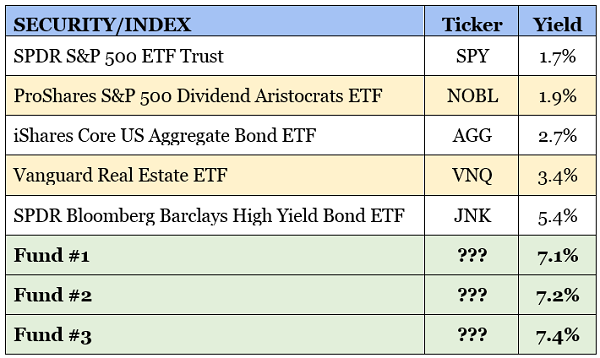

There’s a way for us dividend investors to tap the news of a COVID-19 vaccine for huge payouts of 10% and up. And we’ll position our portfolios for serious price upside, too.

I know the vaccine news has a bit of a “horse is out of the barn” feel to it. After all, the market and shares of the vaccine’s producer, Pfizer (PFE), have already popped (though the rally has taken a bit of a breather lately). But you’re not too late. With the three investments I’ll show you below, you could grab healthcare dividends much bigger than the 3.9% Pfizer pays now.… Read more

Recent Comments