Most investors live in the past and fixate on dividend track records rather than a payout’s forward prospects. That’s too bad for them, but it provides opportunity for us to bank big returns that shouldn’t be available in any “efficient” market.

By looking ahead, we can identify the dividends that are likely to grow the fastest. And when we identify payouts that are poised for yearly raises of 15%, 20% or even 25% or more, we should buy those stocks and enjoy annual stock price gains in that neighborhood.

Sure, it isn’t quite that simple. But it’s pretty close. Let me explain my entire dividend growth strategy first – and later, I’ll also share my 7 dividend payers with 100% to 200% price upside with you.

When To Buy Blue Chips for 234% Gains

First let’s consider the case of Coca Cola (KO), so that I can show you when to time your dividend stock buys for big returns. Coke achieved “dividend aristocrat” status in 1987 (its 25th straight year with a dividend hike). The firm hit its coronation with a head of steam, rewarding investors with a 362% payout hike in just five years (from 1986 to 1991).

Its stock price raced to keep up with its dividend, rising 234% over the same time period:

This is How Warren Buffett Really Got Rich Buying Coke

It didn’t really matter if you bought shares before or after the company was officially a dividend aristocrat. The driving factor for profits was the dividend’s velocity – it was moving higher quickly, so its stock price followed.

Find a payout that’s heading 200%+ higher, and I’ll show you a stock that’s going to triple, too.

But Coke isn’t going to deliver these types of returns going forward. When we look at the last five years, and we see that Coke’s youthful exuberance has slowed considerably. The firm still hikes its payout every year, but it’s a slower climb – totaling 45% over the past five years. Which means its stock price merely plods along too (+25% in five years):

Buffett’s Returns Suffer: Blame Average Dividend Growth!

Why is Coke’s dividend slowing down? Simple – just look at the top line.

It sounds obvious, but income investors often wade so deep into the dividend weeds that they ignore obvious cues – such as shrinking sales.

Coke’s top line has shrunk by 22% over the last five years. Which actually makes the fact that it’s grown its dividend at all quite the feat!

When Sales (Red) Swoon, Payouts Feel the Pressure

Contrast this with the 1986 to 1991 period, when the company was younger and still growing. It boosted its sales by 30% over that time period.

Of course it’s possible to grow payouts faster than profits and sales. But even the most gifted managers can only squeeze so much in payouts from a shrinking pie. It’s better to focus on businesses with the winds at their backs.

And That Can Include “Spry” Blue Chips

Two years ago I told my Hidden Yields subscribers to buy Boeing (BA) because:

- Its business was booming,

- Its stock was quite cheap with respect to cash flow, and most importantly

- Management was plowing profits into payout growth.

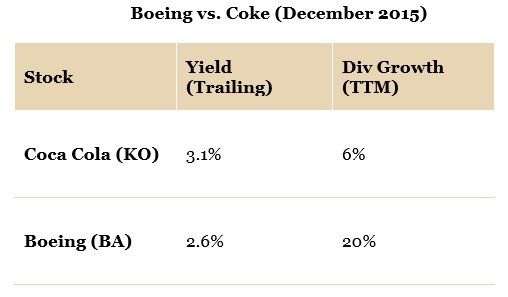

Boeing wasn’t a dividend aristocrat like Coke. But it was a much better buy. Here was the tale of the tape in December 2015 (pay special attention to the last column, because it’s the most important):

Boeing vs. Coke (December 2015)

If you want to make real money with stocks, you should always put your money with the faster dividend grower. Boeing was no exception – its two massive dividend raises in the last two years have sent the stock soaring to 150% total returns (which my subscribers enjoyed).

Our secret, as usual, is we purchased the payout that was growing the fastest. We enjoyed a 57% cumulative “raise” from Boeing, which in turn rocketed its stock price higher.

Boeing Soars With Its Payout

The Third (& Too Often Forgotten) Way a Stock Can Pay Us

There are three – and only three – ways a company’s stock can pay us:

- A cash dividend,

- By repurchasing its own shares, or the most lucrative

- With a dividend hike.

Everyone loves the dividend, but investors usually don’t give enough love to the dividend hike. Not only do these raises increase the yield on your initial capital, but also they often are reflected in a price increase for the stock.

The reason frequent dividend raisers rarely yield much is that investors see a payout hike and bid the stock price up. If a stock pays a 3% current yield and then hikes its payout by 10%, it’s unlikely that its stock price will stagnate for long. Investors will see the new 3.3% yield, and buy more shares.

They’ll drive the price up, and the yield back down – eventually towards 3%. This is why your favorite dividend “aristocrat” – a company everyone knows and has paid dividends forever – never pays a high current yield. Its stock price rises too fast!

For example let’s consider UPS (UPS), which always seems to pay between 2.5% and 3%, give or take:

Unless it’s a Financial Crisis, UPS Yields 2.5% to 3%

The stock’s yield is so consistent because its stock price moves higher – more or less in lockstep – with its ever-rising payout:

Sooner or Later, Stock Prices Move Higher With Dividends

And check out the recent price action, indicated by the blue line above. It’s dipped below the stock’s payout curve. A buying opportunity in UPS? Perhaps.

The Simple, Safe Way to 20%+ Yearly Returns

Since share prices move higher with their payouts, there’s a simple way to maximize our stock market returns:

Buy the dividends that are growing the fastest.

But how do we identify “high dividend velocity” to purchase? Should we simply buy any dividend grower that raises its payout every year?

In other words, should we simply take the Cokes with the Boeings?

No – we can do better. We need to hold higher standards, and “just say no” to plateauing payouts.

Avoid This Dividend on Fumes: Walmart

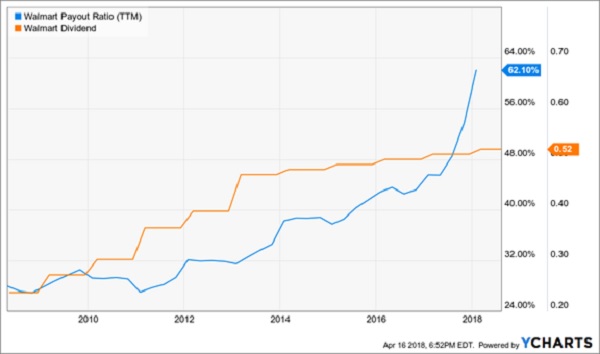

Here’s another example of an aging aristocrat to avoid: Walmart (WMT). It’s still raising its dividend every year – but barely. Meanwhile, its payout ratio has skyrocketed to 62% (blue line below):

Walmart’s Dividend Growth Slows, Payout Ratio Spikes

With less room to increase its payout in the future, Walmart’s stock price is hitting a wall, too. It’s up a mere 13.9% over the past five years. Talk about dead money!

Walmart Hits a Wall (Blame the Lame Dividend)

Buy Instead: 22% Dividend Growth

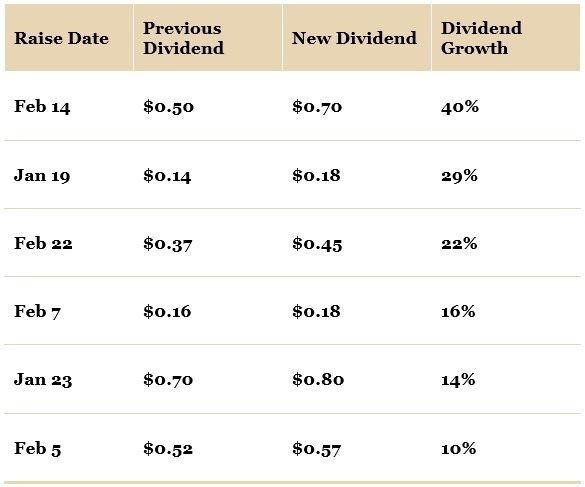

Rather than waste time with middling dividends, my Hidden Yields subscribers buy payouts that are rising at rapid clips. We demand double-digit returns on our money, which means our dividends must grow at this pace.

And we’re receiving generous raises that reflect this. In fact, here’s the list of our last six dividend increases. We’re receiving “pay raises” that average 22% per year!

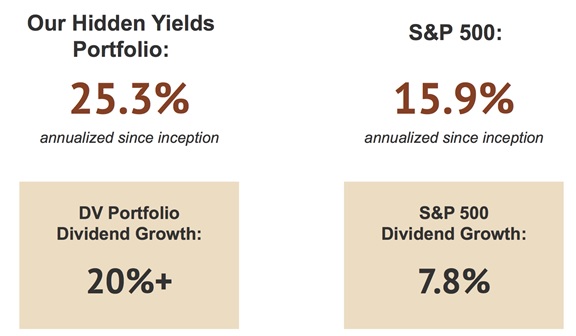

With our payout growth crushing the broader market, it’s no wonder our returns our portfolio is doubling in value every three years. Our 20%+ yearly dividend increases are powering 25.3% annualized returns!

Stock Timing Tip: Buy the “Lags” in Price Action

And it is possible to cherry pick your buys to do even better. Since dividends follow their share prices higher, we can make the most money by buying when these payouts are most likely to “snap higher” towards their runaway dividend curves.

In other words, we buy the price dips when the dividend appears to be running away. I’ll show you some examples of this in a minute.

Anyone who says you can’t time stocks hasn’t used this surefire strategy for buying shares ready to “catch up” to their runaway payouts.

It’s a simple 3-step process:

- Plot a stock price versus its dividend,

- Look for a “lag” between the shares and the payout, and

- Buy any big lags you see.

Here’s an example. In April 2017, my Hidden Yields subscribers purchased this “egregiously lagging” stock price for quick 54% returns:

We “Bought the Blue Lag” for 54% Returns

Here’s another example of a slow stock. Now granted, its dividend is rising so fast that you’ll make money no matter when you buy it. (You only need to hold it long enough for its price to head higher after its payout.)

But you’ll do even better if you buy when the price line (blue) lags the current dividend (orange). We did this, and banked 63% total returns:

We Bought This “Slow” Stock for 63% Gains

Let’s go back to Boeing. Its own lagging price (in blue) represented a tremendous buying opportunity. (We took advantage of it and collect 157% returns in just two years).

Buy Boeing When Price (Blue) Lags Payout

There were a couple of other clues that Boeing was cheap at the time, too. Its shareholder yield – essentially its dividend plus its money spent towards share repurchases – was above 10%. In other words, the company could have comfortably paid double-digits in cash if it wanted to.

Management opted to repurchase the shares. That was smart, because they were cheap. Boeing was trading for less than 12 times its yearly free cash flow (FCF) – quite the bargain for this blue chip.

Now I get questions all the time about using this strategy in rising rate environments. So let’s address the big bad bond market, and its effect on stocks, now.

Question: Does Dividend Growth Investing Work When Rates Rise?

Pundits have called sleepy dividend stocks like General Mills (GIS) “bond proxies” in recent times. GIS has paid 3% (more or less) over the last three years. That compared favorably with the 10-year Treasury note, which paid 2% (more or less) over that time period.

So, the story goes, investors had been buying stocks like GIS instead of safe bonds like Treasuries to scrape an extra 1% or so payout. But with Treasuries rallying towards 3% today, these same investors allegedly have “demanded” a higher yield from GIS. It now pays 4.5%, which means its stock price has dropped as the Treasury’s price has risen:

“Bond Proxies” Like General Mills are Hurting

But the real reason that GIS shares are languishing is that the company’s dividend is slowing down:

Why GIS is Dead Money: Its Dividend is Dead!

The best dividend growers are perfectly capable of rising with interest rates. We’ve seen that in our Hidden Yields portfolio. Since inception nearly three years ago, rates have risen from zero to something – and our portfolio has returned 25.3% annually.

We also saw this happen during the last rate hike cycle. It was awhile ago. Let’s review the three-year period starting in May 2003 when the 10-year rate climbed a full two hundred basis points – from 3.2% to 5.2%.

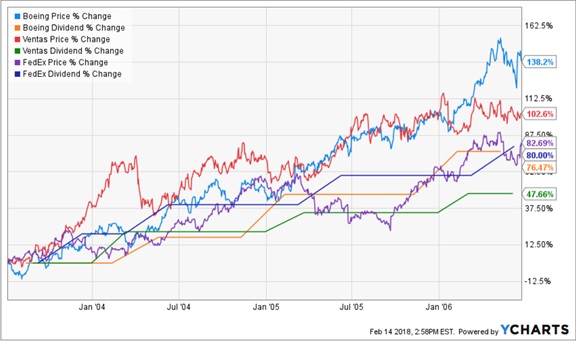

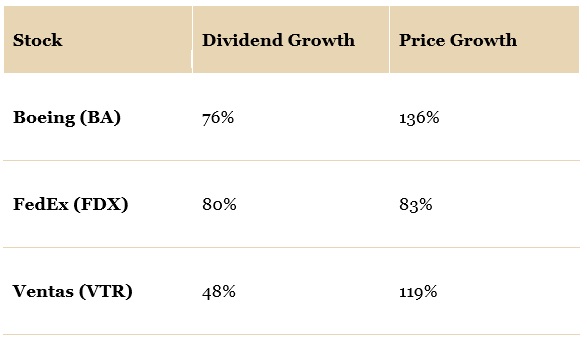

Back then, familiar dividend growers like FedEx (FDX), Ventas (VTR) and Boeing (BA) climbed higher right alongside long-term rates.

Last Rate Hike Cycle: Dividend Growers Grew, Too

Their secret? Their payouts simply outran rates:

Will this rising rate cycle be any different? Only in name – of the stocks leading the charge, that is. The winning strategy remains the same: Buy the stocks of the companies that are growing their payouts the fastest.

How to Bank 25.3% Yearly: Buy These 7 Dividend Growers

How much money should you allocate to dividend growth?

As you can see – as much as possible. This strategy is such a “slam dunk” for investing returns that there’s no reason to collect more current yields than you need right now. If you can “forego” some amount of income today, I would encourage you to consider investing that capital into dividend growers.

It’s a simple three-step process:

Step 1. You invest a set amount of money into one of these “hidden yield” stocks and immediately start getting regular returns on the order of 3%, 4%, or maybe more.

That alone is better than you can get from just about any other conservative investment right now.

Step 2. Over time, your dividend payments go up so you’re eventually earning 8%, 9%, or 10% a year on your original investment.

That should not only keep pace with inflation or rising interest rates, it should stay ahead of them.

Step 3. As your income is rising, other investors are also bidding up the price of your shares to keep pace with the increasing yields.

This combination of rising dividends and capital appreciation is what gives you the potential to earn 20% or more on average with almost no effort or active investing at all.

Which “hidden yield” stocks should you buy today? Well you know me – I’ve got seven best buys that should safely double your money every three to five years.

It’s a simple formula – their dividends are doubling every three to five years, which means their prices will rise in tandem. At the same time, we’ll collect their dividend payments today and enjoy an even higher income stream tomorrow.

This dividend growth strategy has produced amazing 25.3% annualized returns for my Hidden Yields subscribers since inception. In two-plus years, we’ve crushed the broader market (the S&P 500 returned 15.9% over the same time period.)

If you achieve returns of 25.3%, you’ll double your money in less than three years. So if you haven’t been following this strategy, why not? The best time to get started is right now – before the seven dividend growers I mentioned begin to move. Click here and I’ll share their names, tickers and buy prices with you right now.

Recent Comments