We contrarians make our money by buying when things look bleak. We did that, and we’re up 149% on this excellent energy dividend.

But our strategy has suddenly become popular. Heck, I saw a front-page piece on Bloomberg.com outlining our “Crash ‘n Rally” energy strategy!

So, what do we do now?

We’ll talk about next steps for energy dividends in a moment. First, let’s recap how we got here so that we can decide if we want to order another quadruple-shot of Texas tea or step aside of the mainstream herd.

In April 2020, crude oil prices crashed. They actually hit negative territory, which means producers were paying people to take the goo off their hands. Crazy!

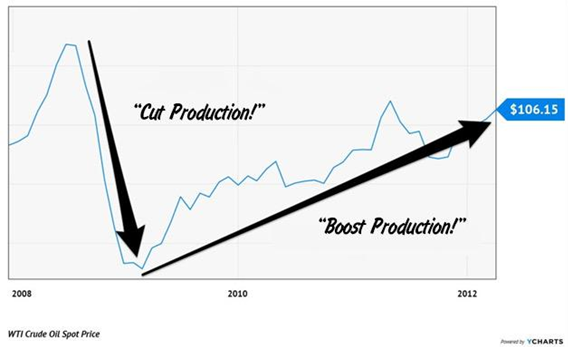

Crude’s 2020 crash rhymed with its plunge in 2008. “Black gold” didn’t hit negative territory then, but it plummeted from penthouse prices (and careened right through the outhouse).

Ironically, this set the stage for a multi-year rally in crude.

Oil’s Post-2008 “Crash ‘n Rally” Pattern

Out in the oil patch, low prices are the best cure for low prices. Producers cut production to save their bottom lines, their dividends, and even their companies. Supply immediately drops off a cliff.

The thing with supply is that it takes years to come back online. Producers can quickly cut shale extractions and bring the offshore rigs back to port, but it takes much longer to ramp these operations back up.

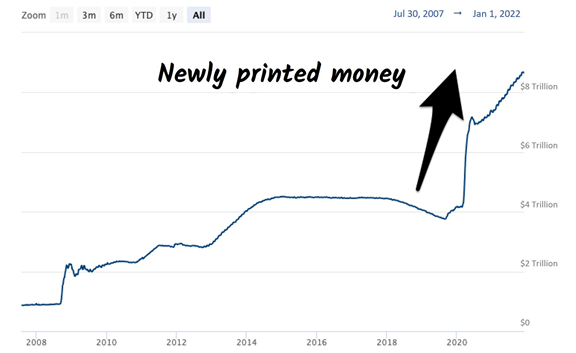

Demand, meanwhile, bounces back faster. Especially when the Federal Reserve prints trillions of dollars out of thin air. The Fed is the reason that oil is back above $90 today (and the reason inflation is running so hot—but that is a discussion for another day.)

Why Oil Demand Recovered So Quickly (and Inflation Took Off)

With supply disabled and demand rising, the price of oil crept higher. And higher. And still higher. The “Crash ‘n Rally” (CNR) pattern played out again.

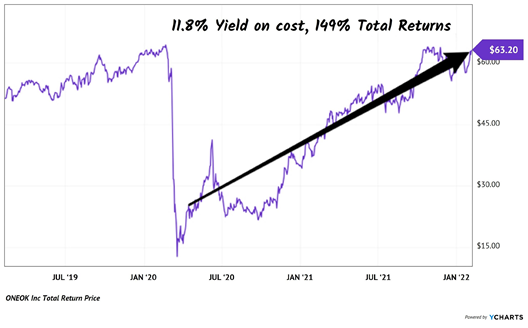

We took advantage of this early in my Contrarian Income Report service. CIR readers bought ONEOK (OKE) in April 2020, when the energy outlook looked darkest.

It was an uncomfortable call, as most profitable contrarian buys are. But we reasoned that OKE would be able to “muddle through” as energy prices inevitably recovered. We weren’t positive its then-11.8% yield would hold, but it did.

Which means early adopters of our Crash ‘n Rally energy calls are still enjoying an 11.8% yield on cost to go alongside their 149% total returns.

Energy Dividends Like OKE Crash ‘n Rally, Too

My CIR-less readers, we love you too and threw you a Crash ‘n Rally play last April in the form of Exxon Mobil (XOM). At the time, XOM paid 6.1% and we projected 61% price upside.

XOM has already returned 45%. But, somewhat disturbingly, we now have Bloomberg reporting on how this Crash ‘n Rally pattern set the stage for high oil prices.

A front-page headline that we’re aligned with—yikes! Our greatest fear as contrarian investors, realized.

Popularity aside, the bull markets that follow crashes in crude tend to last several years. Post 2008, the rally ran for five. This time around, we’re not even two years in. Supply is just starting to catch up. Our energy dividends should continue to grow in the years ahead.

We should admit, however, that the easy contrarian coin has probably been minted. It will likely be a grind higher from here, a staggered climb punctuated by scary pullbacks to shake out the non-believers.

Right now, there are probably a few too many believers on our bandwagon. Short-term we’re due for a dip of sorts.

If you like energy long-term like I do, but the prospect of a pullback scares you, consider dollar cost averaging (DCA) into these positions. The DCA technique probably helped you build the nest egg that you have today. Don’t be afraid to use it to take advantage of volatility in energy dividends.

If you’re “elephant hunting” for big plays like we had with OKE, I’d instead recommend this post-COVID retirement portfolio. Even if there’s another wave, another crash, and another lockdown, we can boost our investment income by 400% or more by buying these post-COVID payers.

Recent Comments