Don’t become complacent with your dividends! Your portfolio and your income are at the whim of Fed Chair Jerome Powell—now more than ever.

I realize he’s acting like a “good boy” at the moment. But what if JP decides to go rogue again and exercise his independence? A surprise rate hike would be catastrophic to many income portfolios.

That means you need to “Fed-proof” your nest egg and your dividends. Today we’ll discuss four funds paying dividends up to 10.7% that do just that.

These four closed-end funds (CEFs) have been left for dead in this market rally. That makes them great “Fed insurance”: they’re cheap, so they’ve got built-in upside if the rally goes into overtime.

If stocks flame out, they’ll likely just trade flat. And we’ll still grab their outsized dividends!

More on these four “Fed-proof” plays—ranked from worst to first—shortly. First, we need to talk about Jerome Powell.

Stocks: Say the Magic Word

Let’s rewind to the holiday season.

Back then, the first-level crowd—beaten down by the selloff—was desperate for any reason to jump into stocks. They found it in early January, when Powell said the central bank would be “patient” with the pace of rate hikes.

Between then and the end of the month, when the minutes of the latest Federal Reserve meeting came out, stocks did this:

“Boring” Fed Excites Investors

Here’s the crazy thing: those January 30 minutes said nothing—the Fed just said “patient” a few more times. And investors doubled down!

More “Patients,” More Gains

No, it wasn’t economic numbers that drove this “second stage” of gains: unemployment was 3.8% in February, a bit lower than 3.9% in December. Fourth-quarter earnings rose double-digits, as they’ve done for five straight quarters now.

That leaves us with the Fed, which we can thank (or curse, if you’re hunting for cheap dividends) for this market run.

Time to Buy “Fed Insurance”

Nobody knows how long this “Fed rally” will last. Powell’s “patient” line could be drowned out tomorrow. Or he could roll out a rate cut, igniting stocks again.

Either way, we’re not going to sit on the sidelines. Our next move starts with …

4 “Fed-Proof” Dividends on the Cheap

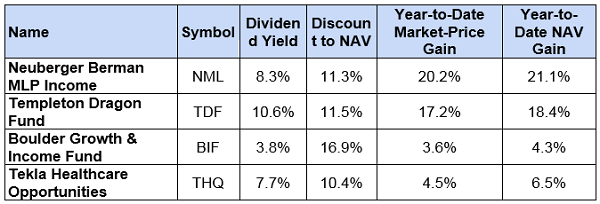

As you can see, each is cheap in two critical ways: a double-digit discount to NAV (in other words, their market prices are way below their portfolio values), and NAV gains that have outraced their market-price gains this year.

Translation: management is putting up better numbers than it’s getting credit for!

But that doesn’t mean they’re all great buys now. Let’s take a trip through these four, in order of appeal:

Worst: Templeton Dragon Fund (TDF)

TDF boasts the biggest dividend yield of our quartet (10.6%!), the biggest discount to NAV (11.5%) and a portfolio that has topped the fund’s market price this year.

That’s where the good news ends for TDF.

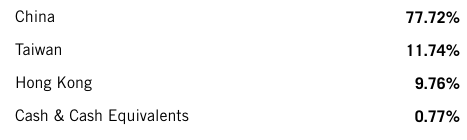

For starters, as its name suggests, the fund has 78% of its assets in China, whose economy is slowing, partly due to President Trump’s trade war.

A Lead Weight

Source: FranklinTempleton.com

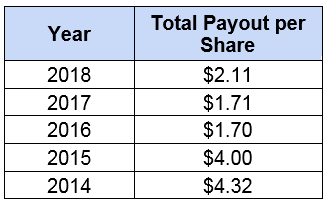

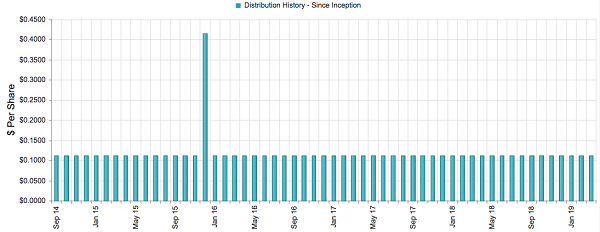

What’s more, TDF’s dividend is as erratic as they come: according to Templeton’s website, the rate is set “based on current market conditions,” and the payout only goes out semi-annually. That makes TDF unappealing for anyone trying to set up a predictable income stream. Check out how lumpy TDF’s payout has been:

TDF’s Gyrating Dividend

Source: CEFConnect.com

So let’s pass on TDF and move on to a fund with a bit more appeal, thanks to its deep roots in the USA.

Mediocre: Boulder Growth & Income Fund (BIF)

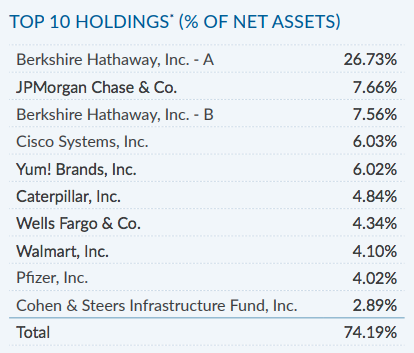

BIF sports the biggest discount of our quartet, at 16.9%. It also has the best pedigree, tapping the value-investing strategies of Warren Buffett.

If you’ve wanted to hold Buffett’s Berkshire Hathaway (BRK.A) but have shied away because it lacks a dividend (and a class A share goes for $307,000!), BIF, with its 3.8% yield, is for you: Berkshire accounts for a third of its holdings:

Source: Boulder Growth and Income Fund Fact Sheet

So why is BIF only my third-best pick?

First, the dividend is paltry for a CEF, and BIF recently switched from a quarterly to a monthly payout—a monthly dividend is a better deal if you’re leaning on your portfolio for income, because your cash flow matches up with your bills.

(You can get my favorite monthly payers now in my “8% Monthly Payer Portfolio,” which I’ll give you when you click here).

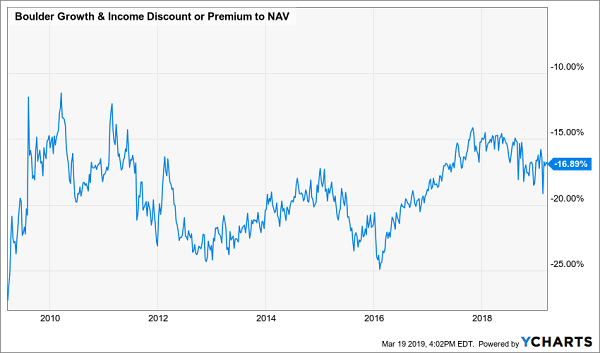

Second, by leaning so heavily on one stock, management isn’t providing a lot of value for their 0.98% fee. And third, BIF’s 16.9% discount has been locked at a low level for a decade, so it’s tough to see any “snap-back” upside here:

BIF’s Never-Ending Sale

Still, if you want to buy Berkshire and other big caps, BIF could be worth a look; you’ll get a dividend that doubles the yield on the SPDR S&P 500 ETF (SPY).

Better: The Neuberger Berman MLP Income Fund (NML)

NML holds pipeline master limited partnerships (MLPs) and has posted the biggest market-price gain of our group—a run that’s been topped by its NAV. There’s reason to expect more: even after its rebound, NML’s market price is still well off the two-year highs it hit in January 2018.

That’s because it started from a low base: energy generally, and NML in particular, took a hard hit in the 2018 selloff, illustrating a big risk of holding NML: volatility. The CEF sports a beta rating of 1.4, making it 40% more volatile than the S&P 500.

However, it does trade at an 11.3% discount to NAV—below the 9.2% average in the past year—so there’s potential for some discount-driven gains here, too, as US oil production continues to rise: NML’s holdings are all in the US.

The dividend is sustainable at 8.3%, thanks to that big discount. That’s because the yield on NAV—or what NML needs from its portfolio to keep its payout steady—is just 7.3%, way below the 21% total NAV return it’s already seen this year.

Finally, most MLPs will kick you a K-1 tax form around your return deadline and annoy you and your accountant. NML gets around this by issuing you one neat 1099.

But if you’re still leery about the always-wild energy space after this big run-up, put NML on your watch list and go with my top “Fed-proof” buy.

Best: The Tekla Healthcare Opportunities Fund (THQ)

The biggest upside is with THQ, whose NAV has overshot its price by a mile this year. It’s only a matter of time before its price closes that gap again:

THQ’s “NAV Magnet”

Plus, its discount, currently 10.3%, has been as narrow as 6.25% in the last 18 months—the second ingredient for at least 10% upside here.

THQ is no dividend slouch, either, with a 7.7% yield on market price translates to just a 7% yield on NAV, which is already nearly covered by its 6.5% year-to-date NAV return. A 7% yearly NAV return is a cinch for Tekla going forward, too. It employs financial pros and medical researchers to get a jump on the next pharma breakthrough.

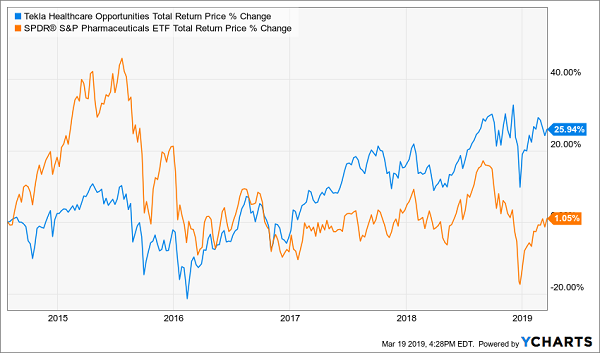

That strategy is proven: check out THQ’s lifetime return versus the SPDR S&P Pharmaceuticals ETF (XPH):

Expert Management Pays Off

Finally, THQ pays dividends monthly—a nice extra benefit for retirees and anyone else leaning on their portfolio to pay the bills.

Rx for a Happy Retirement

5 More “Fed-Proof” Monthly Dividends Up to 9.9%

THQ is just one monthly dividend payer I’m pounding the table on now.

My Contrarian Income Report portfolio boasts 5 more monthly paying stocks and funds that are also terrific buys, as the market sits on pins and needles, waiting for Powell’s next change of heart.

Each of these income powerhouses gives us the sky-high yields (7% on average, with one paying an incredible 9.9% in cash!) and steep discounts we need to thrive, no matter what happens with the Fed—or the economy.

They’re just a click away—all you need to do is take CIR for a quick, no-commitment road test to get your hands on these 5 cash machines now, plus all 19 income plays in this dynamic portfolio (average yield: 7.4%; highest yield: 11.9%!).

That’s not all, either, because you also get …

“Monthly Dividend Superstars: 8% Yields With 10% Upside”

This breakthrough Special Report lays out my top monthly paying buys—the very best of the best picks for your portfolio right now. You’ll discover:

- An 8% payer that’s set to rake in huge profits from an artificially depressed sector.

- The brainchild of one of the top fund managers that’s giving out generous 9.1% yields.

- A steady Eddie high-yielder that barely blinks when stocks plummet. (This one is my favorite “Fed insurance” play of all.)

Recent Comments