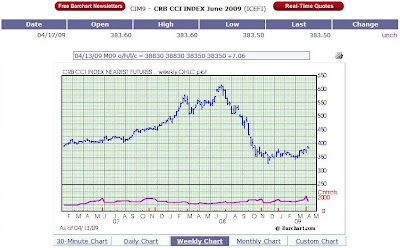

For a few weeks now, we’ve been watching the commodity markets with rapt attention, asking ourselves: “Has the next commodity bull market officially begun?”

From the charts, it looks like broader commodity indeces may have finally formed a bottom.

Source: BarChart.com

So if the wind is indeed once again at the back of us commodity investors, which commodities hold the most promise right now? Let’s dive in and review three very intriguing soft commodity opportunities.

Orange Juice

Orange juice futures continued their recent rally this week, with July OJ breaking out to 6-month highs this week, closing at 88.25.

Last week we were drooling over OJ, citing potential bullish catalysts of:

- Dry conditions in Florida that could hurt supply

- Reports of a weaker orange crop in Brazil

- A favorable technical back drop

Also my commodity broker gave me a ring on Thursday, recommending some summer OJ calls – he also likes the bullish setup, and mentioned that OJ is seasonally strong in the summertime.

Orange juice, after a long drop, appears to be showing some signs of life.

Florida did get some rain this week, which set prices back temporarily midweek, but this proved temporary as OJ surged ahead on technical buying and traders starting to pile in.

Bottom line: OJ’s rally looks poised to continue, and we’re looking to add to our exisiting position on further strength.

Sugar

On February 27, we went long one May sugar contract (which reminds me – I need to roll that baby over tomorrow 1st thing! The wife would not be pleased if we took delivery on that contract!).

At the time, we cited these bullish fundamental factors:

- The global sugar deficit is expected to rise this year

- India, the world’s 2nd largest producer of sugar (after Brazil), will have lower output than forecasted, and may be forced to import sugar this year

Sugar has been rangebound.

Since then, sugar has been rangebound, failing to break up or down. I’ve read many traders recommending short positions on sugar in the short term, though sugar has not yet broken down in the short term as these folks have expected.

Bullish supply news came out this week, with India’s sugar industry reporting that this year’s production will fall 8.4% below previous estimates.

We’re holding our exising position until the market gives us a clear signal on which way sugar is heading.

Cotton

Cotton futures have been slammed since the financial collapse, as significant cotton demand from India and China has evaporated overnight.

This demand and price wipeout has accelarated the decline in farm acreage devoted to cotton – this year’s US cotton acreage is projected to be 7% below last year, and the lowest total amount since 1983, due to high production costs and low prices.

Although supply is coming offline significantly, thus far demand has dropped faster than supply. This may not last for long though, as the best cure for low prices is often low prices.

Has cotton formed a double bottom?

As you can see from the chart above, cotton has put in a double bottom of sorts, and is approaching an upward resistance point in the low 50’s.

Cotton futures have rallied to a 10-week high on continued strength in soybean futures, which surged to 6-month highs themselves. Because cotton and soybeans compete for acreage, high soybean prices make it more likely that farmers will switch acreage from cotton to beans.

We’re watching closely to see which way the price breaks from here, as a breakout to the upside could have some room to run, given the tight supply conditions. A small rebound in demand could set prices off to the races.

Current Futures Positions

No changes this week. Thinking about adding another OJ contract on further strength.

Date Position Qty Month/Yr Contract Entry Last Profit

04/08/09 Long 1 JUL 09 Orange Juice 81.95 88.40 $967.50

02/27/09 Long 1 MAY 09 Sugar #11 13.79 13.19 ($672.00)

Net Profit/Loss On Open Positions $295.50

Current Account Value: $26,005.31

Cashed out: $20,000.00

Total value: $46,005.31

Weekly return: 3.6%

2009 YTD return: -48.8% (Don’t call it a comeback!)

Total value: $46,005.31

Weekly return: 3.6%

2009 YTD return: -48.8% (Don’t call it a comeback!)

Prior year’s results:

2008: -8%

2007: 175%

2006: 60%

2005: 805%

Initial stake: $2,000.00

Recent Comments