Last Thursday, we took a close look at how closed-end funds (CEFs) holding municipal bonds—issued by states and cities to fund infrastructure projects—can help stabilize your portfolio in times like these.

Today we’re going to dig deeper and put some numbers behind how these CEFs can do even more, including handing you a dividend that’s double what you’d get on stocks—and these payouts are tax-free, to boot!

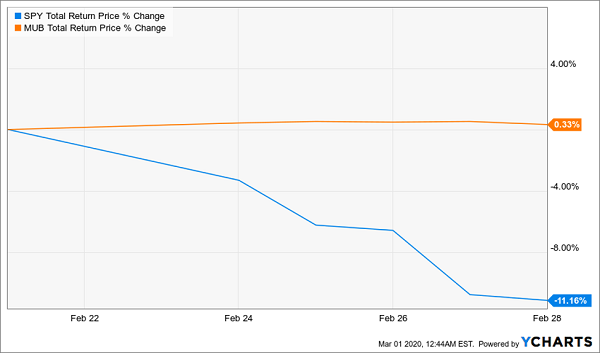

First, here’s what “munis” did during the selloff in the last week of February:

Muni Bonds Hold the Line—Literally

When stocks plummeted, munis were fine. And why wouldn’t they be? As senior government debts, municipal bonds have strict regulations and restrictions that make them less risky than stocks.… Read more

Recent Comments