We income investors don’t talk about international stocks nearly enough. That’s too bad, because there are ways we can use them to build a massive income stream and make our investments safer, too.

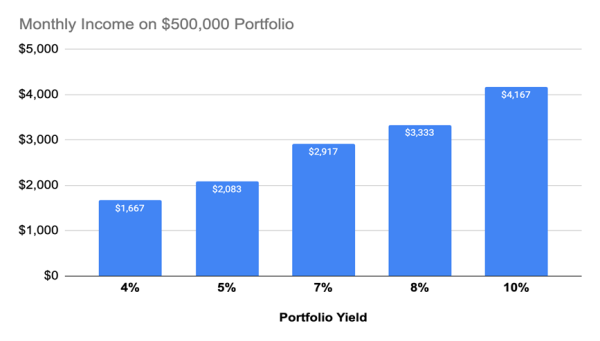

In fact, there’s one way, using high-yield closed-end funds (CEFs), we can “time” US and international stocks to get a 9.2% yield we can build over time by making simple moves to “rebalance” between US and overseas CEFs from time to time.

It all starts with China, because there’s a spark there that sets the stage for our 9.2%+ overseas payout strategy.

Chinese Stocks: 13% Yearly Gains Ahead?… Read more

Recent Comments