Looking for stock values? Sy Harding writes why you should consider foreign markets – many of which are currently in oversold conditions, and have room (unlike the US) for further monetary easing to juice things up a bit.

—-

Being Street Smart

Sy Harding

Why Foreign Markets are Better Bets than US

July 22, 2011

It has been my expectation that slowing global economies, rising inflation, record government debt, austerity measures being undertaken globally, and the end of the Fed’s QE2 stimulus, would result in stock market corrections in this year’s summer season before the global bull market resumes in the fall. My downside target has been a decline of 17% or so for the Dow and S&P 500.

After only a mild 7% pullback in May and June the U.S. market has bounced back to within 1% of its April peak.

However, it’s a quite different picture outside of the U.S.

Markets in most of the other major world economies have been in fairly significant corrections for several months. Quite a number of them have reached my downside projections of 17% declines, and are potentially bouncing off those lows.

I’m not convinced the many global economic negatives are going away just yet, not convinced the ‘soft spot’ in global economies in the first half of the year are about to quickly reverse to robust growth in the second half, which is the popular opinion.

But if we have seen the worst of it, and markets are ready to factor an improving global economic picture into stock prices, betting on that scenario by buying foreign markets may have more upside potential and less downside risk than betting on the U.S. market.

The most obvious reason is that many global markets have been in corrective declines for several months, and have come down from their previously overbought levels to potentially oversold levels, whereas the U.S. market remains near its April peak and is potentially due for such a move itself.

In addition, in many global economies, their central banks have raised interest rates and tightened monetary policies significantly, in deliberate efforts to slow their economies and ward off inflation. That leaves them in a position of being able to lower interest rates and loosen monetary policies again if need be to get their economic growth going again.

By comparison, the U.S. Federal Reserve has kept its key interest rate, the Fed Funds Rate, near zero percent, and monetary policies very accommodative for an unusually long period of time. That leaves very little, if any, room to make conventional moves like lowering interest rates or loosening monetary policies if needed to get U.S. economic growth going again.

China, India, Brazil, have all been aggressively raising interest rates and tightening monetary policies for well over a year, leaving them plenty of room to reverse course if their economies slow too much and need the stimulus.

Meanwhile, their stock markets have been in corrections since November, with declines of 17%, 17%, and 19% respectively. So in rallying in recent days along with the U.S. market they are potentially bouncing off important lows (although we don’t have buy signals on them quite yet).

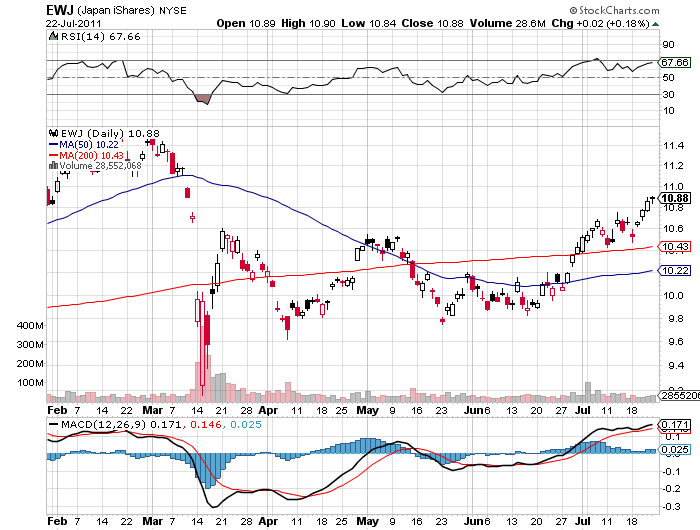

Japan is an even more promising situation. Its economy took a serious hit from the earthquake/tsunami disaster, which plunged its stock market 21%. Four months later its factories are getting back up to speed, and reconstruction activity is expected to give its economy an extra boost going forward.

Japan’s initial plunge in reaction to the disaster had the Nikkei very oversold, and traders jumped in quickly, trying to catch the bottom. The first two rally attempts failed but the new declines found support at higher lows, and our technical indicators then triggered a buy signal on June 30. The Nikkei has been in a nice rally since. And unlike most of the world’s other major economies, economic reports coming out of Japan have begun to turn positive. Its export/import ratio improved more than forecasts in June, and its Diffusion Index of business conditions also turned positive in June, confirming the recovery from the earthquake/tsunami disaster is underway.

I question whether the global economic slowdown (including in the U.S.), record government debt, rising inflation, deteriorating employment, plunging consumer and business confidence, etc., are ready to reverse any time soon, as the resilience in the U.S. market seems to be predicting.

But if you want to bet on that I suggest there are significant reasons to prefer selected global markets over the U.S. market. I’d rather take my chances with markets that have already had corrections and seem to be oversold, rather than one that faces the same kinds of problems but has remained near its previous peak.

In the interest of full disclosure, I and my subscribers have a sizable position in the Japanese market taken at lower prices in late June, via the iShares Japan etf, symbol EWJ.

Sy Harding is editor of the Street Smart Report, and the free market blog, www.streetsmartpost.com.

Japan: Land of the rising stock market once again?

Japan: Land of the rising stock market once again?

Recent Comments