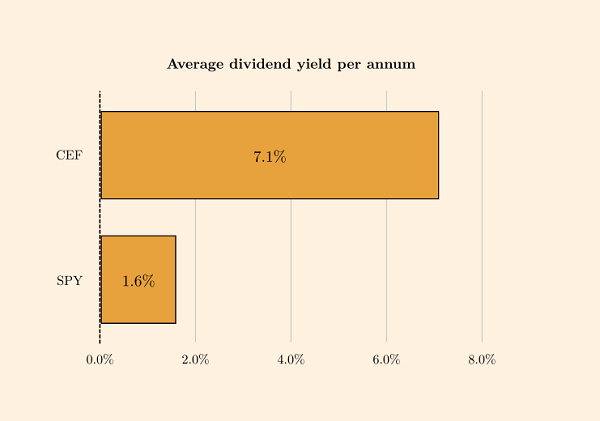

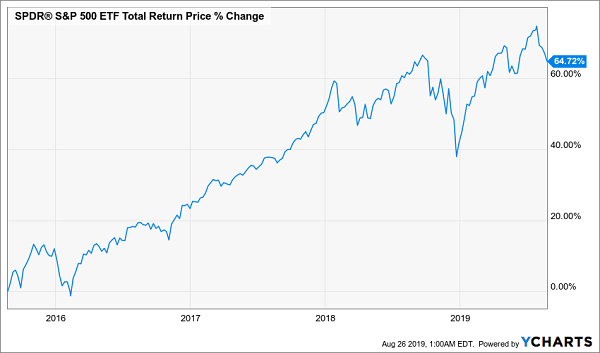

There’s a glaring disconnect out there between the health of the economy (still strong) and the mood of investors (terrible). It’s opened a window for us to grab some solid closed-end funds (CEFs) throwing off yields of 8%+.

This is especially true if you’re investing for the long term, which, if you are investing for income like this, you should be.

We’re going to talk about three such high-income plays today (one of which offers an 11.5% payout that’s growing) and dive just a little deeper into why this opening exists for us.

Fast Growth + Worried Investors = Best Time to Buy CEFs

If you’re a bit nervous about investing right now, I get it.… Read more

Recent Comments