Thanks to the selloff, it’s possible to buy closed-end funds (CEFs) at such high yields that we can do what seemed unthinkable just a few months ago: build a CEF portfolio that will pay $5,000 a month in dividends on about $540k invested.

That’s an 11.1% average yield!

This, of course, is because many CEFs have been caught up in the selloff, and yields move inversely to prices. So a fund that may have yielded, say, 7% six months ago (which is about the long-term CEF average) is suddenly yielding a lot more now.

In addition, it’s possible to build an income stream this big with just three CEFs. The three funds we’ll examine below also come together to form a well-diversified portfolio, with stocks and bonds from hundreds of companies.

The beauty of CEFs is that you can buy them through any brokerage account, just like stocks, during normal market hours. Their dividends will then reliably drop into your account, just as they’ve been doing for investors for years and years.

CEF #1: Corporate Bonds at a Rare Discount

Let’s start with corporate bonds, which provide a source of reliable income, and many are looking very oversold this year.

While periods of high inflation aren’t normally the best time to buy bonds (because bond prices tend to fall when inflation and interest rates rise), inflation is already priced into many bonds. This is why we’ve seen bond funds fall sharply this year, and their yields rise.

One thing is certainly clear: to get our $5,000 a week in dividends, we’ll have to go beyond the benchmark index fund for corporate bonds: the 5.1%-yielding SPDR Bloomberg High Yield Bond ETF (JNK). Instead, we’ll more than double JNK’s yield with the PIMCO Income Strategy Fund (PFL), which yields 11.8% and is priced at a 3.7% discount to net asset value (NAV, or the per-share value of its portfolio), as I write this.

That’s another promising sign of potential upside, because PFL, along with most PIMCO funds, usually trades at a premium. Over the last year, for example, PFL’s average premium to NAV has been just south of 10%.

If history is any guide, that premium will return, and possibly sooner than most investors think.

CEF #2: A Timeless CEF Run by a Value-Investing Guru

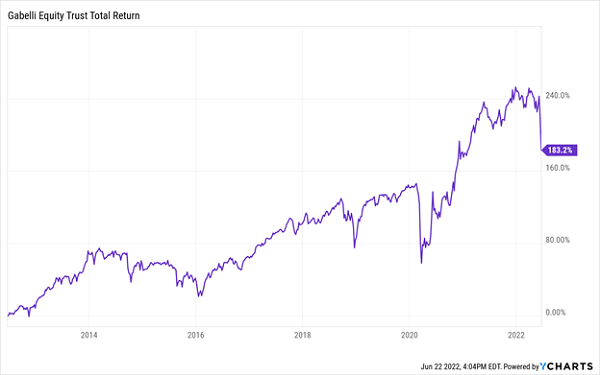

Let’s go further with the Gabelli Equity Trust (GAB), managed by legendary value investor Mario Gabelli. Mario’s fund focuses on buying undervalued companies with strong cash flows and earnings growth, both of which are critical, especially with high inflation buffeting the economy now, and a potential recession on the horizon.

GAB’s portfolio of companies includes Deere & Co. (DE), Mastercard (MA), American Express (AXP), Texas Instruments (TXN) and O’Reilly Automotive (ORLY)—all of which have survived multiple recessions and seen their profits grow in the long run, which is why they’re great buys in this oversold market.

GAB Gives Us a Nice Dip to Buy

In addition, GAB pays a 10.8% income stream. That makes it a much better way to get large cap stock exposure than an index fund, because its high payout reduces the need to sell stocks at today’s lower levels to supplement a portfolio’s income stream.

CEF #3: Get Strong Growth Companies at a Deep Discount

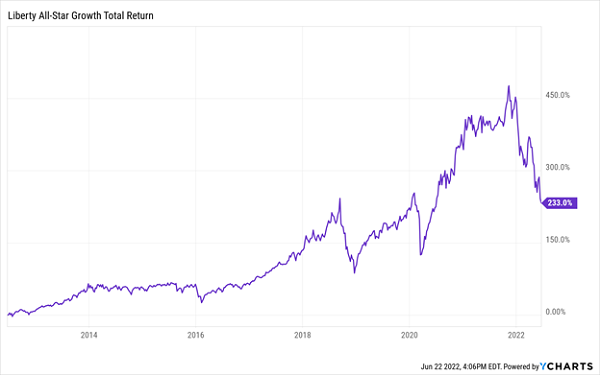

Finally, let’s buy some high-growth firms, because growth stocks have been tossed out this year, even those with terrific prospects. These firms (and here I’m talking specifically about blue chip techs) aren’t going anywhere: we aren’t using Amazon.com (AMZN), Microsoft (MSFT) and Google (GOOG) any less—which is why the 10.6% yield on the Liberty All-Star Growth Fund (ASG) has particular appeal.

If you’re worried that growth stocks could go lower in the short term, the short answer is that, yes, they could. No one can predict what will happen over the next few days or even weeks. But over the long term, ASG has delivered strong gains.

Another Dip Opportunity Appears With ASG

What that tells me is that this selloff has made ASG an oversold bargain, which suggests we’ve got a nice shot at long-term gains while we collect this fund’s 10.6% dividend.

Putting It All Together

Where does that leave us? With just three funds, we have a portfolio yielding 11.1%, on average, which would pay a consistent $5,000 per month in passive income on $540,000 invested. I think you’ll agree that an income stream like that is very appealing in a market like this one.

Inflation or Recession, These 5 CEFs Can Handle It (and They Yield 7.9%, Too!

When I talk to investors about CEFs, many don’t realize how well-established many of these funds are: there are plenty of CEFs that have been paying dividends for decades. In my CEF Insider service, we even recommend one fund that was founded back in 1929!

The three CEFs I’ve just showed you are good examples of the reliable, well-run funds that are out there. And I’ve zeroed in on five more that are even better deals today, with wide discounts I see propelling their prices 20%+ above today’s levels when the market finally settles. Meantime, we’ll collect some very tidy dividend payouts, thanks to these 5 funds’ 7.9% average yield.

Go here and I’ll give you a full breakdown of this terrific asset class and give you access to an exclusive Special Report detailing the names and tickers of these 5 incredible 7.9%-yielding CEFs. PLUS I’ll give you an opportunity to road test CEF Insider on a risk-free basis!

Recent Comments