Bear markets are great for calculated contrarian investors like us. We have many dividend growers in the bargain bin.

I mean, it’s rarely this stuffed. We have lots to sort through today. Specifically we’ll talk about 43 dividend payers that are about to announce their next payout hikes.

Most of these stocks are cheaper than they were at the start of the year. Some are quite a bit discounted. Plus, these upcoming dividend raises are the perfect announcements for us to front run.

Why? Because once the news becomes public, the “dividend magnet” will pull these prices higher.

Dividend Growth + The “Dividend Magnet”

The “dividend magnet” is my favorite financial phenomenon. It contains three “prongs” that basically guarantee long-term profits.

Dividend Growth Prong #1—Growing Payouts = Growing Yields: Every time a company hikes its dividend, the yield on our original cost basis improves, too. If we buy at $100 and a $1 dividend, that’s just a 1% yield. But when that $1 improves to $2, our yield on those original shares has doubled to 2%—just for hanging on. Stick around long enough, and even modest yields can plump up to 5%, 6% and even more over time.

Dividend Growth Prong #2—Beat Inflation: In short, inflation destroys value. If annual inflation is running at 3%, and a dividend stays flat, guess what? That dividend is effectively shrinking by 3%! And considering U.S. inflation is still red-hot, we need all the dividend growth we can get to stay ahead!

Dividend Growth Prong #3—Magnetic stock-price growth. Dividend growth isn’t just about the dividends—it’s about growth, too! You see, when a company revs up its regular payout, sure, you’re getting more cash in your pocket. But the company is also making a statement: “Our earnings aren’t just fantastic, they’re sustainable—so much so that we can afford to throw even more cash at shareholders.” Other investors see this bold statement about the company’s operations, and they want to enjoy the spoils, too. So they buy shares, driving your shares higher.

A great example is Microsoft (MSFT), which came out of the Great Recession with a fairly young dividend program. But Microsoft got aggressive with its payout as growth ramped up, and shareholders enjoyed both a near-doubling in shares over the next five years, and a more-than-doubling of the dividend during that same time period.

Microsoft With the “Double Doubler”

That’s precisely why now is the best time to start looking. Not only are many dividend growers trading at depressed valuations, but the third-quarter earnings season is right around the bend—and where you find earnings reports, you typically find dividend announcements.

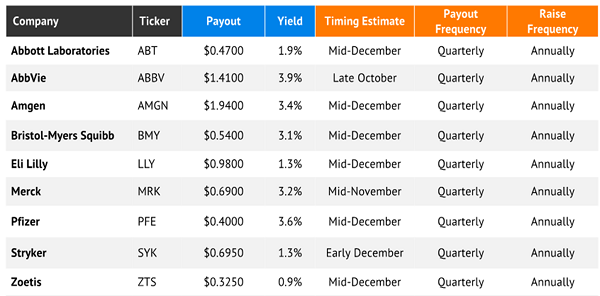

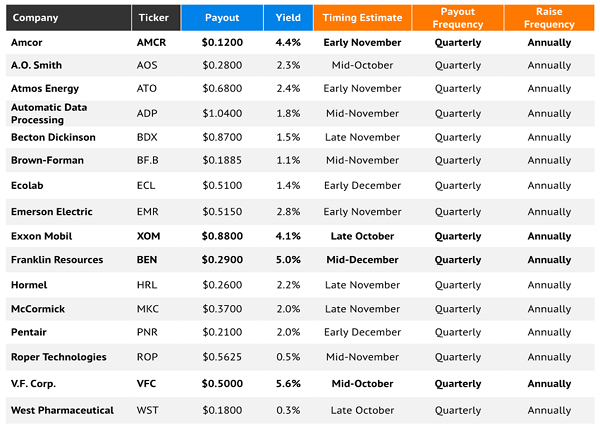

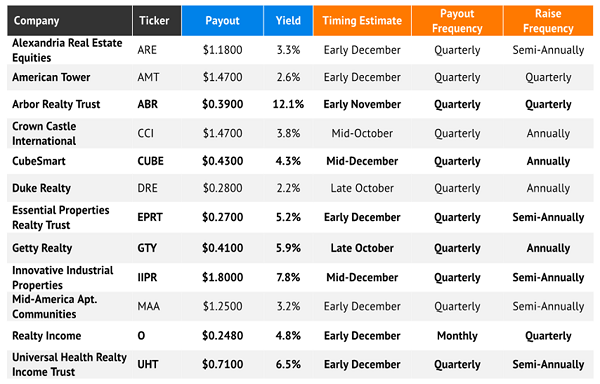

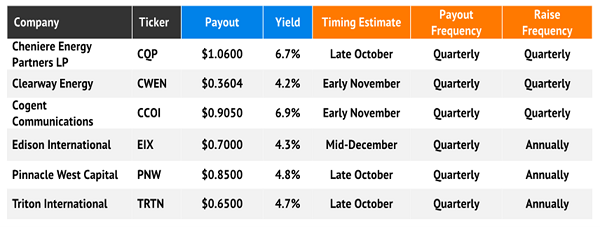

Let me show you 43 companies that I expect will raise their payouts through the end of 2022. I’ll look at several batches and zoom in on a few noteworthy stocks that are really leaning hard into raising their dividends. (Note: Bold = yields of 4% or more.)

Health-Care Stocks

Featured Stock: Eli Lilly (LLY)

Eli Lilly (LLY, 1.3%) might not deliver a mouth-watering yield, but it’s not from lack of trying.

This pharmaceutical giant is responsible for a number of diabetes medications, including Humalog, Jardiance and Trulicity, but also other medicines such as Erbitux for colorectal and other cancers, Olumiant for rheumatoid arthritis and Alimta for non-small cell lung cancer.

Like with other Big Pharma companies, profits were dinged up somewhat during the pandemic, but they’ve returned to growth, and more is expected going forward. This year’s EPS are projected to improve by the low teens, then by the high teens in 2022.

And wouldn’t you know it: Lilly’s dividends have been growing fairly consistently in the low to mid-teens. LLY’s compound average dividend growth is 13.5% over the past five years, including a sweet 15% boost last year, to 98 cents per share.

Look for Eli Lilly to join a host of other Big Pharma names in announcing its next dividend improvement sometime in mid-December.

Dividend Aristocrats

Featured Stock: Automatic Data Processing (ADP)

Before I talk about our featured Dividend Aristocrat, a quick tip of the cap to Exxon Mobil (XOM, 4.1% yield)—possibly the dividend trade of the decade.

The great XOM stopped hiking its payout in 2019. Its debt levels ballooned in 2020, so it kept holding the pause button for another year. But help was on the way in the form of a “crash ‘n rally” oil pattern. By October 2021, Exxon salvaged its 39-year streak of higher annual dividends with a hike to 88 cents per share. We’ll see whether Exxon returns to hiking every year; if so, I’d expect that announcement to come in late October.

On to Automatic Data Processing (ADP, 1.8% yield).

While I love to see companies with consistently aggressive dividend improvements, I also love a “comeback story.” And that’s what we have with ADP last year, which returned to bulky payout bumps after slowing down amidst the COVID crisis.

I’ll point out that ADP’s outlier 2.2% raise announced in August 2020 was out of an abundance of caution rather than reflecting worrisome results. The payroll and HR solutions provider never broke its now seven-year streak of improving net income, and in fact grew fiscal 2021 profits (year ended June 30, 2021) by more than 5%.

For the record, ADP’s dividend growth returned to a more promising pace in 2021 with a 12% raise. We’ll see if ADP improves its streak to 48 consecutive years of higher payouts sometime in mid-November, if history is any indication.

Real Estate Investment Trusts

Featured Stock: Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities (MAA, 3.2% yield) is a large residential REIT that buys, develops and manages multi family homes, primarily in the American Southeast, Southwest and Mid-Atlantic. As I write this, MAA owns more than 100,000 homes across nearly 300 communities in 16 states.

Mid-America’s performance over the past decade or so has been about what you’d expect:

- Longer-term, the stock has performed well amid rising housing costs.

- The stock took a tumble during the initial COVID-19 shock as Wall Street feared the potential for delinquencies and low occupancy.

- It bounced back with a vengeance in 2021 as the real estate market went bananas.

- And MAA has gotten clobbered this year (-34%!) as particularly pricey equities have been punished worst of all amid the bear market.

And that brings us to today, where Mid-America Apartment Communities has become a stock worth putting on our watch lists.

In December 2021, MAA announced a decent 6% improvement to its payout. But then, despite having been a historically annual raiser, it got the lead out in May and announced another 15% hike (a total of 22% year-over-year) to its current $1.25 per share.

The stock has gone nowhere since December, however, amid the market’s washout. And in fact, MAA still remains overpriced compared to other REITs, at a forward P/FFO of 18, compared to the sector’s 14. However, continued punishment—bringing down its price and elevating its yield a bit further—would warrant another close look at this REIT.

Other Noteworthy Dividend Payers

Featured Stock: Cheniere Energy Partners LP (CQP)

It takes a lot to get me to look at master limited partnerships (MLPs), just given that an investment in MLPs means a bigger time commitment during tax season.

But Cheniere Energy Partners LP (CQP, 6.7% yield) has understandably caught my eye.

CQP, created by Cheniere Energy (LNG) to hold its midstream assets, owns Louisiana’s Sabine Pass liquefied natural gas (LNG) terminal, as well as the Creole Trail Pipeline. And like many other energy MLPs, it’s a font of cash flows that get, ahem, piped right back to unitholders.

Cheniere Energy Partners LP is also a rarity in that it’s not just a quarterly payer, but a quarterly raiser. And like many quarterly raisers, it tends to improve its distribution in baby steps that, across the whole year, add up to a big-boy step. However, CQP thrust itself into a different yield level entirely this April when it delivered a 50% hike to the quarterly dividend.

CQP has since gone back to its penny-per-share pattern, but it warrants even closer watching—not just for its quarterly raises, but because of its super-sized yield that’s now close to 7%.

Never Sweat Another Bear Market Again

Every major market index has been sliced, diced and julienned in 2022. Wall Street is a virtual sea of red.

But as bleak as that sounds, investors in a few select stocks are doing just fine.

While most stock market “darlings” are getting crushed, a small, overlooked basket of recession-resistant stocks are not just surviving—they’re positioned to thrive.

I’ll admit it: At first blush, these stocks will seem downright boring. In fact, it’s likely you haven’t heard of many of these—after all, the mainstream media rarely covers most of them, and outright ignores the rest.

But these “Hidden Yield stocks” offer savvy investors the opportunity to turbocharge their portfolios. That’s because these “total return” plays can both produce price growth while spitting out higher and higher dividends each year.

How are they able to do this while supposedly idiot-proof blue chips can’t?

It all boils down to what I call “The Three Pillars”:

Pillar #1: Consistent Dividend Hikes Pillar

Pillar #2: Lagging Stock Price

Pillar #3: Stock Buybacks

Selecting companies with a proven track of increasing their dividend payments is the safest, most reliable way to get rich in the stock market. And I want to show you how it’s done. Click here to get a copy of my 7 Recession-Proof Dividend Stocks With 100% Upside, including full analyses of each pick … and a few other bonuses, too!

Recent Comments