Equal-Weighted Beating Cap-Weighted

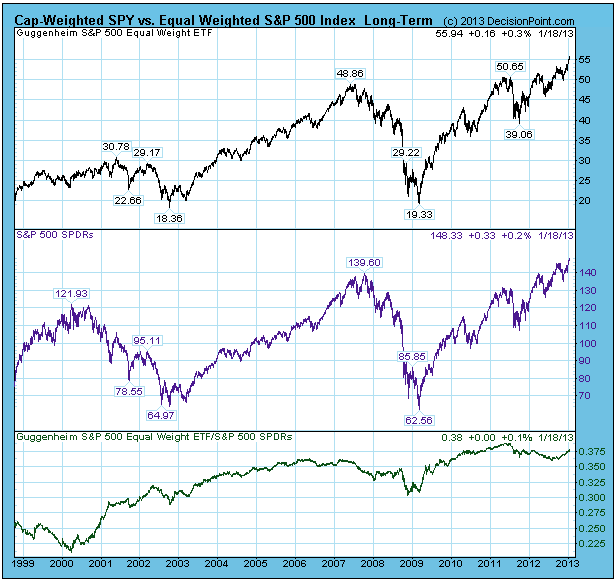

I have long been a cheerleader for equal weighted indexes versus cap-weighted ones, and now seems like a good time to demonstrate why. In a cap-weighted index stocks influence the price of the index based upon their market capitalization (price time number of shares). For example the top 50 stocks in the S&P 500 Index represent about 70% of the index value, with the remaining 450 stocks providing only 30%. With an equal-weighted index all stocks carry the same weight — all the horses are pulling the wagon.

(This is a recent excerpt from the blog for Decision Point subscribers.)

Of course, RSP does not always out-perform the SPX, but the relative strength line (bottom panel above) shows that it mostly does over time.

The table below the mechanical signal status on various market/sector indexes paired with their equal weight counterpart. Note how, when both indexes have the same days elapsed, the equal weight index usually has the largest percent profit. It is particularly notable in the case of the Technology sector, where the problems of a few large-cap stocks (AAPL, IBM) weighed heavily on the weighted index (XLK), but the effects of those stocks were muted in the equal weight ETF (RYT).

Equal weight indexes are not always the best choice — they tend to move faster to the downside than their cap-weighted counterparts — but in a bull market they should receive close consideration, as they are likely to be the better choice.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market timing, market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

Recent Comments