When oil spikes, like it has in recent months, many folks get tempted, wondering if there’s a way to time their way into—and out of—crude for maximum profits and dividends.

Unfortunately, timing markets is tough—especially the oil market, which is global and highly complex. Heck, the experts have trouble doing it! Consider this chart:

Bloomberg analysts looked at how the price of energy commodities trended over the last 20 years and how an index of energy-related investments performed over the same period. They found that professional investors whose job is to turn changes in commodity prices into cash profits had a hard time doing so.

But if you do want to hold oil in your portfolio, there are plenty of ways to do it. Below are five options for investing in oil, ranked from worst to first.

Worst: Energy Exchange Traded Notes (ETNs)

The key difference between ETNs and their cousins, highly popular exchange-traded funds (ETFs)—see our next investment, below—is that the latter holds actual investments. ETNs, meanwhile, own nothing: they’re simply a promise from a bank to pay you the value of the index the ETN tracks.

An example is the now-shuttered S&P 500 Crude Oil Linked ETN (BARL), which promised investors a return commensurate with crude oil futures and, to hedge riskiness a bit, a mix of S&P 500 stocks. That, to put it lightly, didn’t work, and the ETN was wound up just five years after launch, after posting serious losses. Nowadays, there are few energy ETNs on the market because volatility has wiped many of them out.

Lousy: Oil-Tracking Exchange-Traded Funds (ETFs)

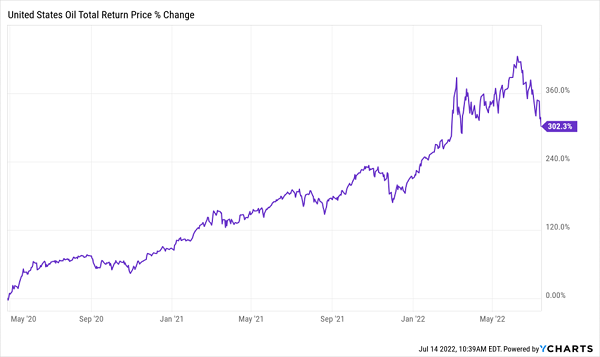

ETNs’ ETF cousins, however, are getting some attention because of oil’s recent rally. Take, for instance, the United States Oil ETF (USO), which tries to track crude-oil futures. USO has soared along with oil since the darkest days of the pandemic:

USO Spiked With the 2020/’21 Oil Bounce …

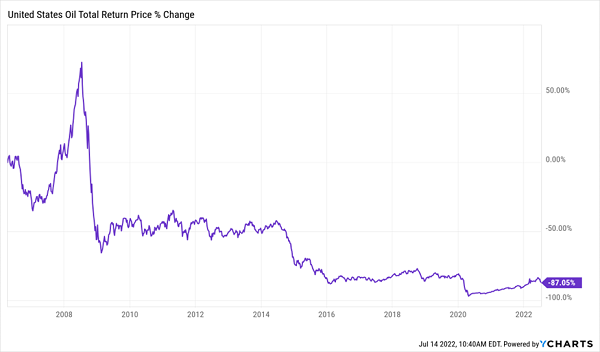

Except if you zoom out, you see that USO is hardly a long-term hold:

… But Has Been Crushed in the Long Run

Trouble is, USO is a pure speculation on the price of oil, and it doesn’t track oil well because it needs to borrow money to buy futures that rise and fall with oil prices. Investors who want exposure to oil would be better off focusing on investments that hold oil and gas stocks, which give us more diversification and, of course, dividends!

Bad: Royalty Trusts

That brings us to royalty trusts, which are set up to turn the profits of an energy production project into cash for investors. That’s pretty much the opposite of USO, which focuses solely on tracking prices. One of the largest and oldest royalty trusts is the BP Prudhoe Bay Royalty Trust (BPT), which yields a sky-high 19.6%. The problem is that over the long haul, BPT has cost investors much more than it has paid them in dividends.

BPT’s Big Drop

Better: Master Limited Partnerships (MLPs)

MLPs are related to royalty trusts in that they feature a special corporate structure that exists to turn over income from energy projects—usually pipelines—to shareholders. A good way to think of them is as toll bridges, charging producers for every barrel that makes its way across their pipeline network.

MLPs don’t pay income tax at the corporate level, so long as they “pass through” 90% of their earnings as dividends. As a result, their yields tend to be higher than those of regular stocks. The benchmark ETF for the space, the Alerian MLP ETF (AMLP), yields 5.6% as I write this.

The main problem with MLPs is that they will drive whoever does your taxes around the bend. Instead of the usual Form 1099 you get from stocks to report your dividends at tax time, you get a complicated K-1 package instead.

You could get around that by purchasing an ETF or a CEF (see below) that holds MLPs. These vehicles usually skip the K-1 and send you a simple Form 1099 instead.

Your Best Energy Option: Closed-End Funds

The final (and best) way to turn oil and gas gains into income is through actively managed, energy-focused closed-end funds (CEFs).

The biggest of these is the Kayne Anderson Energy Infrastructure Fund (KYN), which holds a number of pipeline operators, oil-service stocks and MLPs, along with a smattering of renewable energy firms and utilities, which give it some diversification away from the energy space. Top names in the portfolio include pipeline operators like Williams Companies (WMB) and MLPs Enterprise Products Partners (EPD) and Energy Transfer LP (ET).

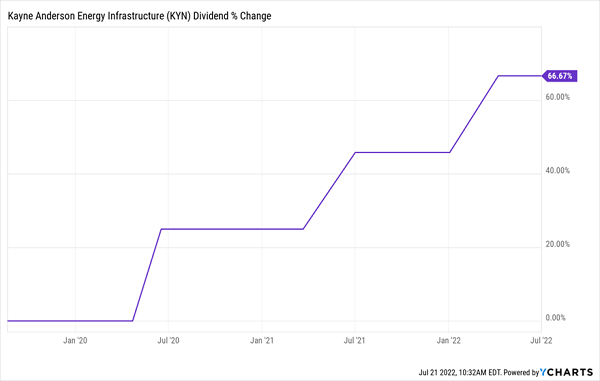

The fund, which yields 9.3% and trades at a deep 12.7% discount to net asset value (NAV, or the value of the stocks in its portfolio), is run by Kayne Anderson, a 38-year-old cornerstone of the energy-investing world. Moreover, KYN has managed to grow its dividend right through the COVID-19 crisis, successfully converting oil-price gains to rich payouts for investors:

KYN’s 9.3% Dividend Is on the Upswing

But as mentioned off the top, this one isn’t a solid buy-and-hold play: it’s been caught in the downdraft of oil prices over the 18 years since its inception, so it has only delivered a 50% lifetime total return (including dividends)—and it’s down 66% on a price basis. That means you’ll want to keep this one on a tight leash, as you should with any energy investment.

These 5 Little-Known CEFs Give You a Regular Monthly “Paycheck” of $3,292

Instead of trying to play short-term rises in oil prices, you’re far better off buying a diversified portfolio of CEFs and tucking them away for the long term.

The 5 CEFs I’ll tell you about here are perfect examples. They pay a rich 7.9% average dividend, give you instant access to everything from international stocks to real estate investment trusts and, best of all, they pay dividends monthly.

So a $500K investment would get you $39,500 a year in dividends, or $3,292 a month.

Monthly paying CEFs are the answer in a volatile market like this, sending us regular payouts that come in right alongside our bills. And if you don’t need all the income from your CEF portfolio, great! You can reinvest it more quickly with monthly payers, boosting your long-term upside (and income stream) as you do.

These 5 CEFs are all trading at attractive discounts, so now is the time to buy them, before their next surge. Click here and I’ll show you how to get your copy of an exclusive investor report that unveils all 5 of these monthly paying income machines, giving you their names, tickers, current yields and more.

Recent Comments