What if you could lock in a 7.7% gain year in and year out, and get it all in cash, no matter what the S&P 500 does?

With the market’s paper gains for 2018 now mostly gone, no thanks to the correction, I’m guessing this would have a lot of appeal. So today, I’m going to show you 2 “pullback-proof” dividends paying 5.4% and 7.7%, with plenty of price upside ahead, too.

Thanks to the pullback, these two are perfect for buying now and sitting on forever (or at least a few decades). More on them in a moment.

How to Beat Fear and Get Rich From the Pullback

First, if the daily barrage of negative headlines has you pondering bailing out on stocks, stick with me for a second, because that’s the worst thing you could do now.

Imagine, for example, if you’d sold out on any of the scares we’ve seen in the last 10 years. It’s worth revisiting this rogue’s gallery, to remind ourselves that we’ve been here (and to worse places) before.

It includes:

- The 2008–09 financial crisis

- The 2010 Greek debt crisis

- The 2010 flash crash

- The Chinese stock-market crash of early 2016

- The correction of February 2018

Plus many smaller tantrums along the way.

If you pulled the ripcord on these occasions, you’d have missed some or all of the following monster gain (not to mention dividend payments):

Longer Timeline, Bigger Return

But if you still can’t pull yourself away from your iPhone, ponder these words from the master himself, Warren Buffett: “The stock market is a device for transferring money from the impatient to the patient.”

Given recent events, now seems like a particularly good time to give you the 2 buys I mentioned off the top—plus my favorite strategy for funding your golden years without suffering a daily panic attack from the headlines.

The Strategy: Live on Dividends Alone

You’ve likely heard of Wall Street’s “4% rule,” which says you should supplement your dividend income in retirement by selling 4% of your portfolio every year.

Trouble is, if you’d followed this “wisdom” during this selloff, you would have sold straight into this:

The 4% Rule Slams Into Reality

And that’s in just six weeks! I know I don’t have to tell you that pulling a fixed percentage of capital from your portfolio in a really long slump is a recipe for wiping out your nest egg—not to mention your dividend income.

Luckily, there’s a better approach: investments paying outsized cash dividends of 5.4%, 7.7% and even higher. That way, if you have a nest egg in the $500k neighborhood you could live on dividends alone—and shut off CNBC for good!

Pick No. 1: A 7.7% Dividend That’s Sailed Through the Carnage

Which brings me to the first buy I’m going to show you today: a fund that not only throws off a massive 7.7% payout but pays dividends monthly.

This little-known fund holds some of the top names in the healthcare sector, which has clobbered the market this year. But thanks to the correction, healthcare has pulled back from highs in January and early October, opening a nice buy window.

Healthcare Backs Up the Truck

But we’re not going to satisfy ourselves by purchasing the “dumb” index fund you see in this chart, the Health Care Select Sector SPDR ETF (XLV). Its 1.5% payout won’t come close to cutting it if we want to “lock in” our gains in cash and retire on dividends alone.

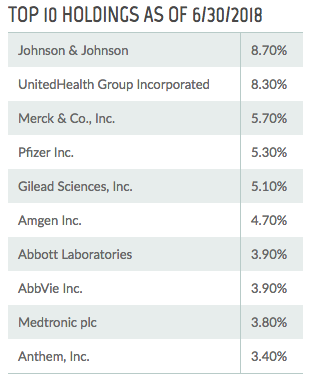

Instead we’re going to turn to a closed-end fund (CEF): the Tekla Healthcare Opportunities Fund (THQ). Check out its top holdings—I’m betting you know every single one.

Source: Tekla Capital Management LLC

If you’re a regular reader, Tekla might sound familiar, because the company is a long-time favorite of my colleague, CEF “professor” Michael Foster.

That’s because it’s poached an all-star team of doctors and researchers from the likes of Merck & Co. (MRK) and Johnson & Johnson (JNJ) to work with its own financial whiz kids.

Their expertise is showing up in THQ, Tekla’s newest fund, launched in 2014. So far this year, it’s bagged a 7% total return (with dividends included). And while that’s a bit behind XLV’s, 8.7%, we’re not going to split hairs here because unlike XLV, which could give up the difference tomorrow, THQ’s gain was almost entirely in cash, thanks to its monster 7.7% payout.

That kind of performance, during a very volatile year, is just the kind of field test we want from a “forever” retirement play.

And THQ’s monster dividend gets further support because the fund’s market price is 9.2% lower than its net asset value (NAV, or what its portfolio is worth on the open market). This discount is a quirk of CEFs that gives us both price upside (that gap has narrowed to as little as 5.8% in the last 2 years) and downside protection.

For income-seekers, the upshot is that thanks to this markdown, the only yield that matters is the yield on NAV (or what management must get from the portfolio to maintain the payout). Right now, THQ’s yield on NAV sits at 7.1%, a much easier bar for the team at the top to clear.

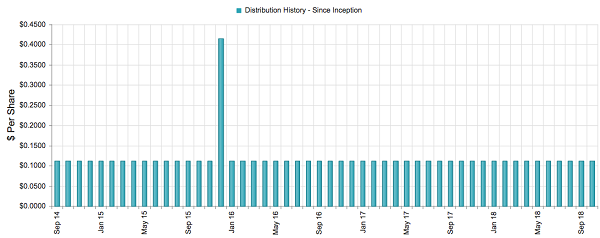

And they have, delivering the proceeds to shareholders in a steady stream month in and month out:

Source: CEFConnect.com

The bottom line?

THQ boasts a monthly 7.7% dividend, top-flight management and high-quality portfolio in a sector with plenty of upside, thanks to the wave of retiring baby boomers. That makes it a great fund to buy now, before its discount narrows further.

Pick No. 2: Play Defense With This 5.4% Dividend

Of course, big-cap healthcare stocks aren’t the only way to tap big gains (and income) from this cash-flush sector. Another option: Go straight to these companies’ “landlords” and grab a big chunk of the rent the collect every month in cash.

How?

Through healthcare REITs, owners of the labs, medical offices and hospitals everyone from big pharma to your family doctor counts on. And you can bet these properties will stay hot no matter what the economy does.

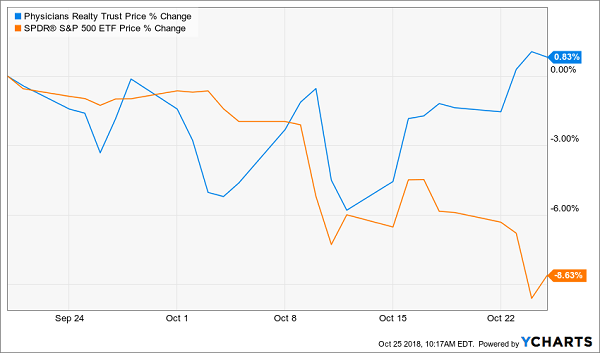

The herd knows it. Check out how my next pick, Physicians Realty Trust (DOC), sailed through the October swoon while the market fell on its face:

A Textbook Defensive Play

DOC sits on a portfolio of 249 medical-office buildings across 30 states, almost all of which (97%) are rented.

The trust isn’t only diversified by territory: it also gives you an extra layer of safety by spreading its properties across a long tenant list, with no single occupant chipping in more than 6% of annualized base rent.

Which brings me to the trust’s dividend, which clocks in at a gaudy 5.4%. Sure, that doesn’t quite hit the same level as THQ, but there’s room for growth: funds from operations (FFO, a better indicator of REIT performance than earnings) are surging: up 27% since the first quarter of 2016.

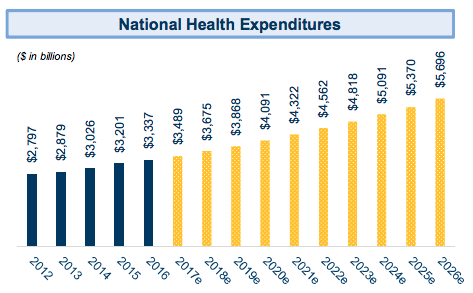

And I’m sure you know that healthcare spending is exploding—and that will push up demand and rents (and by extension FFO and dividends) even more:

Source: Physicians Realty Trust Bank of America Merill Lynch Global Real Estate Conference Presentation, September 2018

Meantime, this payout is safe, at 86% of trailing-12-month FFO, easily manageable for a steady Eddie like DOC.

And let me leave you with this: even though it aced the downturn, you can buy DOC at just 16-times FFO. That’s a smoking deal, given the REIT’s defensive chops and room for upside in both the share price and the dividend. Grab this one now and lock in its “pullback proof” 5.4% payout today.

Yours Now: An Entire 19-Stock Portfolio With Safe Cash Payouts Up to 11%

As I showed you above, defensive REITs and CEFs are your “dividend lifeboats” when the markets get rough. That’s because their massive cash payouts give you more of your profits in cash, rather than here today, gone tomorrow paper gains.

And by focusing on REITs and CEFs with steady cash flow, you can make sure your nest egg stays intact—and grows for the future.

$40,000 in Income on $500k

I’ve got 6 more dividend plays to give you—all REITs and CEFs—that fit this description to a T. Each one taps into the same kinds of surging trends as THQ and DOC, but with one crucial difference: they pay even higher dividends.

I’m talking 8% cash payouts, on average—enough to let you retire on dividends alone with a $500k nest egg, thanks to the $40,000 yearly income stream these defensive superstars give you.

That’s why I call this my “8% No-Withdrawal Portfolio.” I can’t wait to show it to you.

That’s not all, either.

Because the newest issue of my Contrarian Income Report newsletter will publish this Friday, with fresh updates on the 19 stocks and funds in our service’s portfolio, handing our savvy CIR members massive yields up to 11%!

I want to send all 19 of these cash-rich plays your way, too. Don’t miss out.

Recent Comments