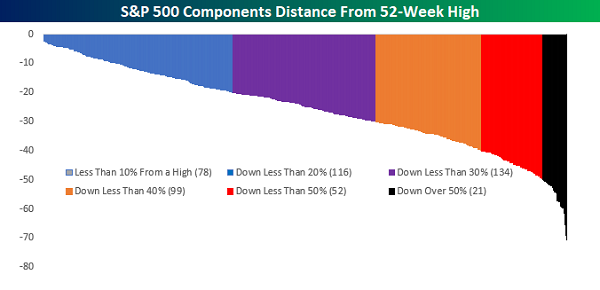

To put the decline into context, in the heat of the selling on Thursday, the folks at Bespoke Investment Group noted the average name in the S&P 500 index was down more than 25% from its 52-week high.

Source: Bespoke Investment Group

To a contrarian thinker, this is the kind of decline that creates buying opportunities. The Bulls out there are quick to point out the S&P 500 is trading at less than 15x forward earnings, which is more than a 10% discount to the historical average. In addition, crude oil declining under $50 a barrel will create a potential U.S. economic growth tailwind for 2019.

On the other hand, it’s easy for the “glass half-empty” crowd to argue that profit expectations will have to come down if the U.S. economy does slip into a recession in 2019 or 2020. If you’re an investor that doesn’t feel the need to stick your neck out here, take solace in the fact it rarely pays to fight the Fed.

Looking Ahead to Shorter, Quieter Trading Days

Looking ahead to next week, U.S. stock markets will close at 1 p.m. ET on Monday and remain closed for the Christmas holiday on Tuesday.

Trading volume to will likely dry up for the final 4.5 trading sessions of 2018. Now that the final options expiration of the year has passed, most professional traders have closed up shop for the year, content to start anew in 2019 with a clean slate.

Protecting Capital and Generating Income Despite Volatility

Whether it’s because of central bankers, decelerating growth outside of the U.S. or political turmoil, 2018 will go down as the most challenging year for investors in nearly a decade.

This is especially troubling if you’re nearing retirement or already retired. All you really care about is generating consistent income and protecting your hard-earned nest egg, whether the broader market is up 10% one year or down 10% the next.

The good news is: there’s a better way. My colleague Brett Owens has created an “8% No-Withdrawal Portfolio” that generates steady income and impressive capital gains.

Thanks to his work, you no longer have to settle for low bond yields, or dividend “aristocrats” that can fall more in one day as they pay over an entire year in dividends.

Wall Street has tried to address this issue with structured products, such as single premium immediate annuities (SPIAs). But just like the casinos don’t pay for all the glitz and glamour because gamblers usually win, the big financial service firms charge hefty fees to provide you with that steady income.

Instead, Brett’s system could hand you $40,000 a year on every $500,000 invested (in an up market or down one) with under-appreciated income plays like:

- Closed-End Funds (CEFs)- We’ll share our top three CEF picks with you, each of which pay a monthly dividend. Many of these trade at a discount to net asset value.

- Preferred Stock- Brett lets you know two of the best active managers in this space to invest alongside with.

- Recession-Proof REITs- discover two REITs that actually benefit from higher interest rates today.

That’s 7 contrarian investment picks just to get started. Click here for instant access to the full 8%, No-Withdrawal portfolio.

Recent Comments