Successful dividend investing is simple, though not necessarily easy. There are nuances which trip up many investors (including most professionals!). These twists and turns create “yield alpha” opportunities for contrarian-minded income investors like us.

If everyone else in the market were perfectly grounded and calculated, there would be no chance for us to make above-average returns. Thanks to these inefficiencies, we are able to bank big yields and price gains in Dividend Land. Ready to retire on dividends? Follow these five steps and we’ll do it together. Let’s start with an obvious yet underappreciated rule for income investors.

Step 1: Count Your Dividends

Since we focus on high yield, most of our returns come from the “yield” component of stocks. So let’s not forget about them when figuring out our returns!

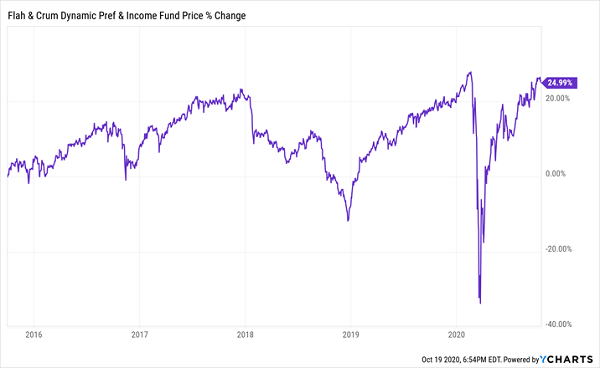

For example, we added this preferred stock fund to our portfolio in October 2015 and its price-only returns look quite pedestrian:

Don’t Fixate on Price Alone…

We’ve gained 84%, while the price is up only 25%. The majority of our fat 84% gains have been delivered via cash dividends. So let’s make sure we add in the orange (top) line below to reflect the big driver of our profits!

… Remember to Add Those Dividends!

Step 2: Find Price Upside, Too

While we could build a portfolio that’s 100% invested in these types of safe bonds and do just fine, we’re better off putting 50% or so of our cash in stocks. The upside is too good to ignore.

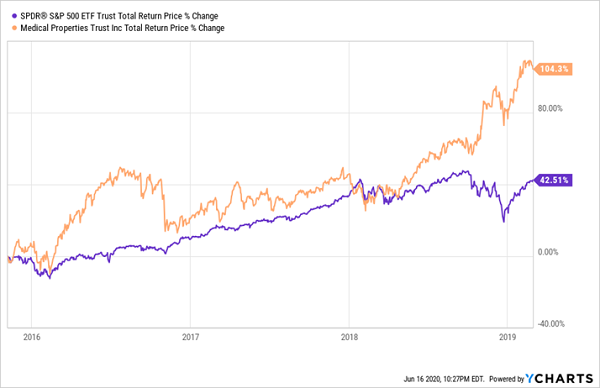

Dividend growth is, over the long haul, the main driver of higher stock prices. We added this stock in November 2015 and received three dividend raises over the ensuing three-and-a-half years. The result? We enjoyed 104% total returns and totally crushed the broader S&P 500:

Why We Buy Dividend Stocks, Too

Step 3: Monitor Dividend Coverage

A dividend hike is the ultimate sign of dividend safety, so I prefer stocks that consistently raise their payouts. The likelihood that a company is going to raise its dividend (or cut it) is directly related to its payout ratio, or the percentage of its profits (or cash flows) that it is dishing out to shareholders as dividends.

As a rule of thumb, a payout ratio below 50% is a sign of dividend safety. Some capital efficient firms can pay more, and real estate investment trusts (REITs) can pay up to 90% of their cash flows as dividends.

It depends on the company (and if you don’t feel like following the payouts and cash flows of 20 stocks and funds yourself, I’ll gladly do it for you as part of your subscription!).

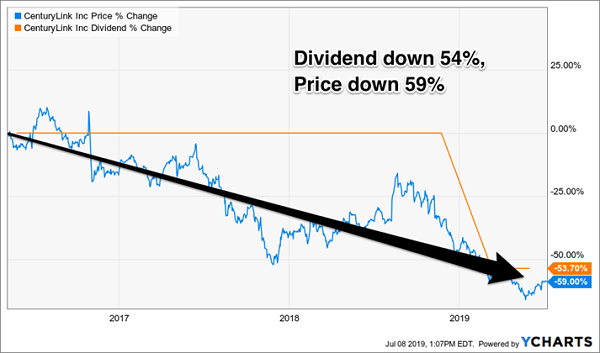

Dividend cuts are no fun. Not only are they a monthly pay cut for us, but (worse) they destroy capital. Take the case of CenturyLink (CTL) (which recently changed its name to Lumen(LUMN)), a company that has been writing its investors dividend checks it couldn’t cash since I called out this “paper telecom tiger” in May 2016 (and many times since!).

At the time, CTL was paying out 135% of its earnings as dividends. The company wasn’t growing profits, either, so the payout eventually had to go. Mr. Market eventually sniffed this out, investors dumped the stock, and sure enough, CTL’s management team finally made the inevitable cut:

Stocks Rise and Fall with Their Dividends

Remember the rising dividend in step two that drove our gains? The opposite happened to unfortunate CTL investors here. Their stock’s price dropped 59% on top of a 54% pay cut!

Step 4: Don’t Fight the Fed

“Don’t Fight the Fed” was chapter four in investing wizard Martin Zweig’s legendary book, Winning on Wall Street. Here’s why we’ll make it step four.

Zweig devoted 40 thoughtful pages to teaching readers why they should “go with the flow” with respect to the Fed’s trend at any given moment.

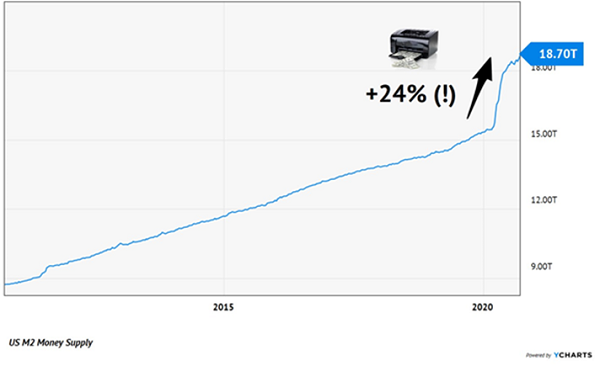

The only financial fundamentals that matter right now are the Fed-driven money supply. Chair Jay Powell (JP) pulled the lever on the money printing quantitative easing (QE) machine early and often in March, smashing all previous records in the largest money creation event of all-time (as defined by M2, the measure of the amount of money “out there” in circulation).

“M2” Money Supply: +24% Year-Over-Year

This is the “big picture” reason why the major trend in stock (and bond) prices still points up. It is also what is different this time, versus March. There’s a ton of new money sloshing around out there.

Amidst the talk about Fed “mandates”—from inflation targets to employment levels—there’s one unstated mandate that doesn’t get mentioned. Powell is doing whatever he can to support the stock market!

Investor sentiment by many measures has now, incredibly, rebounded to pre-virus levels. (The wonders of nearly three trillion new greenbacks!) The S&P 500 is priced for near-perfection in a world that, to anyone actually living in it, is obviously anything but at the moment.

I’ll tell you what is near-perfect, however, and that is a central banker on “full tilt.” Like a poker player trying to win his initial stake back, our man JP is getting nuttier by the week.

After playing some serious footsie with the corporate bond market, our Fed lead JP made it official. Earlier this year, he announced that the Fed was going to begin building its own corporate bond portfolio.

US Treasuries not yielding enough for you? No problem, buy corporates for more income. Our printing press is backstopping them both!

Step 5: Favor Out-of-Favor

What did our winners in step one and two have in common? Two things:

- They were well run, and (most importantly)

- We bought them when each was out-of-favor.

Contrarian investing should be uncomfortable. We want to buy stocks when their yields are high with respect to their norms. To put it plainly, we want to buy this stock when our “dividend per dollar” (as reflected by the orange line) is high. It means the price is low!

High Historical Yield Meant Low Price

And likewise we want to purchase closed-end funds (CEFs) when they are trading at discounts to the value of the assets on their books. This is a unique feature of CEFs because they trade like stocks, with fixed pools of shares. They can and will trade at premiums and discounts to the value of their bond portfolios, which means we can sit back and wait for bargains.

Free Webcast: How to Bank 20% Returns (Plus Big Yields!)… No Matter What Happens in November

Between the election, the virus and the long-feared recession the permabears have been warning about, we have no shortage of dark clouds.

Regardless of how these things play out, it’s still possible to have the huge yearly returns I mentioned earlier with safe dividend stocks?

I’ve spent the past 18 years refining the payout principles I outlined above. The result of my research? A “Dividend Swing Trade” strategy that will help you:

- Turn your “mere” 3% and 4% dividend payers into 20%+ total returns every single year,

- Buy dividend stocks when they are ready to run 50% to 100% higher,

- Make sure your portfolio is also bulletproof from any pullback, and

- Generate 5%+ annual yields to boot!

Interested in earning a safe, secure 20% in total returns (plus big yields!) from dividend stocks in the next 12 months? Then you should catch my webcast. I’m offering it complimentary for readers like you. Please click here to grab your seat for today’s important income strategy event.

Recent Comments