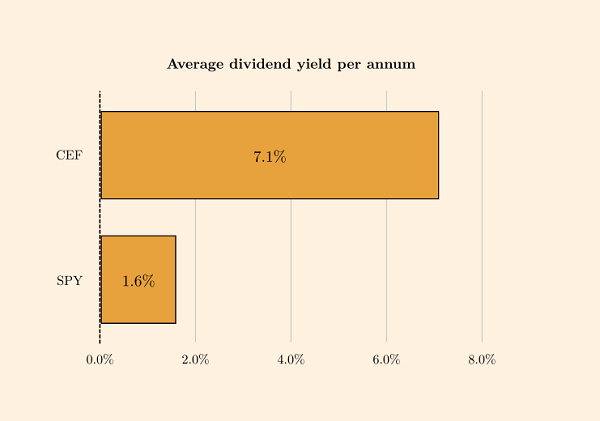

Markets are betting on the federal government pumping $908 billion in stimulus into the economy. If that cash wave rolls out, it’ll boost the group of funds I want to talk to you about today. They pay dividends of 6%+ and trade at big discounts to their true value now.

The Current Stimulus State of Play

First up, while the final stimulus bill is still being negotiated by Congress, it seems likely we’ll get a version similar to what’s been released already when a compromise is reached. So let’s take a look at what’s on offer.

Before we go further, I’ll say that the government’s new stimulus bill looks more effective than the CARES Act passed in the spring.… Read more

Recent Comments