By this point, you’ve probably heard that earnings season has been off the charts so far.

But there’s a problem.

You see, corporate profits are so good that the big buying opportunity I’ve been telling you about for months is vanishing fast!

Why? Because US firms are too profitable, and economic growth is too strong for the herd to not want to pile into stocks very soon.

So today we’re going to front run those folks by buying before they do.

In a moment, I’ll show you not only why you should buy now, but 2 funds you that are solid bets for serious upside and a huge dividend stream of 7%.

Funny thing is, these 2 funds hold the S&P 500 and Dow stocks you know well. And they pay that huge income stream and return 9% in gains and dividends, on average, every year.

Before I get into these funds, let’s take a look at just how good this market is.

A Profit Bonanza

In February I pointed out that earnings growth was set to remain strong for 2018, and again nearly a month ago, I pointed out that earnings estimates were going up as stocks went down. This is very rare. When it does happen, it’s usually a blaring signal of a strong bull run.

And now that companies are actually reporting earnings, it looks like I wasn’t optimistic enough.

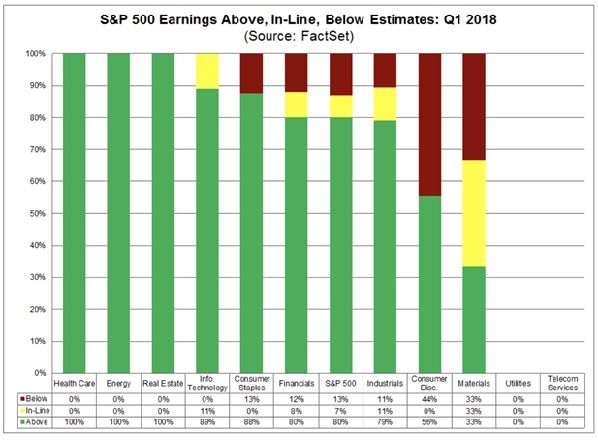

So far, nearly 20% of S&P 500 firms have reported, and 80% of those companies are reporting earnings per share (EPS) far above estimates. Heck, in some sectors, all companies are crushing the Street’s forecasts!

Earnings Come in Piping Hot …

Tech and finance are doing well, thanks to non-stop demand for gadgets and higher interest rates, which boost bank profits. But sectors that have been beaten down so far in 2018, such as energy and real estate, are also doing better than expected.

This all means that earnings growth so far is clocking in at 18.3%, well above the 17.1% growth rate forecast at the end of March and putting us on track for what could be the best earnings record in history.

Yet stocks have gone nowhere in 2018.

… But Investors Miss the Memo

Bottom line: buy signals simply don’t get much stronger than this.

2 Funds to Put on Your Buy List Now

Now you could just run out and buy the SPDR S&P 500 ETF (SPY). You’d get a 1.8% dividend yield, turning your $100,000 investment into $152.50 per month in income. Or you could buy the two other funds I’m going to spotlight today and get almost 4 times that: $591.67 per month in income.

Earnings Season Pick #1: 7.2% Income From the S&P 500

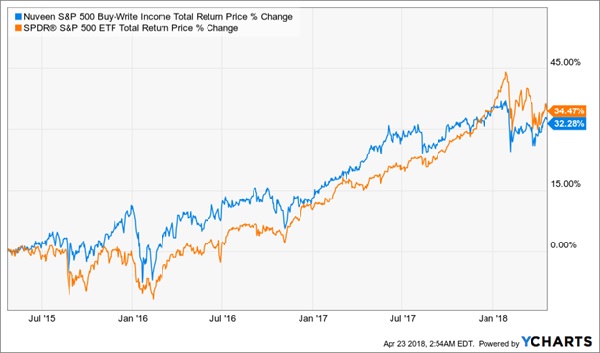

The first fund I’ll show you is the Nuveen S&P 500 Buy-Write Income Fund (BXMX). As the name suggests, it invests in the S&P 500 while also selling “insurance” on those same stocks in the form of “call options” to give you a higher return and a higher income stream. The fund yields 7.2% and has mostly matched the S&P 500’s total return over the last 3 years (note that all returns are after fees).

A Hidden Cash Advantage

So if SPY and BXMX are nearly identical in performance, why not just go with the ETF?

Simply put, the income. Because of its bigger yield, a larger portion of the returns you get come in the form of cash paid in the form of dividends. And unlike SPY, where your capital gains can come and go with a volatile market, you can take your cash from BXMX and put it elsewhere—or, if you prefer, straight back into BXMX. The choice is yours.

Earnings Season Pick #2: Top Stocks, Low Volatility

Now let’s look at the Nuveen Dow 30 Dynamic Overwrite Fund (DIAX), which is almost identical to BXMX except that it buys the Dow Jones instead of the S&P 500. Since the Dow tends to be less volatile, this is a good option for toning down market swings.

Oh, and this fund also pays a 6.9% dividend yield.

The best part is that DIAX is actually beating the total return of the Dow Jones index fund, the SPDR Dow Jones Industrial Average ETF (DIA):

Beating the Market With 3x the Dividend Income

It’s tough to argue with outperformance—but outperformance that includes an income stream that is 3.4 times greater than that of the index fund ($575 per month versus DIA’s crummy $169.17 on the same $100,000)? No one can quibble with that.

1 Click for Even Bigger Dividends and a Safe 28% Win This Year

I’ve got 5 other “limitless” profit machines poised to deliver income and gains that go far beyond a medium-term earnings-season pop.

I’m talking about:

-

- A safe—and growing—8.2% average dividend, and

- 28%+ total returns in the next 12 months.

What’s totally bizarre about this situation is that these 5 funds are even further off the radar than BXMX and DIAX, leaving them trading at even wider discounts (which is where a big part of our 28% total return will come from).

These huge markdowns completely break with the historical pattern for these 5 winners, and they simply can’t last, especially when you consider that these 5 funds also hold S&P 500 names expected to rack up big earnings beats.

The best thing about these 5 cash machines is that they’ve delivered market-crushing gains with much less volatility than what your average ETF investor is forced to stomach. Check out the steady climb one of these funds has piled up since inception, compared to the sickening ups and downs of the market:

A Smooth Ride Higher

The topper: this fund is run by one of the top minds on Wall Street and pays a rock-solid 10.0% dividend today!

This is just a taste of what these 5 income generators can give you, and I can’t wait to show you everything I have on each and every one of them. Simply click here to get the names, ticker symbols and my complete research on all 5 of these must-own funds now.

Recent Comments