Let’s talk about three dividends averaging 12%. I bring them up because everyone on Wall Street hates them.

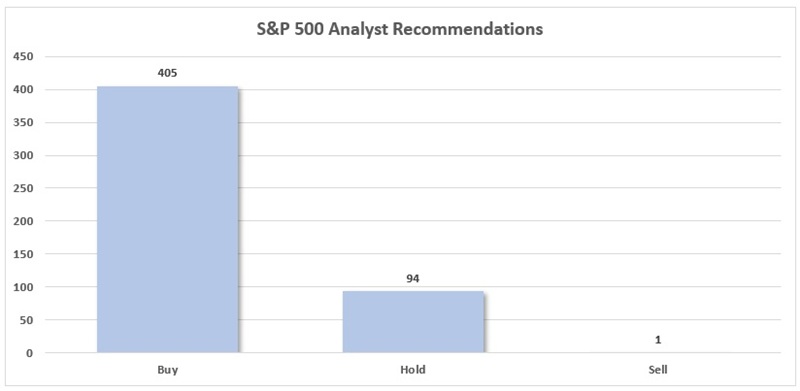

This is notable because the suits are paid to be bullish. Sell calls are rare, especially among S&P 500 stocks. In fact, analysts shun just one index component today!

Just 1 “Sell” Call Out of 500!

Source: S&P Global Market Intelligence

Buy calls? They are numerous—405 out of 500. Eighty-one percent!

Are 81% of the companies in the S&P 500 really buys? Normally, no, but now—especially not. AI is disrupting business models and many of these Buy-rated names are doomed companies.… Read more

Recent Comments