If you’re relying on income from your portfolio, you know how annoying it is to manage a collection of quarterly dividend payers.

Take five of the most popular dividend stocks on the market today: Johnson & Johnson (JNJ), JPMorgan Chase & Co. (JPM), Home Depot (HD), Procter & Gamble (PG) and Bank of America (BAC).

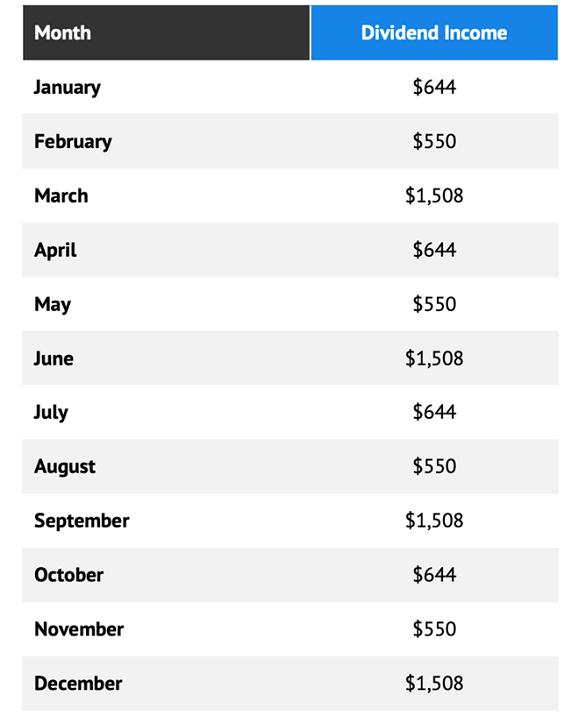

These are staples of every investor’s portfolio, but a route to a steady income stream they are not! Here’s what your monthly payouts would look like with this quintet if you held, say, $100,000 in each one, for a $500,000 total investment:

Source: CEF Insider

That’s a nightmare! Your monthly income ranges from just $550 a month to $1,508. And you’re still bagging just a 2.2% overall yield! And while switching to other blue-chip stocks could get you a higher yield, it won’t solve the problem of inconsistent income because very few pay monthly.

But there is one asset class where steady monthly payers abound: closed-end funds (CEFs). Of the roughly 500 or so CEFs out there, about 350 pay dividends every month. And because CEFs hold everything from corporate bonds to real estate investment trusts (REITs) and blue-chip stocks, you can likely switch over to them without having to sell the stocks you hold now.

In fact, with just three of the CEFs we’ll look at below, you can turn the wobbly 2.2% income stream we just saw into a rich 7.7% yield that’s as smooth as can be:

Source: CEF Insider

That’s more like it! And you’ll be far more diversified too, with bonds, utility stocks and blue chips backstopping your dividend flow. More on these three monthly paying CEFs in a moment. First, if you’re new to CEFs (and many folks are—as I wrote last Thursday, the media is only now starting to tell investors about these well-established income generators), let’s take a quick look at how CEFs work.

CEFs Have 3 Ways to Keep Our Dividends Safe

CEFs generate their dividends in a few different ways. For one, their human managers trade in and out of whatever assets their fund holds, and every so often they’ll take profits on those trades and hand them over to us in the form of dividends.

Over the last decade, this has been easy to do for a stock-focused CEF. With the market up 14% annualized in that time, it’s been simple for a CEF manager to maintain, say, a 7% dividend (most stock-focused CEFs pay this much and more).

Another way they offer outsized payouts is by employing leverage. That may sound risky, but you can lower your risk by zeroing in on CEFs with very conservative leverage, say 20% of their portfolios or less. And even though interest rates are rising, the booming economy is inflating these funds’ holdings at the same time, and that’s more than enough to offset any rise in borrowing costs.

Finally, there’s a CEF’s discount to net asset value (NAV). We don’t have to get into the weeds here, but because of a quirk in their structure, CEFs’ share prices usually trade at a different level than their NAV, and often at a discount. That means the yield on market price (or the yield we get) is often much higher than the yield on NAV (the yield that management must cover to keep the payout going).

A CEF like the Gabelli Dividend & Income Fund (GDV), for example, trades at a 12% discount to NAV today and yields 5.3% on its market price. But because of that discount, its yield on NAV is just 4.7%, which is even easier for management to cover.

Now let’s swing back around to that steady-as-she goes $3,208-a-month income stream we mentioned a couple minutes ago. Here’s a model portfolio of the three CEFs that can get you there. (Note that these aren’t my favorite monthly dividends to buy right now, as their discounts aren’t quite deep enough to get our blood pumping. For my 4 top monthly paying CEF picks, see the link to the special report I’ve provided at the end of this article.)

A 3-CEF “Mini-Portfolio” With a Steady 7.7% Monthly Payout

Let’s base our portfolio on sound utility stocks with the Reaves Utility Income Fund (UTG), payer of a 7.6% yield today. The fund’s holdings generate reliable cash flows through thick and thin due to demand for the telecom, energy and pipeline services that stays constant no matter what the economy is doing. Top UTG holdings include NextEra Energy (NEE), American Water Works (AWW) and WEC Energy Group (WEC).

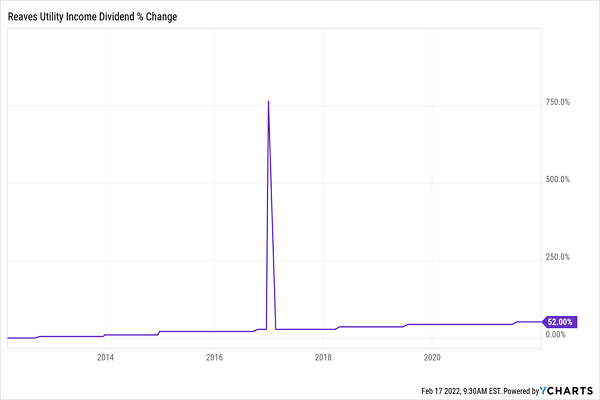

Not only does UTG offer that huge yield, but it’s been steadily raising its payout over the last decade, with a special dividend thrown in for good measure back in 2016:

A Rare 7.6% Payout That Grows

Now let’s add the PIMCO Income Strategy Fund (PFL), a small fund from one of the biggest bond traders in the world. PFL holds a variety of bonds from the US and abroad and pays out a whopping 9.4% in income.

Then we’ll add real estate exposure through the Cohen & Steers Quality Income Realty Fund (RQI), a 6.1%-yielder that mainly holds real REITs, with smaller concentrations of corporate bonds, preferred shares and convertible bonds (which management can convert to stocks under certain conditions).

Top REIT holdings include cell-tower owner American Tower (AMT), self-storage REIT Public Storage (PSA) and warehouse landlord Duke Realty (DUK). All three are profiting from consumers’ focus on buying goods (especially online) over services, which of course was a trend brought on by the pandemic (and isn’t likely to go away anytime soon).

Put it all together and you get that smooth $3,208 of monthly income we talked about earlier. You can use these funds to either reinvest in these CEFs and further grow your income stream or invest them elsewhere. That flexibility is what financial independence is all about.

My Top 4 Monthly Paying CEFs to Buy Now (for 7.5% Dividends, 20% Upside)

I’ve combined my 4 top monthly paying CEFs for you to buy now in a new Special Report you can get when you click right here. These 4 overlooked (for now!) CEFs yield 7.5% today, and all are screaming bargains—to the point that I’m forecasting 20%+ upside from each of them by this time next year.

These funds will help crash-proof your portfolio, too: thanks to their already-deep discounts, they’ll hold their own in a correction, letting you enjoy your 7.5%+ monthly dividends in peace!

Your Special Report, with all the details, is waiting for you now. Click here to get your copy and uncover everything you need to know about these 4 monthly paying CEFs, including their names, tickers, current yields and my in-depth analysis of their management strategies.

Recent Comments