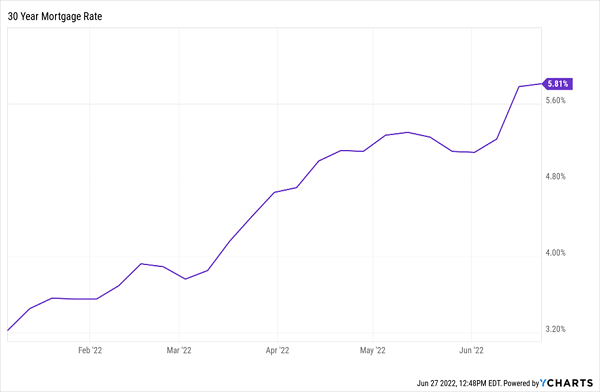

As we grind on into the second half of the year, the gloomy headlines about inflation and a bear market seem to be getting darker. There’s now talk of the housing market cooling off, and in some corners even chatter about a potential recession.

But if you’re a serious investor instead of a day trader with a short attention span, there’s no reason for you to freak out and hide in a bunker. True investing success depends on looking beyond short-term cycles, and instead focus on long-term income.

I’m not saying that makes it easy. It’s always a challenge to find reliable investments, and even more so in this environment.… Read more

Recent Comments