Last Thursday, we took a close look at how closed-end funds (CEFs) holding municipal bonds—issued by states and cities to fund infrastructure projects—can help stabilize your portfolio in times like these.

Today we’re going to dig deeper and put some numbers behind how these CEFs can do even more, including handing you a dividend that’s double what you’d get on stocks—and these payouts are tax-free, to boot!

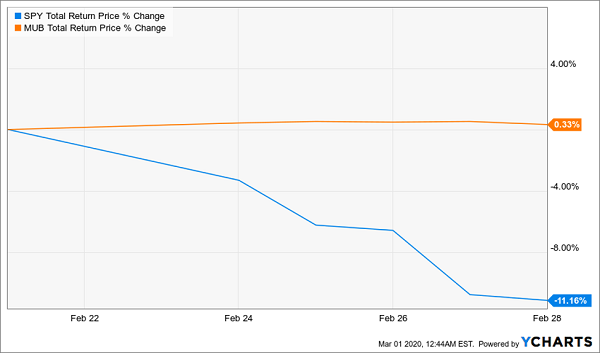

First, here’s what “munis” did during the selloff in the last week of February:

Muni Bonds Hold the Line—Literally

When stocks plummeted, munis were fine. And why wouldn’t they be? As senior government debts, municipal bonds have strict regulations and restrictions that make them less risky than stocks. When recessions hit, the income muni bonds pay doesn’t stop, which is why they’re much less volatile than stocks, and favored by retirees.

Diversifying your portfolio away from risk is one benefit of muni bonds, but today I want to focus on three aspects of this asset class that make them much more attractive, while I also show you how you can get in and lock down yields exceeding 4%.

- The Tax Benefits

Tax season is right ahead of us, and this could be a big headache for you, especially after a year like 2019.

Big Profits—and a Big Tax Bill

If you went all in on stocks in 2019, you’re now sitting on some huge gains. And if you sold those gains because you needed cash, I have some bad news.

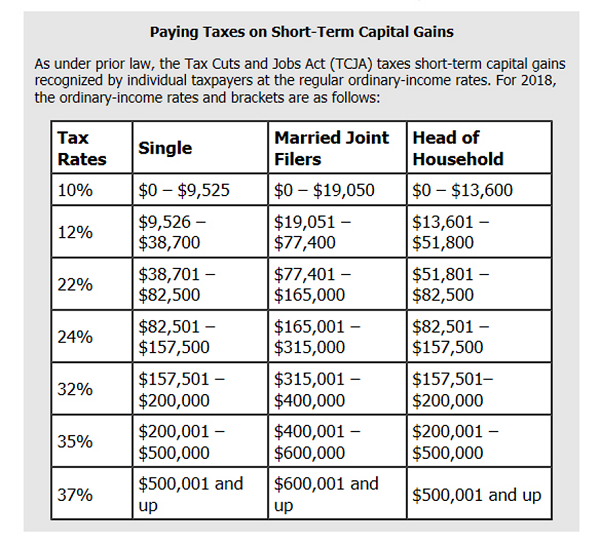

Source: kwccpa.com

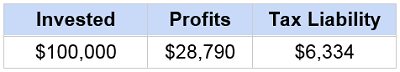

If you’re a middle-class married couple, expect to pay 22% of your gains to Uncle Sam (note that the 2018 rates cited above are the same for 2019). That means paying $6,334 for every $100,000 invested on 2019’s gains!

Now let’s take municipal bonds.

With a few exceptions, most municipal bonds are federally tax-exempt. This is because “munis” fund state activities, which the federal government does not tax. That also means investors who buy munis aren’t taxed on their income from munis.

Let’s say you invested in the muni market in 2019 with the Eaton Vance Municipal Income Trust (EVN) and held throughout the year. Last year, you would’ve gotten a 4.9% tax-free income stream from your investment, meaning a tax liability of zero by the end of the year. For a $100,000 investment, that means shaving your tax bill by over $6,000!

- Capital Preservation

Tax benefits are a big part of the story. Another is capital preservation. As discussed above, holding munis through a market correction means fewer losses, realized or unrealized. And that’s a big deal when you need cash. Here’s why.

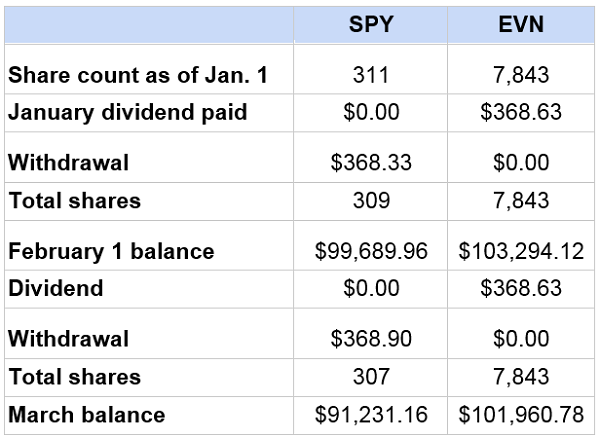

If we compare holding $100,000 in SPY (making 311 shares) to our muni-bond CEF (7,843 shares, as per prices on January 1), we see that withdrawing just an annualized 4.4% from SPY results in us losing shares each month (total shares went from 311 at the start of the year to 307 by March) because SPY’s 1.9% dividend isn’t enough to get us the income we need. Since EVN’s payouts cover that income, total shares stay constant.

But what’s worse is, because of the market volatility, the value of our SPY-based portfolio has gone down by nearly $10,000. Our muni portfolio has gone up in value while giving us a high income stream.

This doesn’t mean munis are superior for everyone in all situations, but it does mean they are a great vehicle for preserving capital and are wisely used in tandem with other investments.

- CEFs Outperform the Passive Alternative

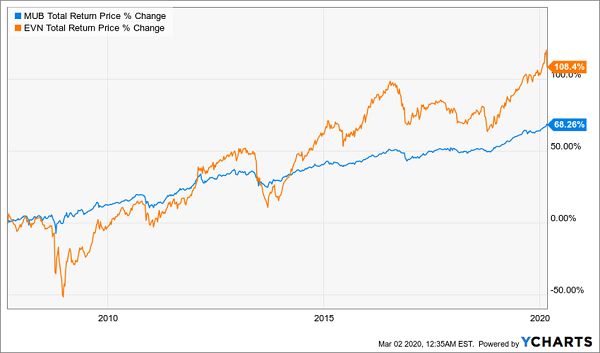

So, if I’ve piqued your interest in munis by now, for the tax benefits and capital preservation abilities they offer, why should you take EVN over an index fund like MUB?

Here’s why:

The CEF Advantage

Not only is EVN crushing the index by a growing margin, meaning more capital preservation, it’s also a bigger yielder: 4.3% over MUB’s 2.2%.

Where does that leave us? With bigger yields, tax benefits and capital preservation, all in a single buy—which is why muni-bond CEFs are tailor-made for uncertain times like these.

5 Amazing Funds That DOUBLE EVN’s Payout

A 4.4% dividend is terrific—especially when it’s tax-free. But even with its “hall pass” from Uncle Sam, EVN’s payout doesn’t come close to the huge cash stream you get from the 5 high-paying CEFs I’ve got for you right here.

These 5 cash machines pay 7.3%, on average—and that’s just the average! You’ll find “recession-resistant” payouts of 7.7%, 8.5% and even 9% among this bunch.

Better still, all 5 of these funds are trading at ridiculous discounts now. Here’s what that means in a time of coronavirus:

- If the market falls from here, these 5 funds should easily outperform: after all, it’s hard for a fund that’s already cheap to get a whole lot cheaper!

- If the market regains its footing, these funds are primed to soar even faster.

Either way, we’ll continue to collect our safe (and massive) payouts.

Don’t miss your chance to drastically increase your income stream and add some much-needed stability to your portfolio. Click here for full details on these 5 stout high-income plays: names, tickers, buy-under prices, dividend histories and my complete analysis.

Recent Comments