Many financial advisors doubt that we can retire comfortably on a million dollars, let alone $500K.

Let me outline our compelling dividend counterpoint—a five-stock portfolio with an average yield of 12.3%.

This generates more than $60,000 in annual income on a $500K portfolio, or a sweet $123,000 in dividends on that million-dollar nest egg. And, most importantly, this “retire on dividends” strategy leaves the principal untouched.

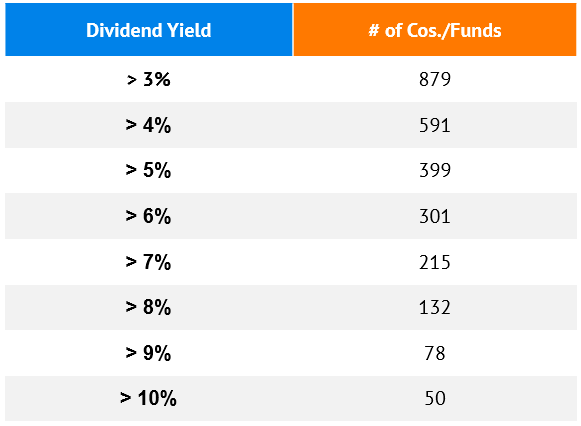

Contrary to popular opinion, we have a pool of dividend candidates. Let’s start with the 879 dividend-paying stocks that yield more than 3% and work our way up the chain:

Believe It Or Not, 50 US Stocks Yield 10%+

Note: U.S.-listed… Read more

Recent Comments