It’s a question I get from investors all the time (including subscribers to my CEF Insider service): how should I invest when interest rates rise?

Because fear of rising rates is common among investors, there’s a hidden trap here: if you react to this worry, you will lose money. Instead, you need a second-level understanding of rates so you can bet against this fear and make money. (I’ll also give you 3 great buys that let you quickly and easily pull this off below.)

What Most People Get Wrong About Rising Rates

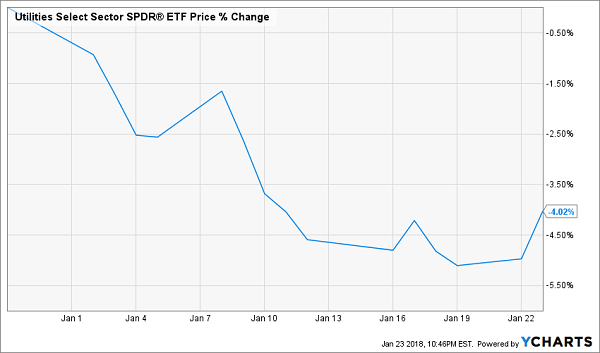

Here’s the common thinking on rates: as they head up, rising yields on US Treasuries will make these investments more attractive than large-cap US dividend stocks.… Read more

Recent Comments